StartupFactory

Y Combinator, tech’s unicorn builder extraordinaire

The world’s most important accelerator is deep into AI

P (YC) = 1

Many things get described as “a certainty” or “a guarantee” when in fact the difference between 90% likely, 99% likely, and 99.9% likely — which is significant — is often ignored.

With that disclaimer in mind, I am as close to 100% certain as it is possible to be that if you have been even a moderate internet user for more than a few years, you’ve come into contact with, either directly or indirectly, a portfolio company of the world’s pre-eminent startup accelerator: Y Combinator (YC).

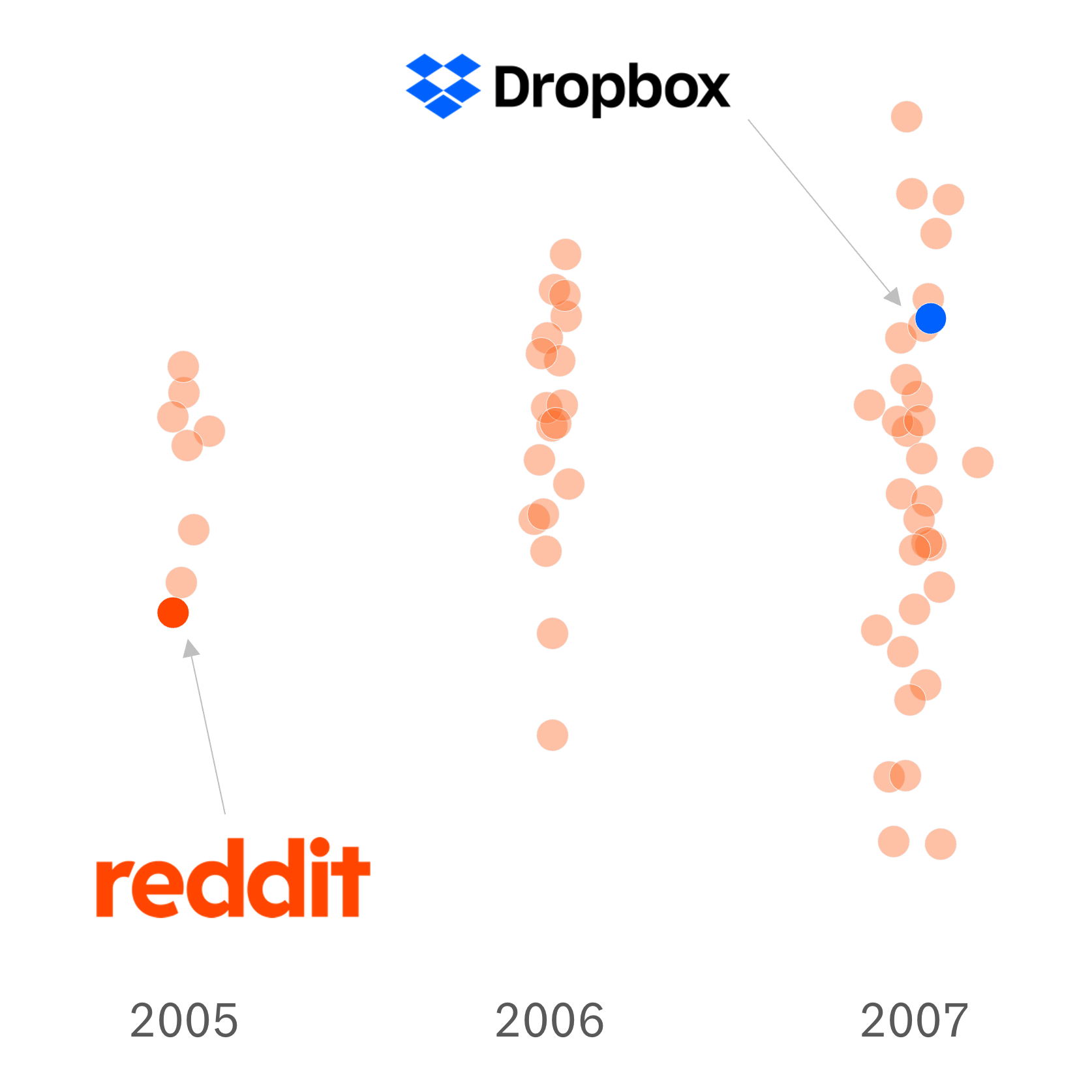

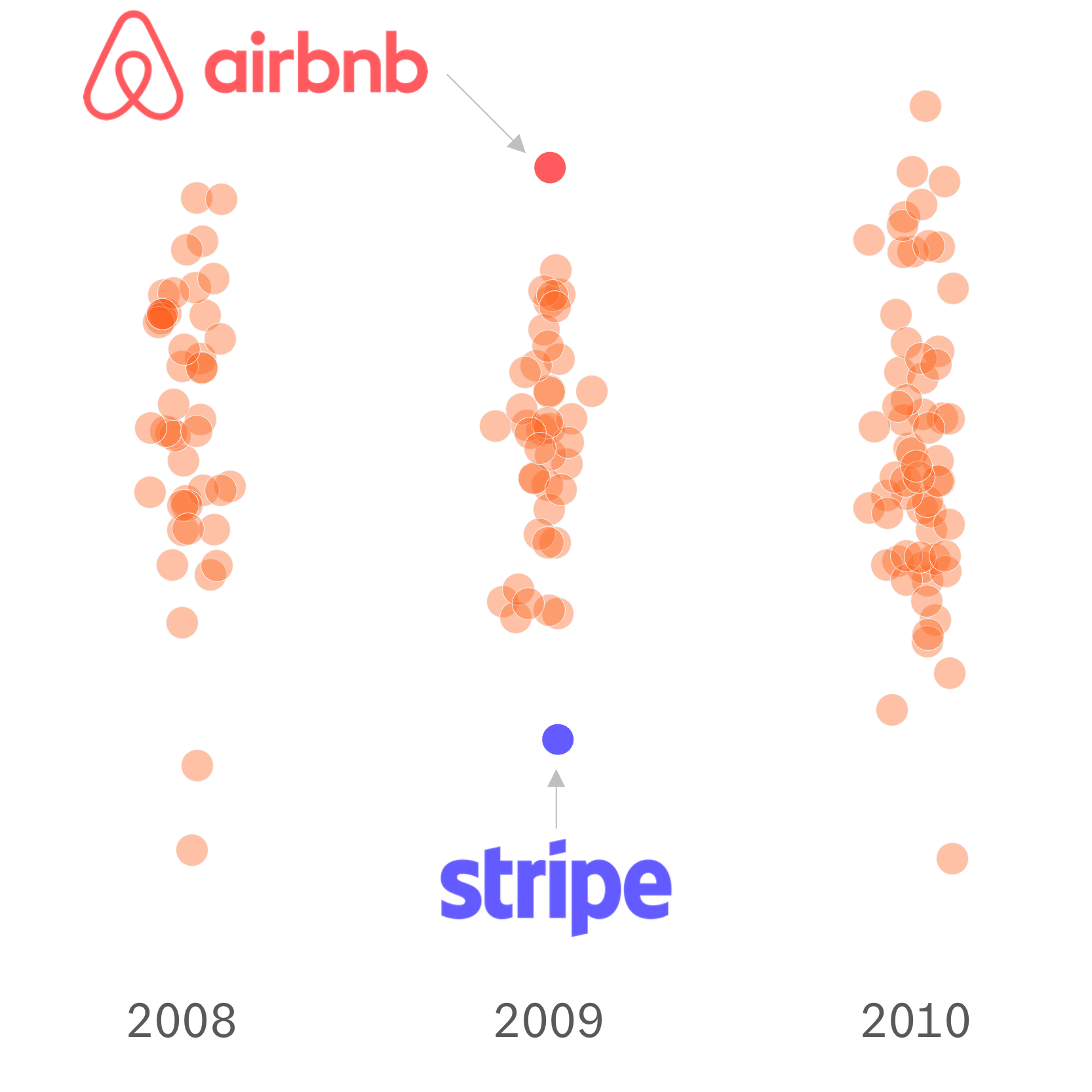

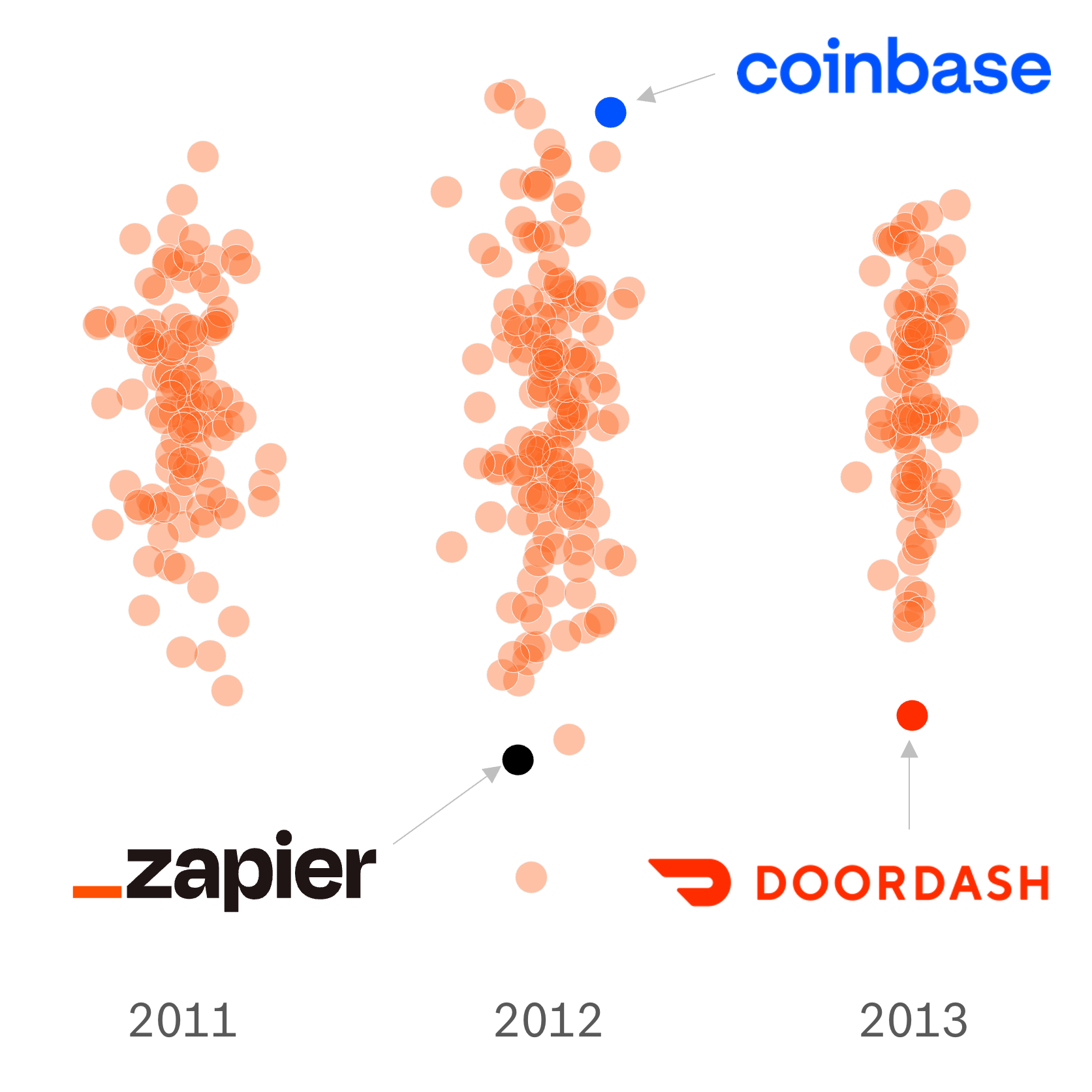

Indeed, if you’ve ever bought anything on the internet that uses Stripe, ordered food on an app (DoorDash), scrolled Reddit, watched video games on Twitch, visited any of the 400,000+ websites hosted on Webflow, stayed in an Airbnb, ordered groceries on Instacart, bought crypto on Coinbase, shared a file on Dropbox, or interacted with any of the 2.2 million businesses that use Zapier’s software to automate their processes, then you’ve come into contact with a YC company. And, if by some utter miracle you haven’t done any of those things, there’s another ~5,000 companies backed by YC that you could have crossed paths with.

