Permian pioneer

ExxonMobil is eyeing up a major deal, with America’s largest oil company on the brink of buying Pioneer Natural Resources, Texas' biggest crude producer, in a deal worth approximately $60 billion. If completed, this would mark Exxon's largest deal since it acquired the second half of its name for $81 billion back in 1999.

Pioneer wields a strong presence in the Permian Basin — a sprawling patch of shale in Texas and New Mexico that's become the backbone of America’s oil industry. In the last quarter alone, Pioneer extracted a staggering 711,000 barrels of oil equivalent per day from the basin, trailing only behind Chevron and ConocoPhillips in the region.

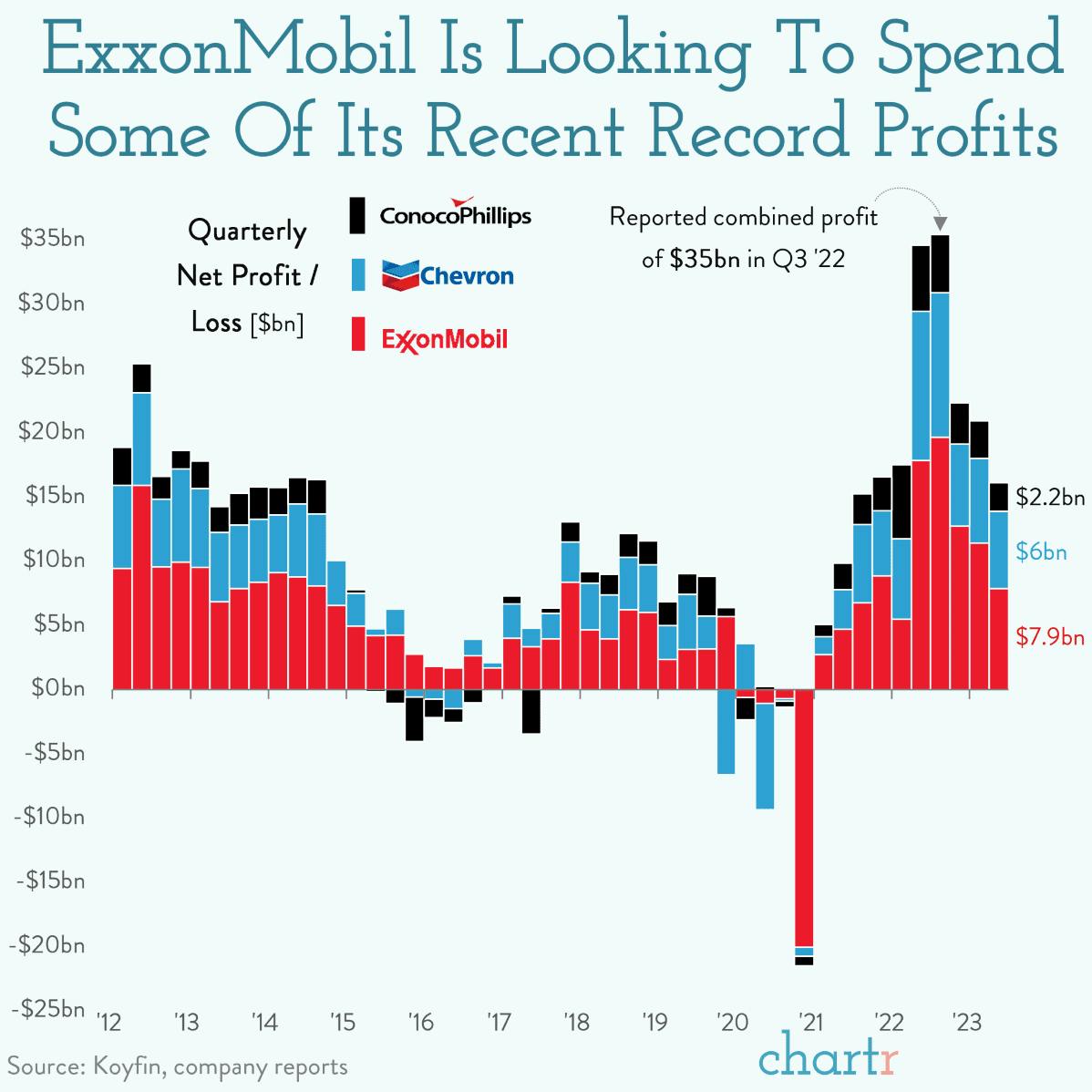

Buying Pioneer makes a lot of sense for Exxon: the company has been investing heavily into its own operations in the booming Permian Basin and, like its rivals, is flushed with cash after last year’s record-breaking profits.

The deal also comes just two years after Exxon’s public showdown with hedge fund Engine No. 1, which pushed for the company to adopt a more environmentally friendly strategy — the behemoth clearly isn’t ready to let go of the oil and gas that's fueled its profits for decades.