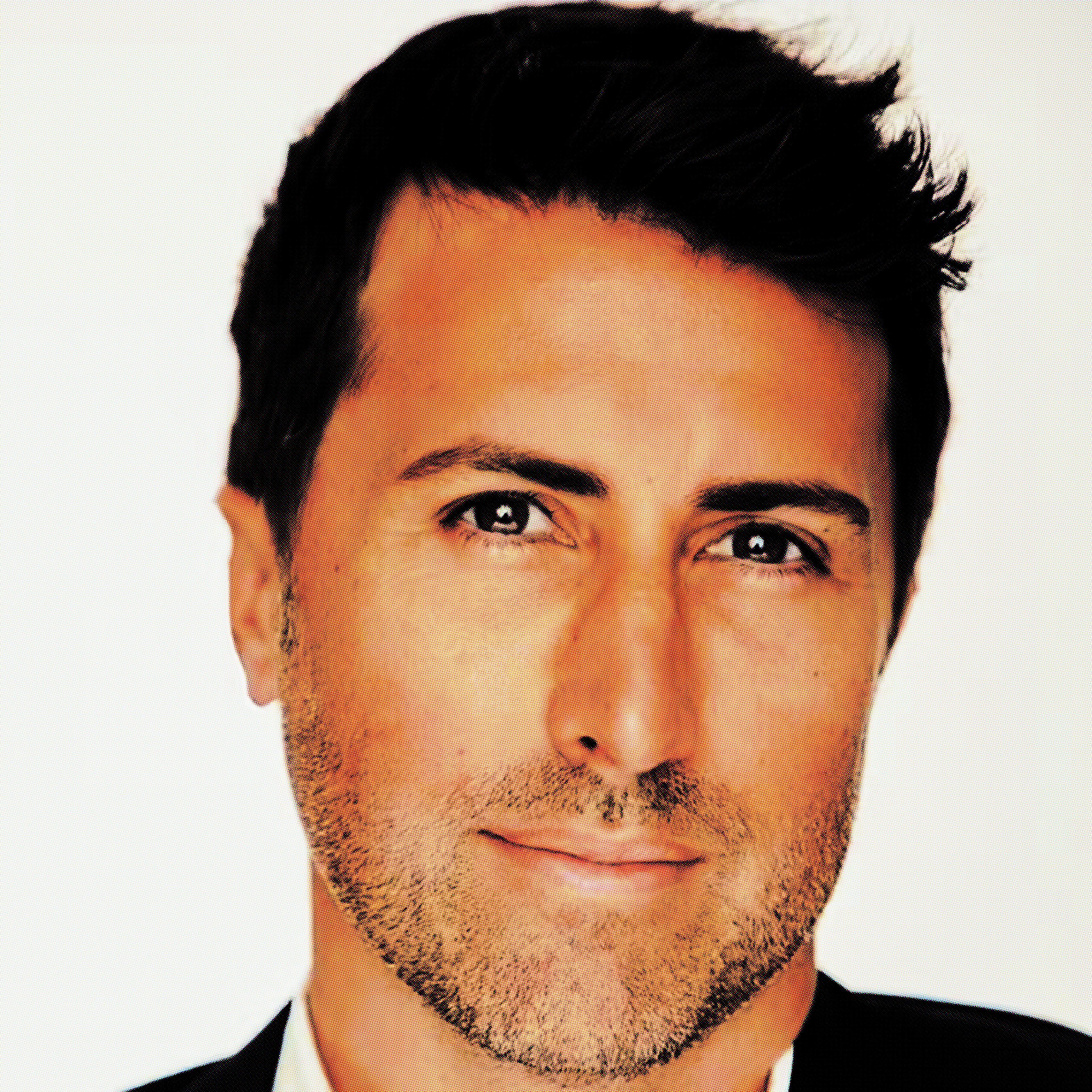

Final Boss: How CEO Jason Wilk took Dave Inc. from near-disaster to one of 2024’s top performers

Over the last two years, the small-cap fintech firm’s shares have soared roughly 1,000% as it turned the corner on profitability.

Two years ago, Dave Inc.’s days looked numbered.

Its share price had cratered 98% in little more than a year since its debut on the public markets via SPAC. Quarterly losses and negative cash flow mounted. Short interest was rising as bears began to smell blood.

Revenues, however, were hanging in there, rising at an annual 25% rate, and margins were improving. In meetings with investors and analysts, CEO Jason Wilk stuck to a simple mantra: the company had the cash, time, and user trends it needed to turn profitable by 2024.

