Super Micro sinks as Wall Street hates its trade-off of profitability for sales

Companies tied to the AI boom generally get rewarded for aggressively expanding capacity. That’s not the story this time.

Throughout the AI boom, investing aggressively in your near-term capabilities for the promise of bigger profits down the road has generally been applauded by investors.

Not so for Super Micro Computer, at least this quarter.

Shares of the server company are getting whacked this morning after its fiscal Q1 earnings report, where management delivered a much better Q2 sales outlook than analysts had anticipated, but with weaker-than-expected guidance for earnings per share. Profitability is taking a hit as the company offers preferential pricing to bigger customers and then looks to bolster its capacity to meet those huge orders, with hopes of many more to come.

“The company is placing greater investment for a strategic mega-scale AI win and expects margin to improve as it leverages investments,” Bloomberg Intelligence senior industry analyst Woo Jin Ho wrote. “This is no guarantee, as Super Micro didn’t provide a full-year margin outlook.”

When you’re selling umbrellas during a rain storm, you’re not only supposed to be able to sell more of them, but it’s also presumed that you’re able to display some decent pricing power that supports profitability.

Dell and Super Micro are both server companies looking to hitch their wagons to the explosive growth of AI. Their margin outlooks are heading in different directions.

“Supermicro received its largest design award in the company’s history, which is leading to better than expected revenue in F2Q26 and FY26,” Needham analyst N. Quinn Bolton wrote. “However, this program is expected to compress gross margin in the near term due to higher costs associated with the initial ramp along with lower margins this design award carries.”

Bolton cut his price target on the stock to $51 from $60. JPMorgan also reduced its price target to $40 (from $43), while Rosenblatt lowered its view of where shares are going to $55 from $60.

Not only this big contract, but also new production facilities that are being brought online to meet increased demand are expected to weigh on margins in the near term. To continue the analogy, to be able to sell umbrellas in a persistent downpour, you also need to be able to produce a lot of what people want to provide shelter from the storm.

During the conference call, executives were inundated with questions about the margin outlook.

“We’re going into a quarter where we are ramping one of the largest clusters in the world,” said CFO David Weigand. “We are ramping a new product line at mega scale. And so therefore, we were being a little conservative on the margin because we will have a higher cost as we ramp production and shipment.”

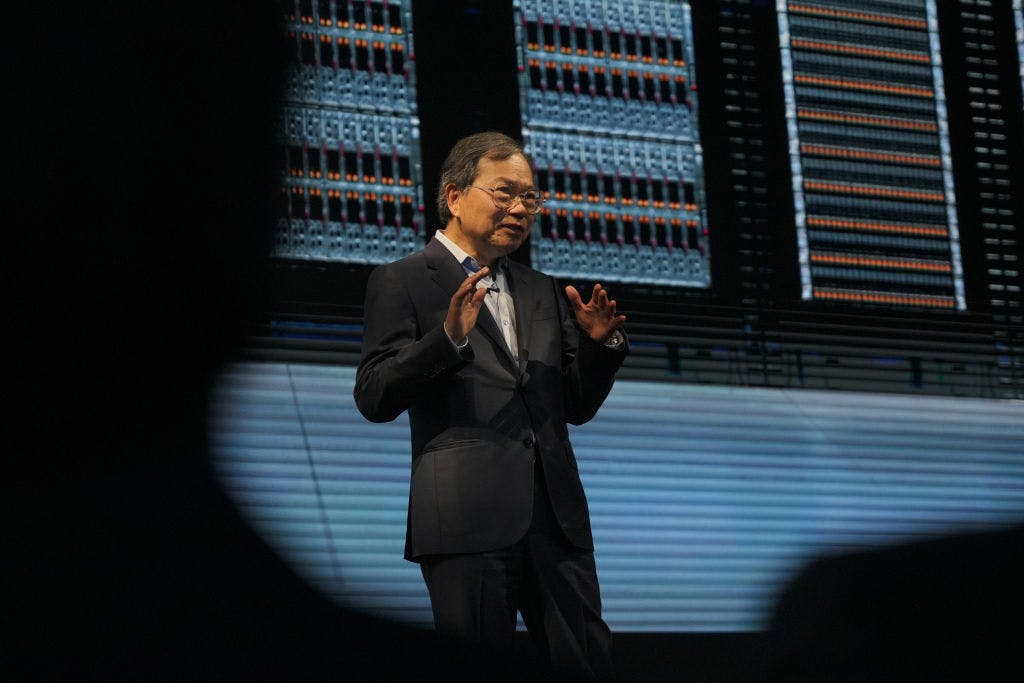

CEO Charles Liang said that a double-digit gross margin is still in Super Micro’s plans; it’s just going to “take a little bit longer.”