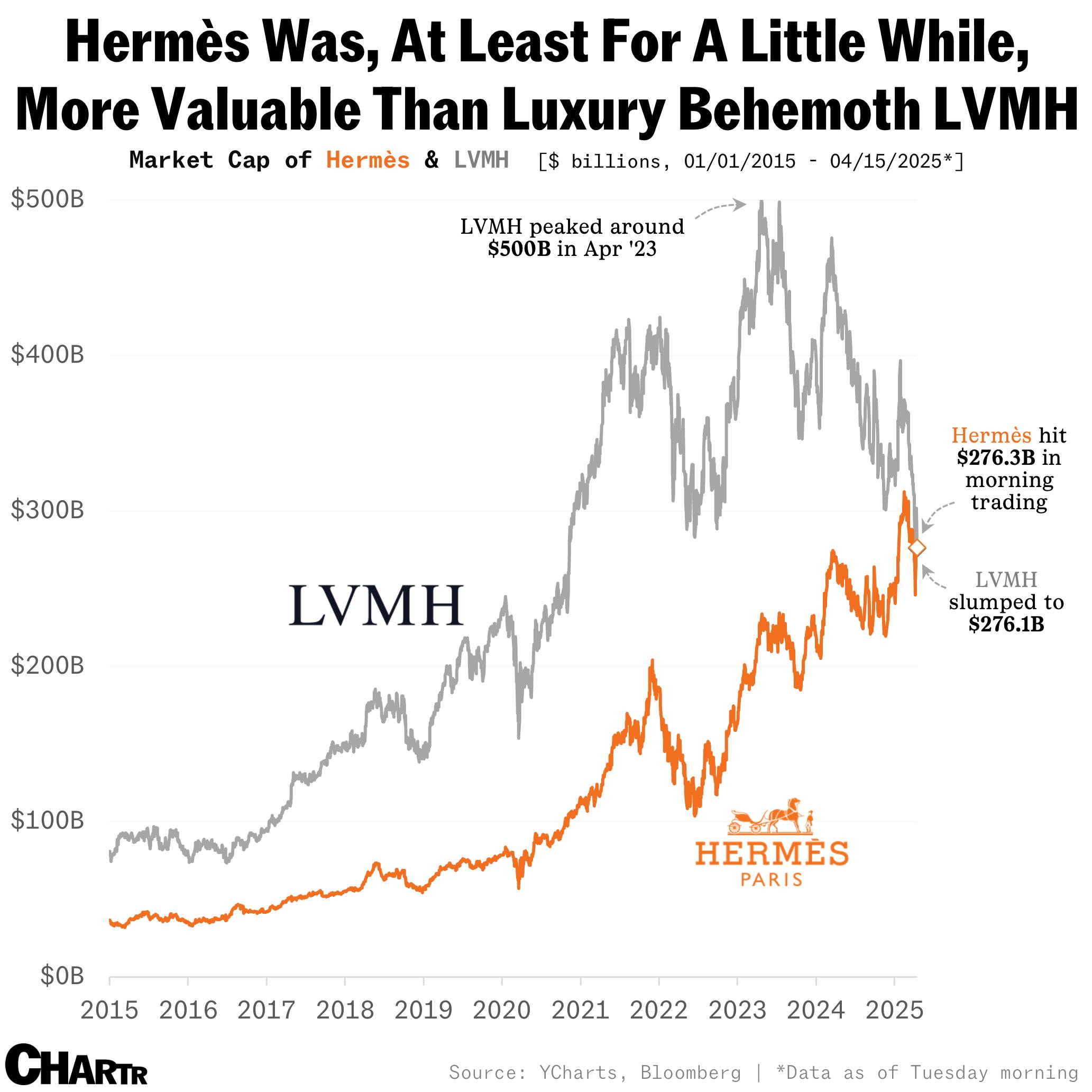

Hermès briefly overtook LVMH’s market cap for the first time ever

Earlier today, the Birkin bag designer’s value surpassed the French fashion giant that tried to buy it 15 years ago — making it the world’s most valuable luxury company, for a moment.

The drinks and taste makers at LVMH are unlikely to be popping the Champagne anytime soon. On Monday, shares of the luxury goods behemoth — which counts Louis Vuitton and Moët & Chandon among its stable of 75 upmarket brands — slid more than 8%, after the group reported disappointing sales for the first quarter.

State of (f)lux

To add l’insulte to injury for Bernard Arnault’s storied business, another high-end French retailer that the LVMH magnate attempted to buy in 2010 actually surpassed the fashion giant in market value earlier today.

As reported by Bloomberg, Hermès International SCA’s market cap reached €243.65 billion (~$276.3 billion) on Tuesday morning — leapfrogging LVMH to become the world’s most valuable luxury company after the latter saw its market cap sink to €243.44 billion (~$276.1 billion).

Hermès, the almost 200-year-old fashion brand, renowned for its silk scarves, leatherware, and much-coveted Birkin bags, has enjoyed a steady ascent in the 15 years since the French conglomerate’s takeover attempt, when Arnault (or “the wolf in cashmere”) amassed a considerable 17% stake in the company, kicking off a years-long “handbag war” of litigation.

In response to LVMH’s covert stake building, family shareholders at Hermès united, with Arnault eventually selling most of his shares. Over the next decade, Hermès managed to establish itself right toward the top of the luxury pile by targeting the ultrawealthy with its ~$12,000 handbags, driving demand by cultivating exclusivity via waiting lists and, sometimes, supply constraints.

Thanks in no small part to that increasing demand, Hermès has thus far weathered the luxury sector slowdown a little more successfully than other prestigious European brands, as the wider industry wrestles with tariff turmoil and reduced spending. With Hermès expected to report quarterly results on Thursday, improved sales could see it once again cross the €300 billion mark, as it did when it posted glowing 2024 results in February.