“Our path to profitability is a pretty simple story. We are improving our margins,” Wilk told a conference of investors in June 2023. “Once we’re at 2.2 million to 2.4 million members, the company is now profitable.”

Later that year, the company hit those targets slightly ahead of schedule, with Dave eking out a small profit for the first time in Q4 2023. It’s replicated that feat every quarter since. The company’s shares, once relegated to the dustbin of SPAC-related disasters, have sprung to life.

In 2024, Dave Inc.’s shares rose 937%, making it the third-best performer in the Russell 2000 index, behind buy-now, pay-later company Sezzle and just ahead of quantum computing stock D-Wave Quantum.

We asked Wilk to zoom in for a Q&A about the company’s seeming resurrection, the cash-advance business, and some touchy, legally fraught issues related to how it’s done business in the past.

This interview has been edited for clarity and length.

Sherwood News: The business seems to have turned a corner over the last year in terms of net income, and growth is still strong. Tell me a little bit about what the last year meant for the business. Then we can talk about the stock price.

Jason Wilk: Well, we hit a real inflection point back in Q4 2023. We had started to deliver this very clear message to investors that once the company reached 2.1 million monthly transacting members, basically a paying member, within a quarter the company would reach profitability. We said that we were going to hit that 2.1 million number sometime in 2024. We ended up getting there ahead of schedule in 2023, and the market reacted very favorably to that.

We’ve not needed to add operational expenses or head count to achieve those numbers. The company is now achieving just significant operating leverage, which is really showing its teeth in terms of profitability.

So, a fairly simple story, and the market benefited from the simplicity of the story.

Overall, our product offerings are very simple. We offer a way for consumers to get access to cash at a far cheaper rate than overdraft fees or payday loans. Then we pair that with a best-in-class free checking account that lets you access ATMs, direct deposit your account, with no monthly minimum balance fees, no overdraft fees.

So yeah, we’ve always had a great story. We just went public at the worst possible time. We’re trying to claw way back to where we once started.

Sherwood: It was a pretty precipitous tumble. I have a chart here showing the share price down 90% or more from the date you went public.

Wilk: Yeah, and we were one of the last companies to go out via SPAC. The whole market fell apart before we had a chance to get any kind of a real footing underneath us. That really was the problem.

It was never a business problem. We always had good fundamentals. I mean, we weren’t profitable at that time, but we never, by design, were supposed to be profitable at that level of user scale. We just had a really, really unfavorable situation with respect to our cap table; all of our PIPE investors sold out of their position immediately when the market turned.

That was even before our lockup expired. We didn’t have any analyst coverage yet and the market was just in turmoil, so it was a really tough place to be. But we kept our head down. We really persevered, kept doing what we said we were going to do, and we’re about halfway back to our IPO price.

Sherwood: Just to take a step back, the model as I understand it is an app. You guys have a relationship with the bank — you’re not a bank, but accounts are provided through an FDIC-insured institution, right?

Wilk: That’s right. We ourselves are not a bank. We are a financial technology company. We partner with a bank that has a license with the Fed. They have the FDIC insurance, so all of our customers open up accounts with them on the account-opening agreement, but we are very much on the front end. We’ve got all the technology. We’ve got all the underwriting capabilities.

Sherwood: So you’re like the technology face, the site, the app, the front end that banks are so bad at in general. You do that, and then in addition to being an app and a website, tell me a little bit about the business. I’ve seen your customer base described as “financially vulnerable.” These are people who would otherwise be dealing with payday lenders?

Wilk: If you look at the large incumbent banks, we were started to sort of disrupt their model, because of their inherent cost structure. They’ve got a couple hundred thousand employees. They’ve got these 10,000 bank branches that are very expensive to service. They’re built on these legacy tech stacks. And when you peel all that back, for a big bank to break even on a customer per year — just to operate their checking account — it’s about $300 a year.

Well, when you’re dealing with a customer who is lower income or has a lower credit score, they’re not able to use you for a mortgage or a credit card product. The only way you can recoup your annual maintenance costs on the checking account is by charging a high monthly minimum fee, as well as high overdraft fees, because the bank has to make that money back somehow.

There lies the opportunity to build a digital-first bank. No branches, use modern technology like chatbots to service customers, and actually use real underwriting to assess risk beyond legacy FICO score and you could build a vastly superior business at a fraction of the cost.