So how did YC, which started with just $200k in capital from its founders who “wanted to learn how to be angel investors”, become the most influential early-stage investing firm in the world?

Like similar accelerators, the core YC program involves a bootcamp of sorts. For 3 months founders live and breathe all things “startup”, working hard to make as much progress on their companies before Demo Day — when the latest crop of would-be-world-changers pitch to investors and media.

Startup factory

The secret of YC’s unique success is debated. But a combination of good judgment, a focus on technical founders making something people want (YC’s mantra), a culture of mentorship and collaboration, standardized investing terms, and a good old-fashioned dose of “right time and right place” can certainly lay some claim to the $600B+ value that’s now attributed to YC-backed startups.

The founders selected tend to be at a very early stage — the winter 2023 batch included 52% of applicants with only an idea and 77% of the batch had zero revenue before starting the program. Investing in those sorts of companies is inherently about as risky as it gets… which is why the firm never puts all of its eggs in one basket.

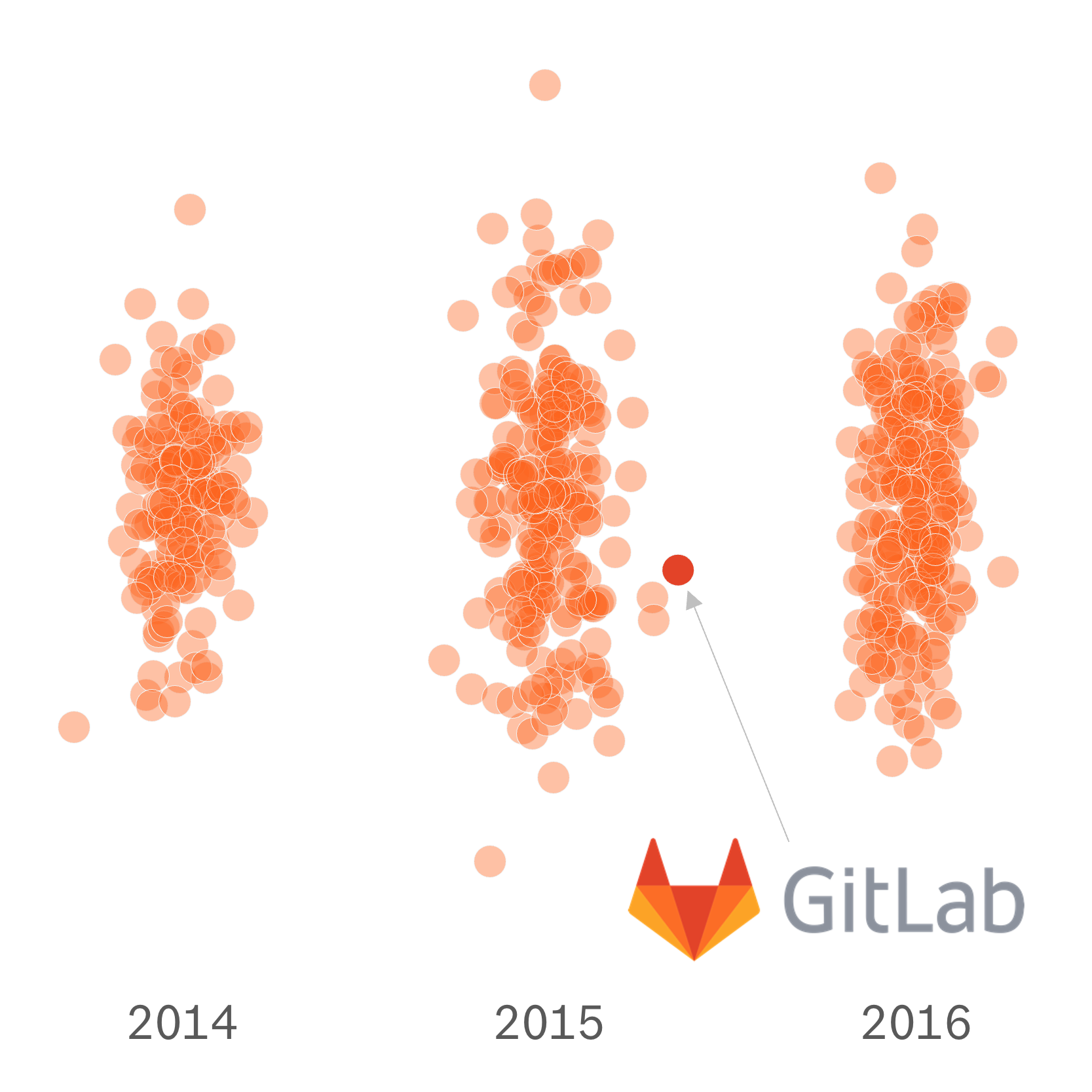

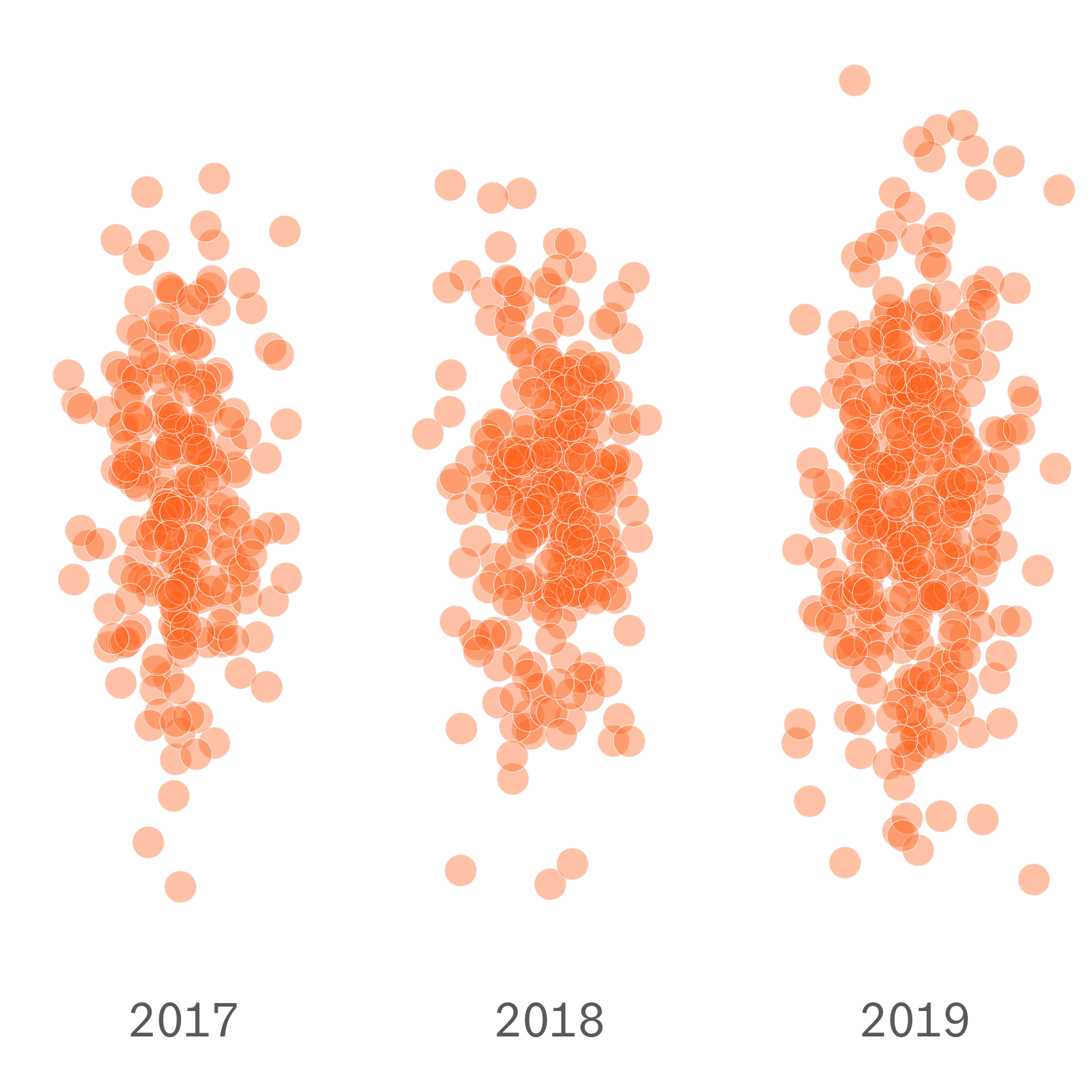

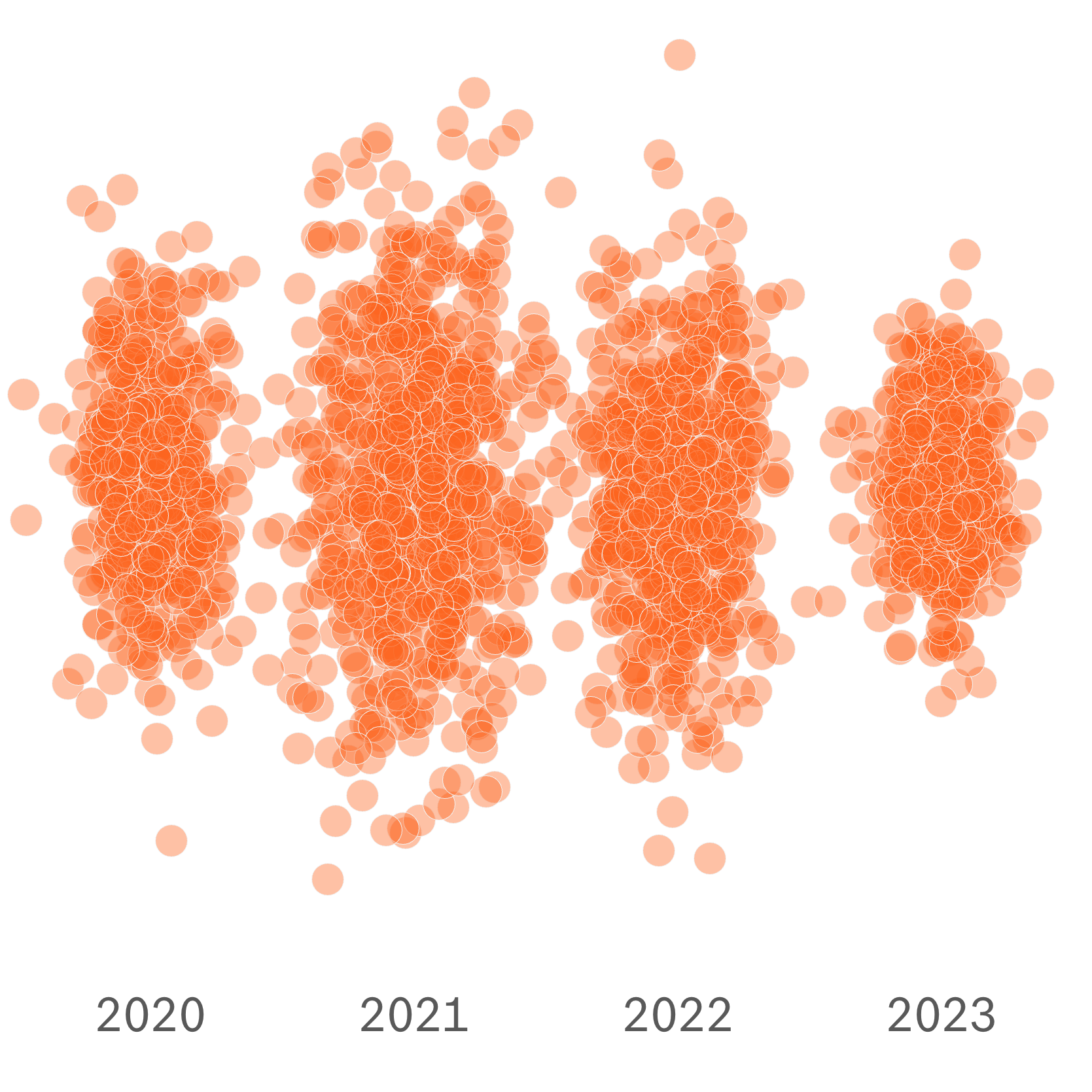

By investing in hundreds of companies every year, YC maximizes its odds of beating the golden law that governs much of early-stage investing: most investments will fail, but even a small number of hits can make it all worth it — and YC has certainly had its share of hits. Indeed, as YC companies went on to have success, the company’s twice-yearly programs, one in the summer and one in the winter, fell into a virtuous circle. Once YC alumni had success, hungry founders started applying in their thousands… YC got to pick the best ones for its program, investors wanted to back YC graduates… those companies were more likely to be successful… and so on and so forth.

