Disney just announced its first ever streaming profit... and more price hikes

After burning billions of dollars, Disney’s streaming unit is finally profitable, reporting $47 million of operating income, after the company introduced a series of price hikes which made binging episodes of The Mandalorian, Bluey, and The Bear increasingly expensive.

The quarterly figures came just a day after Disney announced yet another raft of price rises across many of its most popular standalone and bundle packages. As of October 17, most Disney+, Hulu, and ESPN+ plans will increase by $1-$2 each: Disney+ with ads, for example, is going up from $7.99 to $9.99 a month, a whopping 25% rise, while the ad-free version will increase from $13.99 to $15.99.

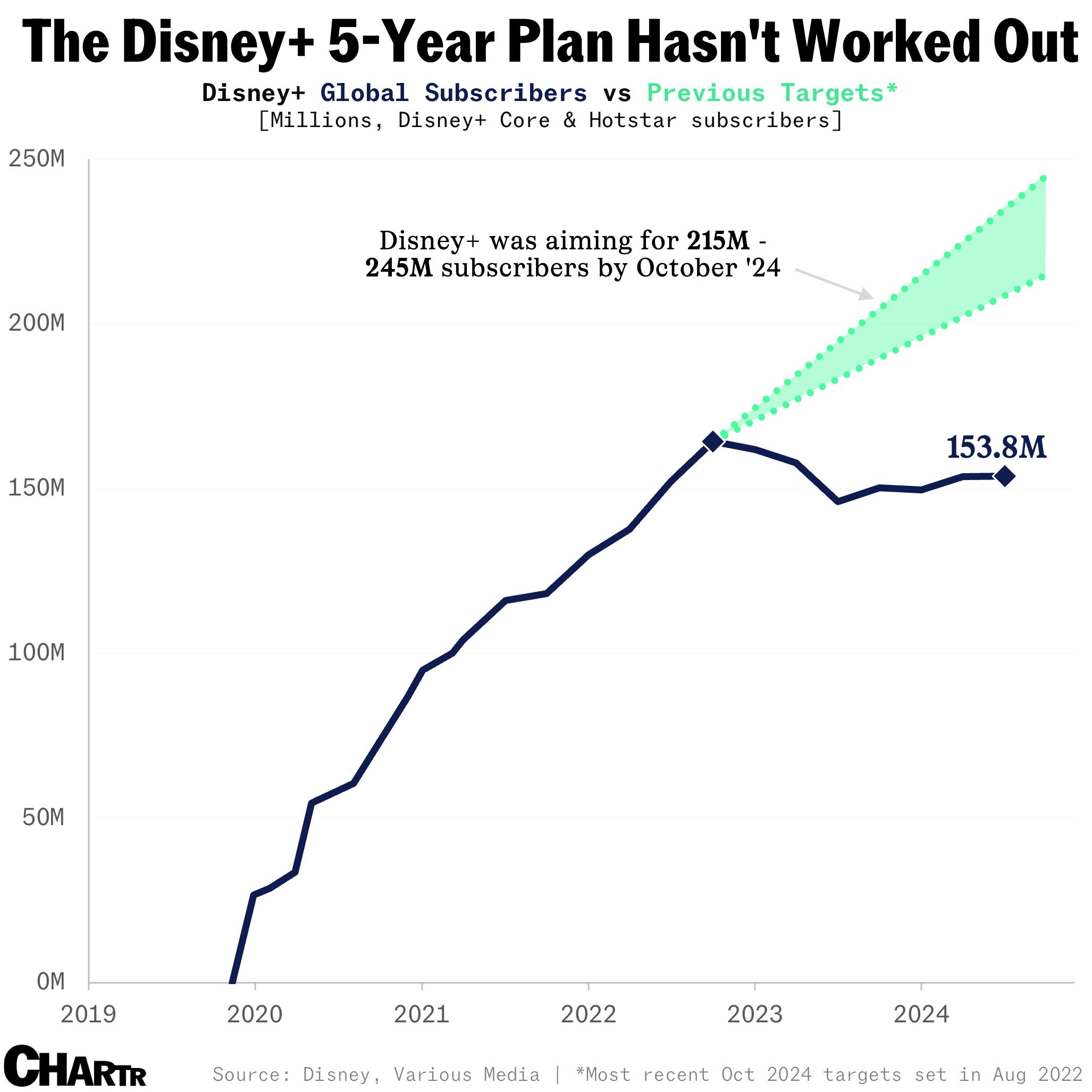

The company was hoping for nearly a quarter of a billion Disney+ subscribers by the fall of 2024. It’s settling for more profits instead. Indeed, Disney's looking to cash in on the trend of rising subscription costs in the wider streaming world, just as investors begin to feel that corporate America’s ability to hike prices elsewhere might finally be fading.

The fact that the Disney+ subscriber count, having fallen in recent years, was steady this quarter — thanks in part to the success of the Inside Out franchise, which drove new subscribers looking to watch the first installment — suggests that the majority of customers aren’t yet pulling the plug on Disney’s streaming offering. This latest round of price rises could be the final straw.

Related reading: How steadily rising subscription prices are boiling consumers like frogs.