Google’s bigger bets are showing promise, but Search is still the company’s cash cow

Google, Snap, and Reddit all reported good numbers.

Yesterday, a trio of technology companies — all of which actually derive most of their revenue from advertising — reported earnings. All had good news for their investors.

Snap reported that sales had jumped 15%, losses had narrowed, and numbers of daily active users had climbed to 443 million, sending the company’s shares up ~10% in premarket trading. Reddit did one better, crushing expectations and giving out-of-hours traders enough confidence to bid the stock up more than 20% at one point yesterday evening, thanks in part to its new AI-content licensing deals.

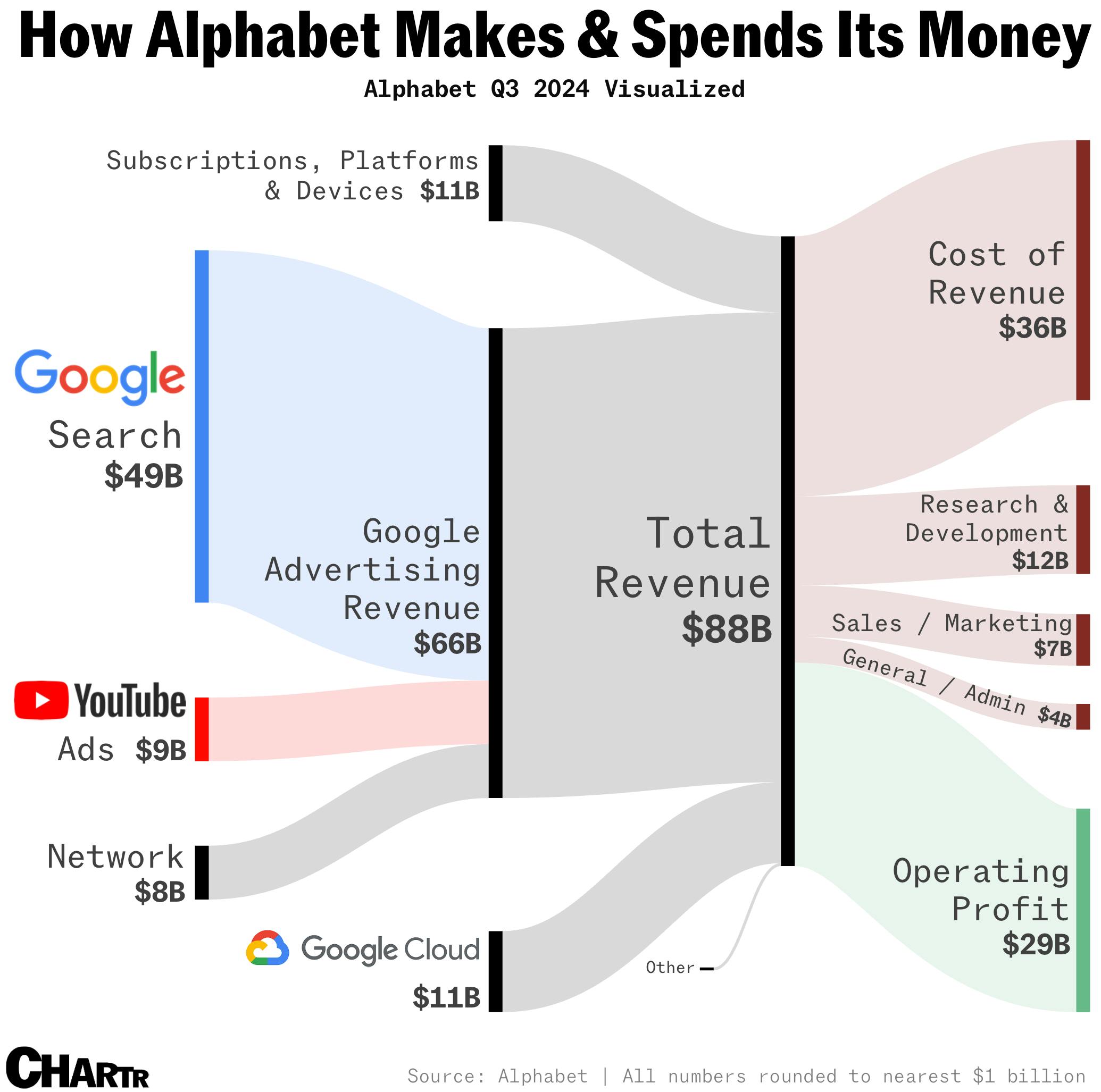

But most consequential of the three was Alphabet, which is worth roughly 60x Reddit and Snap combined. The Google owner revealed that its Google Cloud business — think servers, computing, analytics, and other enterprise IT solutions — continues to reap the rewards from the AI gold rush, with revenues rising 35% year on year. But, despite all the AI hype, good old Google Search continues to be the profit center of the company.

The continued dominance of Google is enabling the company to take some very expensive swings on nascent technologies. Many of these are in their infancy, but some are starting to make a splash. Its self-driving car division, Waymo, is reportedly doing 150,000 paid trips per week, and its Gemini AI model has now been squeezed into pretty much all of its products.

The dependability of the Google Search cash firehose also means that some of the company’s other highly used products, like Gmail, Google Maps (which just hit 2 billion users), and Google Chrome, don’t need to be huge moneymakers in their own right (yet). Of course, that dominance is catching the eye of the regulators: just a few weeks ago, the Justice Department said it was considering taking action to break Google’s monopoly on Search.

Microsoft and Meta report today.