Make something people want

Indeed, YC’s reputation now precedes it, enabling its partners to be incredibly selective: its most recent batch took in less than 1% of applicants. What those applicants are working on is a good signal for what the prevailing wisdom of Silicon Valley believes will define our future.

The conclusion from looking at the data? It’s all about AI. Indeed, per our calculations, a staggering 64% of the 2024 winter batch of YC had "AI" or “AI-related” tags in their Y Combinator company profile in the company’s startup directory.

YC’s own definition of AI-focused was more diluted, citing “at least 50%” of the most recent batch building around it in one form or another. It’s also likely that some of those startups aren’t really doing anything groundbreaking in AI, but just incorporating some AI into their product strategically — which would be hard to blame them for considering that investors are blindly throwing money at anything that looks like AI. Whichever way you slice it, AI is the common thread.

So, what are those founders working on?

Well, there’s a startup that wants to build an “AI creative suite for the fashion industry”, one working on “AI-powered PowerPoint”, one doing “Professional Quality AI Music”, one building “AI for Robot Arms in Factories” and one whose product offer is “Type a script, get a movie” (paging Hollywood’s unions?).

Interestingly, you can track tech hype cycles throughout YC cohorts. In 2022, when “Crypto / Web 3” was the hottest thing to work on, 33 YC startups were working in the space — in the most recent batch there was only 1.

The Bookface effect

Like so many walks of life, success in tech is rarely only about what you know, but who you know. Getting that first customer, being introduced to a potential key hire, finding that friend of a friend who can point you in the right technical direction… Y Combinator’s true superpower is now in its network. At the center of its community is Bookface: YC’s internal social network, which in the words of Garry Tan, YC’s CEO & President, was needed because “because YC had funded larger batches and the hardest part of a community is knowing who is in it and who you can trust and ask for help”.

That community is increasingly influential and vast. YC’s original 4 founders, Paul Graham, Jessica Livingstone, Robert Morris, and Trevor Blackwell have all since moved on. But, the company’s leadership has been a who’s who of tech power players even when they weren't leading it: most notable being Sam Altman, who led YC before becoming the fired-then-rehired CEO of OpenAI.

Who wants to be an entrepreneur?

It would be overly charitable to give YC or its peers (of which there are many) sole credit for the tech startup ecosystem that flourished in the last 20 years, but it certainly played a part. Its rise has coincided with 20-something billionaires fronting magazine covers, technology companies becoming the driving force in the American economy and tech investing entering the mainstream in TV, movies and books. Put simply, America seems to revere entrepreneurs more than ever and the venture capital industry has boomed as a result (per data from the NVCA).

Going SAFE

Apart from its direct output, arguably YC’s most important contribution was the standardized investing documents that it introduced which made investing in two-people-who-have-a-cool-idea a little less legally onerous.

Initially, YC offered a straightforward $20K in exchange for around a 6% equity stake. Today, YC’s pockets are (a lot) deeper, and the proposition is $500K split into two parts — a $125K Simple Agreement for Future Equity (SAFE) for 7% equity and a further $375K that converts at terms realized in the future. The “SAFE” is a YC invention from 2013 that allows investors to cut a check now, which converts into equity at a later milestone. Standardizing the offer and the legal docs skips the messy part — negotiating a price and valuation — with each individual company and has since been adopted by a number of other early-stage investors.

Now, nearly two decades on from its first group of hackers, YC is the force in early-stage investing, particularly in San Francisco. At the end of March, Forbes reported that the company was raising $2 billion for its bi-annual accelerator and follow-on investments. That’s 10,000x the capital that the founders first put in.

Y Combinator is a neon orange big tent tech church, welcoming anyone under its roof who wants to worship at the altar of two things: (1) Building technology that changes the world, (2) Making a lot of money. It’s gotten pretty good at both.