So when you look at Dave today, we have no monthly minimum balance fees, no overdraft fees on the checking account. We make money off debit card swipes on our debit card, about 1.5% on every swipe, paid by Mastercard.

Then on the extra cash side of the equation, which is sort of our version of overdraft protection, we charge a very simple 5% fee on that with a $5 minimum or a $15 maximum. So if you’re going to overdraft or borrow $100 from Dave, that’s only going to cost you $5. Whereas in an incumbent bank, they’re going to charge you $35 every time you overdraft your account.

And because we’re digital-first, we can maintain that lower price and we still had a 71% gross margin in Q4.

Sherwood: To get back to the stock, the shares have done well over the last year and a half, but over the last month it’s had a pretty sharp downturn with the rest of the market. (Editor’s note: It’s down more than 30%.) Do you have any sense of what’s going on there?

Wilk: That’s a real head-scratcher, because we just produced what we believe to be a flawless quarter. We had amazing growth, nearly 40% for the year, and produced over 230% growth in our EBITDA for the year. There’s just, I guess, a lot of uncertainty with respect to the macro environment right now. All the stuff we’re hearing from our active shareholders, they’re buying more stock.

Sherwood: One thing I do have to ask you a bit about is the DOJ litigation.

(Late last year, the Justice Department filed a civil complaint against Dave Inc. and Wilk, alleging the company “misled consumers by deceptively advertising Dave’s cash advances, charging hidden fees, misrepresenting how Dave uses customers’ tips and charging recurring monthly fees without providing a simple mechanism to cancel them.”)

Some of the allegations in there about the tips program seem kind of unsavory. The complaint says: “Dave falsely suggests based on how much the consumer ‘tips,’ Dave will donate enough to charity to provide a specified number of meals to feed hungry families. In truth, however, Dave does not donate to charity as claimed but instead makes only a token charitable donation — usually $1.50 or less — while keeping the bulk of the tips itself.”

Is there anything you can tell me about that?

Wilk: We’ve donated over $20 million to Feeding America. I think the number is like $22 million since our partnership, and we have helped countless amounts of people, especially during some of these major natural disasters that have happened over the years.

We feel really good about all the contributions we made, especially as a new company that was doing all these charitable donations even as we were unprofitable.

Prior to our new fee structure, where we just charge you a set 5% fee, we did originally ask customers, since inception: if they were finding our service valuable, did they want to give us an extra tip?

We thought the people loved it. It was a fantastic way for us to start our business. But as we’ve been scaling the extra cash product, the longer you see customers stay on the platform, obviously they’re not going to tip as much. That became a challenge as we’re trying to get people more and more money to provide for them, for the everyday essentials. The new fee structure we rolled out better aligns ourselves with issuing more credit to consumers.

Sherwood: The new fee structure, was that in reaction to the DOJ complaint? Or was that more broadly just a business decision in and of itself?

Wilk: So the stakeholders here are three groups of people. One are customers. The more we know about the durability of the monetization, the better we feel about scaling up credit limits.

Two, investors, who were having a hard time forecasting on tipping. For an investor, it’s much easier to pencil just a 5% fee and to forecast that out.

And then the third was regulators who thought that tipping was never optional. But this would be a very strong proof point, in our opinion, now that we move toward a set fee model based on all the data we had. We’re not seeing any impact to conversion.

If anything, it’s actually been a positive reception from customers. So, you know, I’d put regulators as the last piece of the puzzle there, because it’s a good business decision for the company to do it. But it should, in theory, be viewed favorably by regulators as well, because they couldn’t wrap their heads around the customer being willing to give an optional fee.

Sherwood: Looking in your recent annual report, I noticed that you have this litigation in there as a risk factor for the company going forward.

Wilk: Exactly. We don’t know the outcome. All we know is that we feel very good about all the previous practices. We feel very good about the practices we have in place right now. And ultimately, we’ve said that we don’t think there’s any impact to our business model whatsoever, whatever way that case goes. It’s just a matter of coming to some resolution over some time.

Sherwood: Well, congrats again. You’ve been public in a pretty wild time for the markets, and as you know, there are a lot of SPACs that have sputtered. You guys are one of the few that seem to have made a comeback. Good luck with it.

Wilk: Thanks so much. It’s been tough. But I’m really proud of my team for sticking with us. The vast majority of our key players stayed at the company, weathered the storm, and really believe in the product and the mission. That part has been rewarding.