Microsoft has been on a winning streak: having recently dethroned Apple as the world’s most valuable company, hitting a $3 trillion market cap, the tech behemoth has also just posted revenue of ~$62 billion for its second quarter, up 18% on last year — with AI boosting the company’s cloud unit significantly.

But, not all of its AI-related products have been hits.

Bada Bing, bada boom

A year ago, Microsoft executives proudly announced that ChatGPT would be infused into its products, starting with the company’s Bing search engine, which had historically lagged well behind its big tech peer Google. At a time when any mention of AI was enough to send pundits into a frenzy, the news was hailed as a seismic moment for the company. But, 12 months on, Bing hasn’t quite made the impact that execs were hoping for, with Bloomberg recently reporting that Bing’s share of the search market has barely budged, climbing just 1% to 3.4%.

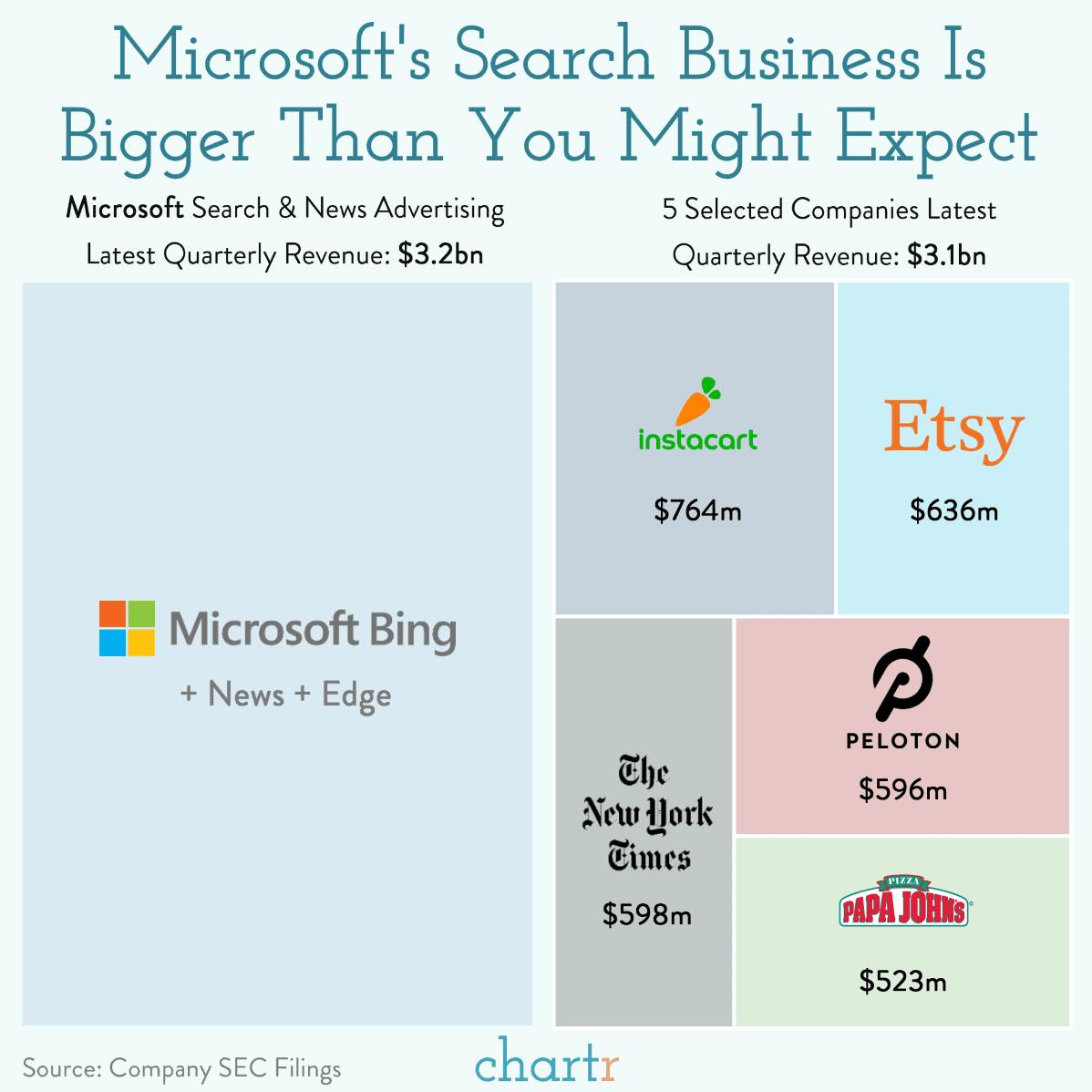

Indeed, Microsoft’s Search & News Advertising (mostly comprised of revenue from Bing) reported quarterly revenues of $3.2bn, reflecting just 8% growth and slower than the progress made by the company overall. That’s a mild disappointment in an otherwise knock-out year; but, when you’re Microsoft, even one of your slowest growing divisions — with a product that’s derided by many — is enormous. Indeed, the $3.2bn Search & News Advertising figure recorded last quarter was still larger than the revenues of the NYT, Etsy, Peloton, Instacart, and Papa John’s combined.