Spotify reported record profits after price hikes

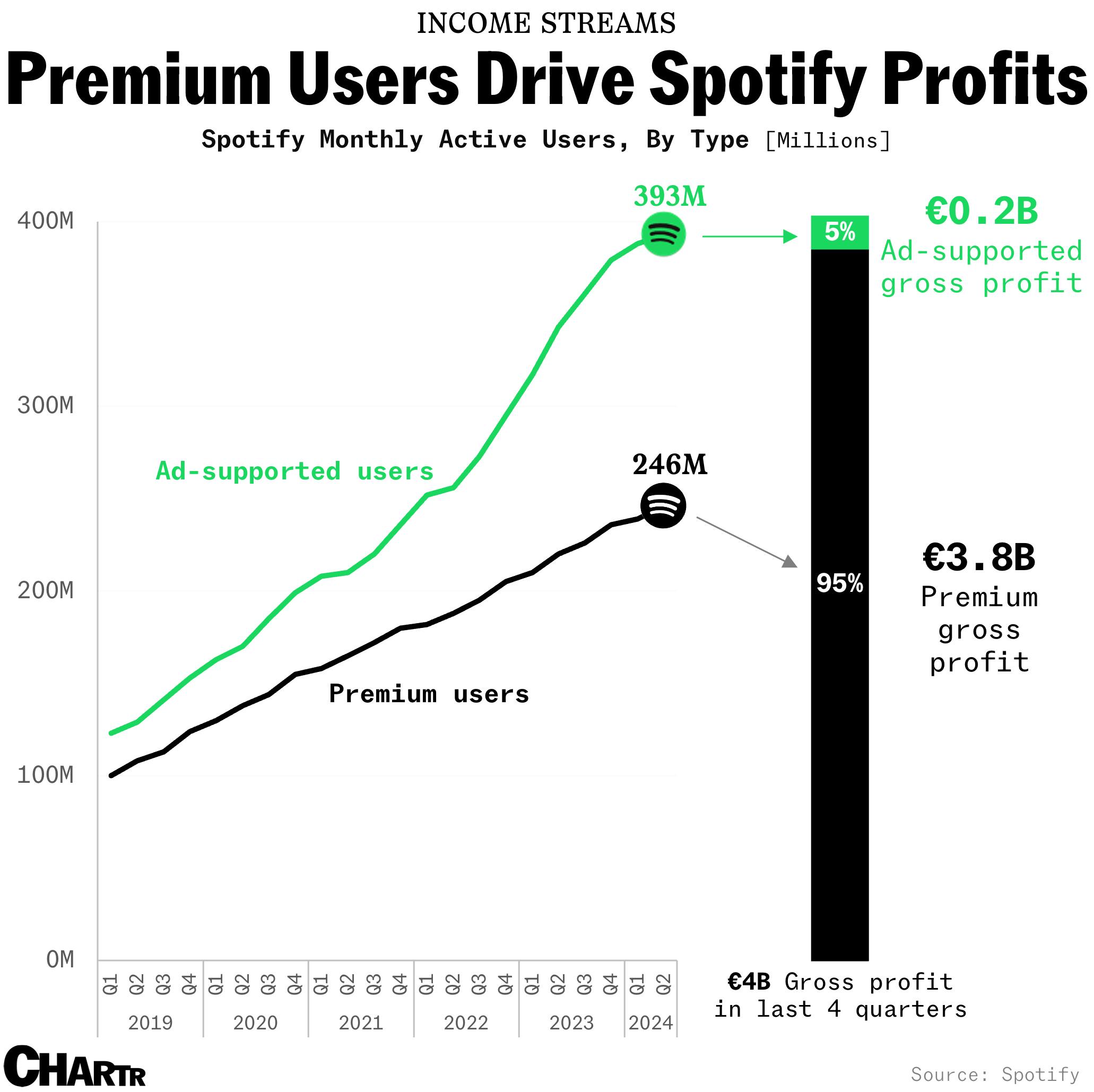

Spotify’s free tier is just the icing on a very large, increasingly profitable, premium cake

Stairway to heaven

Spotify is singing a tune that investors are thoroughly enjoying this morning, with shares in the world’s largest music streaming platform up more than 10% after the company reported a record quarterly profit, continued subscriber growth, and strong guidance for the rest of the year.

While there was a lot of noise around Spotify increasing prices for the first time ever last summer, and then again earlier this year, premium users weren’t perturbed. Indeed, despite having to cough up more for their music, Spotify’s subscriber numbers were up 12% year-on-year to a record 246 million. The combined effect of higher prices and more subs? Revenue from premium users that was up 21%.

That’s of course carried over to the company’s bottom line too, where it’s also still all about music fans who are forking out a monthly fee: per our calculations, Spotify’s premium users accounted for 95% of the company’s gross profit over the last 12 months.

Oops!... I did it again

Given that this quarter only accounts for up until the end of last month (June 30th), it’s reasonable to assume that the figures mostly reflect just the price hike from last year, while the US price hike in June 2024 has yet to fully wash through for an entire quarter.

Many people seem increasingly willing to live with constant advertising interruptions when sitting down to watch something from their favorite streamers (especially if it means the platforms get considerably cheaper). Indeed, streamers like Netflix are finding success cutting prices for inflation-weary consumers by offering ad-supported tiers.

Music might be different. So far, it seems like watchers might be more price sensitive than music fans: Disney+ actually lost users after its price hike, while Spotify has continued to grow. I guess the question boils down to what is more annoying? An ad interruption during your nightly TV binge, or an ad that breaks up your favorite album?