Same energy: Energy stocks are reporting weaker earnings, but the stocks are still flying high

Last week was the busiest for second-quarter earnings season, and corporate America didn’t have much good news. Indeed, companies in the S&P 500 are currently on track to report the worst operating quarter since 2020, with data cited by the Wall Street Journal revealing that earnings for the flagship S&P 500 Index are down 5.2% on this time last year.

Same energy

In 2022, energy was the bright spot in the market. Soaring oil prices may have hurt your wallet when you filled up your tank, but it was a boom time for oil companies like ExxonMobil and Chevron. This year, the going isn’t quite so easy for the sector. ExxonMobil, for example, reported net income for the second quarter of $7.9 billion, less than half of the remarkable $17.9 billion it reported in the same quarter last year. Chevron, a smaller rival, also reported a leaner quarter, with a 28% decline in revenue.

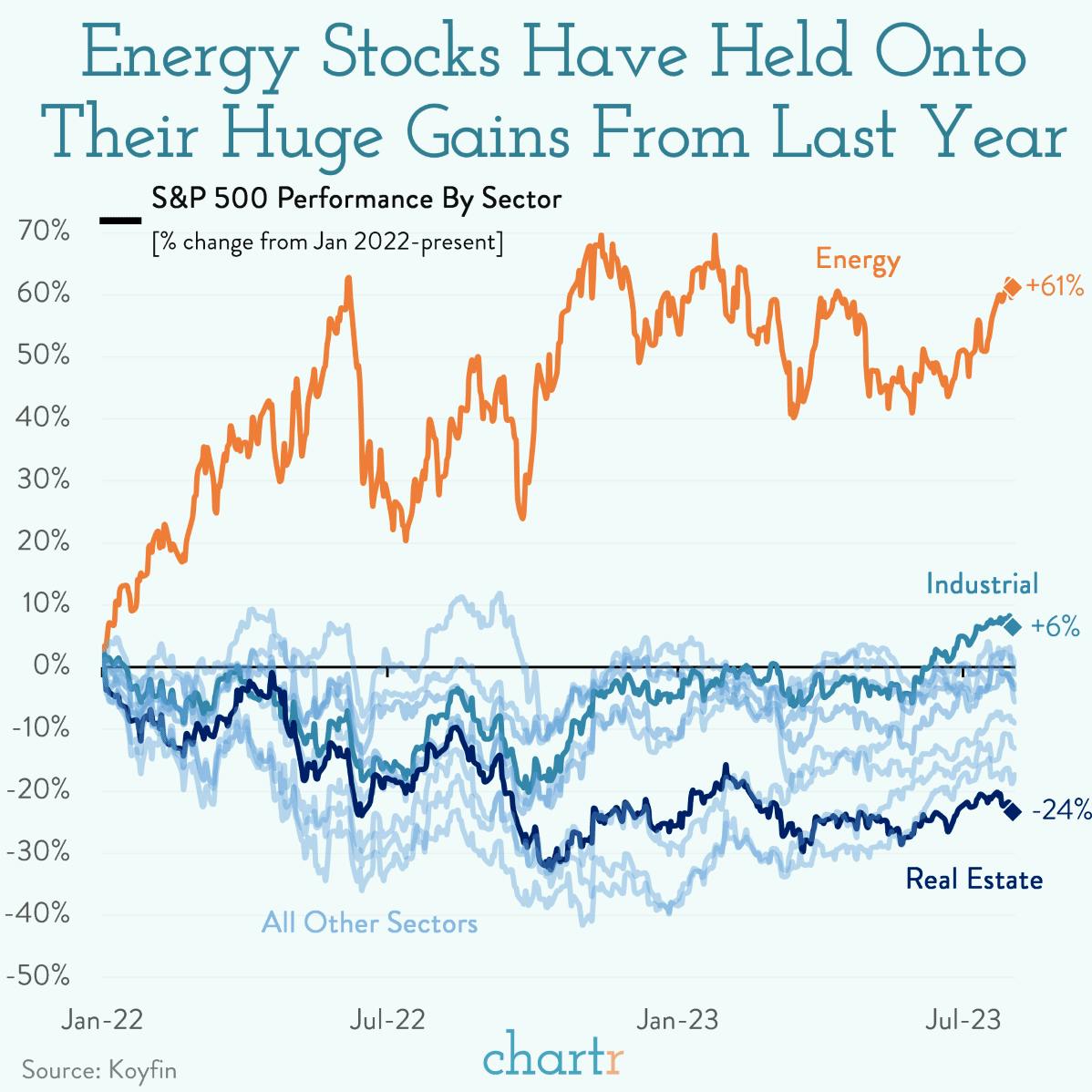

However, even if the earnings aren’t quite as ludicrous as they were last year, energy stocks as a whole have broadly held onto their gains — rising more than 60% since the start of 2022.

Taking stock

Beyond energy, the performance of America's stock market has been fairly underwhelming since Jan 2022. Industrials have been the second-best performer, with a modest 6% increase, and while the headlines have been dominated by AI — propelling Nvidia, Microsoft, Alphabet, Apple, Amazon, and Meta to add a total of $3.1 trillion in market cap this year — the tech sector as a whole hasn't gained since 2022. Meanwhile, the real estate sector has been the hardest hit, grappling with fears of rising mortgage payments and empty office spaces.