FREE PARKING

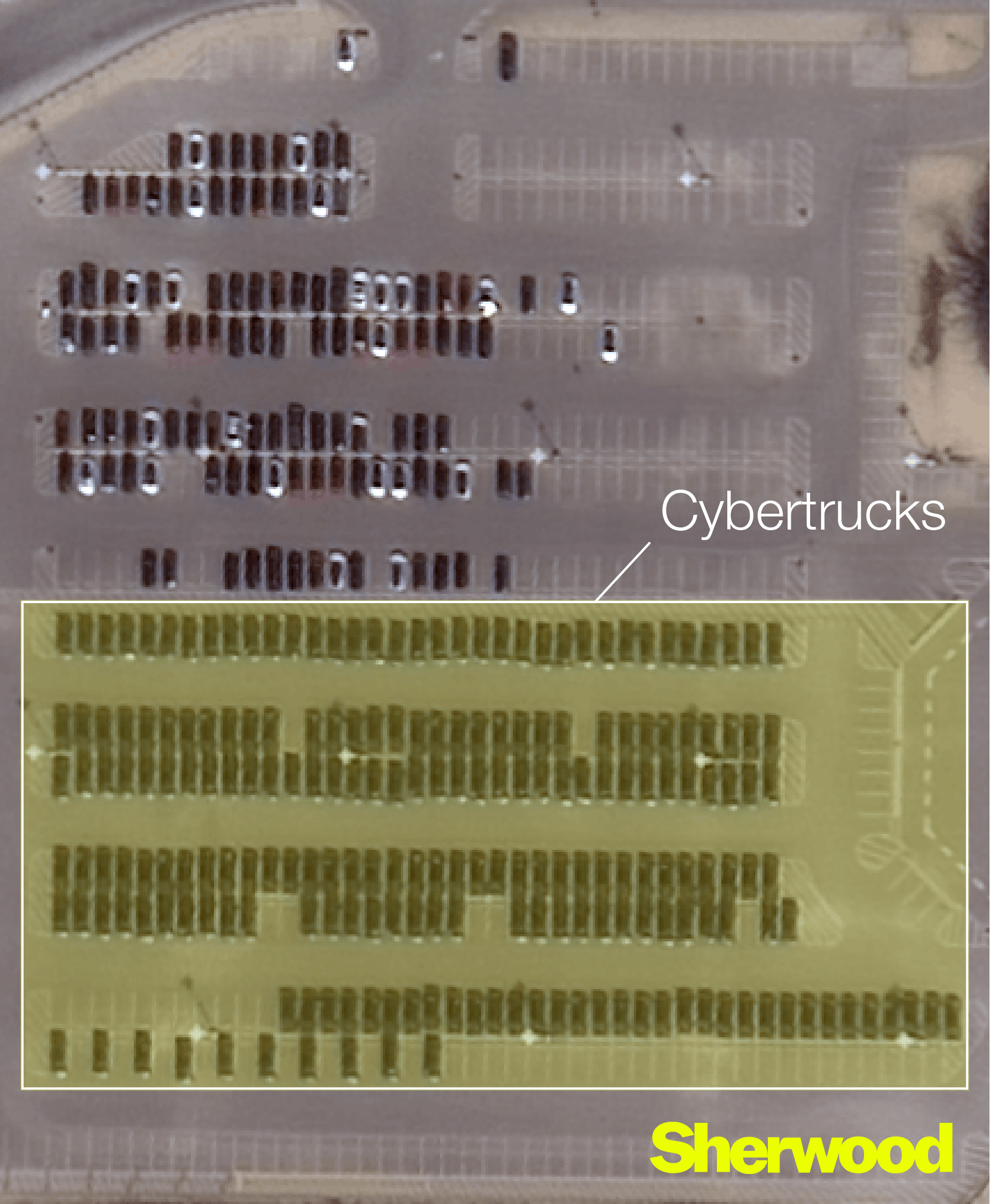

Look at all the Cybertrucks stashed outside Tesla’s factory in Texas

We count more than 500, which is roughly 1% of the entire number of Cybertrucks owned in the US. That’s a lot of stainless steel that can’t survive a car wash.

Cybertrucks represented 5% of all US Tesla sales last quarter, but they make up a huge portion of the inventory piled up outside Giga Texas, the factory where they’re produced. Our analysis of satellite imagery of the production facility suggests that about half the vehicles in the main production lots appear to be Cybertrucks.

That’s likely because the stainless steel trucks, despite recently becoming less expensive, have proven especially difficult to sell as CEO Elon Musk has taken on a more controversial role in the US government and the brand has become increasingly unpopular. The company is sitting on about $200 million worth of Cybertruck inventory, Electrek reported earlier this month.

By our count, there are more than 500 Cybertrucks — which amounts to more than 1% of the number of Cybertrucks owned in the US — being stored on lots at Giga Texas. Here’s a view of the the main parking lot there, where new vehicles reside before they’re shipped off to customers:

Here’s a second major inventory lot, which appears to be mostly Cybertucks.

Since the Cybertrucks began coming off the line just over a year ago, Tesla has sold fewer than 50,000 of the vehicles in the US — something we know from government data after the vehicle’s eighth recall last month. The 6,406 the company sold in Q1 is also about half of what it sold a quarter earlier, according to data from Cox Automotive, when the truck was less of a political lightning rod. By any accounting, the Cybertruck’s numbers are far fewer than the 1.5 million preorders it originally had.

Tesla didn’t immediately respond to a request for comment.

Today, Business Insider reported that Tesla is reducing Cybertruck production and reallocating employees to work on the much better-selling Model Y lines instead, though it should be noted that Tesla’s total sales are down significantly.

As a result of the excess of Cybertrucks already produced, they’re starting to pop up in parking lots around the country as well. Tesla also seems to be using these idle Cybertrucks to tow around Model Ys as a form of advertising.

Let us know if you see any more Cybertrucks hiding in plain sight.