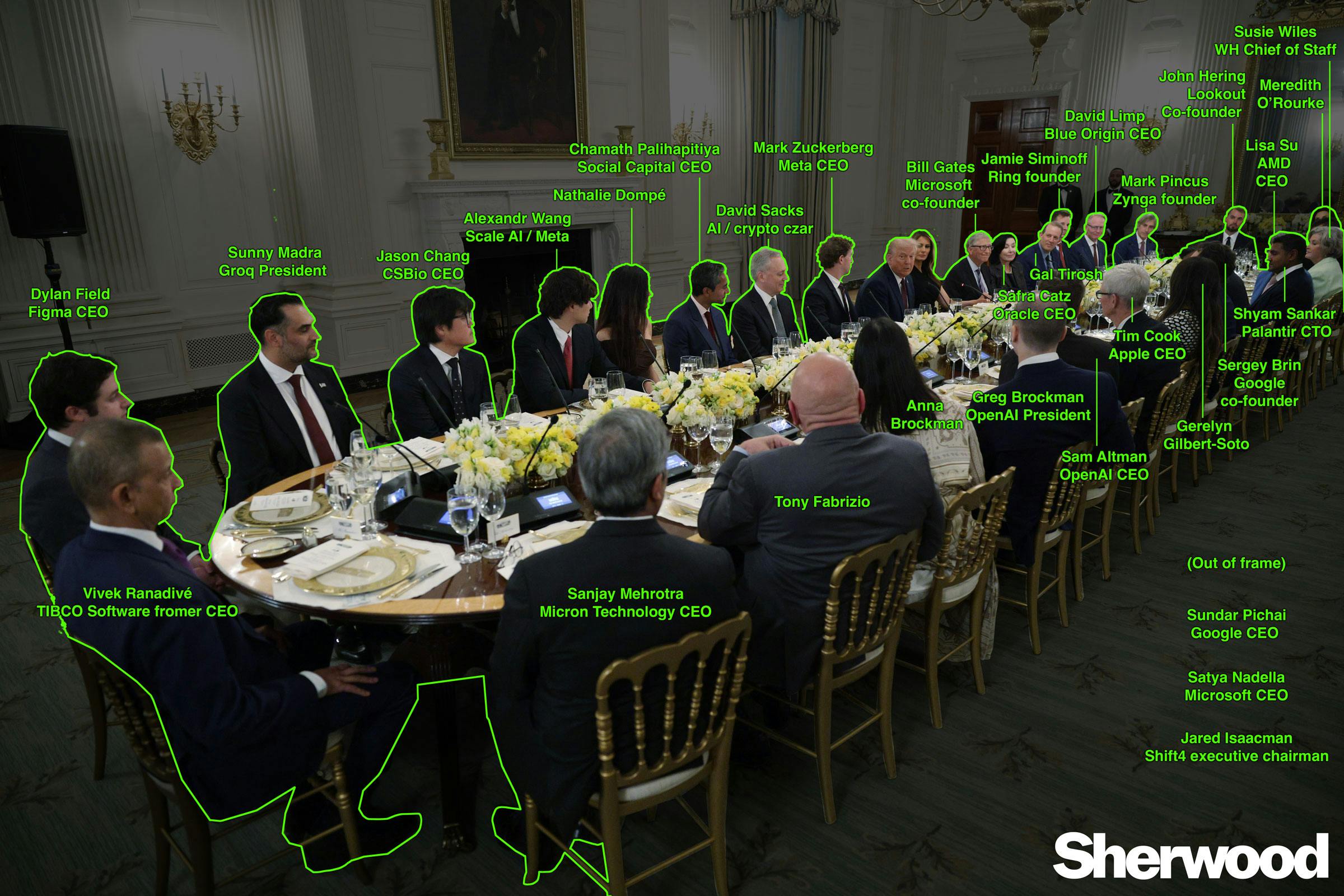

An interactive who’s-who of the tech execs at Trump’s White House dinner

The White House invited a gaggle of top founders and tech executives for an intimate dinner at the White House.

A who’s-who of tech executives and AI power players sat side by side at a long table in the White House on Thursday evening to lather President Trump with praise for his leadership on AI.

Billed by White House spokesperson Davis Ingle as “the hottest place to be in Washington, or perhaps the world,” the exclusive dinner was packed with “the most brilliant people,” according to Trump, who said, “This is a high-IQ group.”

Proximity is power, and none of the tech figures were closer to Trump than Meta’s CEO, Mark Zuckerberg. Photos from the dinner showed the two laughing and chumming it up, a remarkable turn of fortune for Zuckerberg, who Trump once famously warned might “spend the rest of his life in prison” if he interfered in the 2024 presidential election.

Attendees included:

Dylan Field, Figma CEO

Sunny Madra, Groq president

Jason Chang, CSBio CEO

Alexandr Wang, Meta’s chief AI officer

Nathalie Dompé

Chamath Palihapitiya, Social Capital CEO

David Sacks, the White House’s “AI and crypto czar”

Mark Zuckerberg, Meta CEO

President Trump

First Lady Melania Trump

Bill Gates, Microsoft cofounder

Safra Catz, Oracle CEO

Gal Tirosh

Jamie Siminoff, Ring founder

David Limp, Blue Origin CEO

Mark Pincus, Zynga cofounder

John Hering, Lookout cofounder

Lisa Su, Advanced Micro Devices CEO

Meredith O’Rourke

Susie Wiles, White House chief of staff

Shyam Sankar, Palantir CTO

Sergey Brin, Google cofounder

Gerelyn Gilbert-Soto

Tim Cook, Apple CEO

Sam Altman, OpenAI CEO

Greg Brockman, OpenAI president

Anna Brockman

Tony Fabrizio

Sanjay Mehrotra, Micron CEO

Vivek Ranadivé, former TIBCO Software CEO and current CEO of Sacramento Kings

Satya Nadella, Microsoft CEO

Sundar Pichai, Google CEO

Jared Isaacman, Shift4 CEO

Notable absences

Perhaps more interesting than who was invited to the dinner was who didn’t attend.

Never one to hold a grudge, former “First Buddy” and Tesla CEO Elon Musk posted on X that he was invited, but would send a representative. It’s unclear if the Musk/Trump beef is heating up again.

Also absent was a representative from the company that is powering all of the AI that everyone was gushing about and recently struck a remarkably unusual trade deal with the White House: Nvidia. CEO Jensen Huang was notably missing from the gathering, but maybe he prefers one-on-one dinners at Mar-a-lago.