US electric vehicle sales are expected to slide nearly 40% in Q4

This is weirdly good news for Tesla.

Last quarter, electric vehicles enjoyed record sales in the US as buyers rushed to get ahead of the end of the federal EV tax credit. Now comes the aftermath.

This quarter, electric vehicle sales are expected to plummet 37% in the US to 230,000, compared with 364,000 in Q4 2024, according to new estimates from Cox Automotive. In a strange turn of events, the decline might actually be good news for Tesla, the biggest EV maker in the US.

Analysts surveyed by FactSet currently expect Tesla deliveries in Q4 to decline 9.5% year over year to 449,000 — down substantially, but not by as much as EVs overall. That means Tesla is picking up EV market share. And as other traditional automakers dial back their EV programs in light of the EV drawdown, Tesla and other pure-play EV companies could continue to gain a bigger slice of a smaller pie.

The data also suggests good news for forthcoming Tesla competitor Slate Auto, which still expects to release an EV truck in the mid-$20,000s next year.

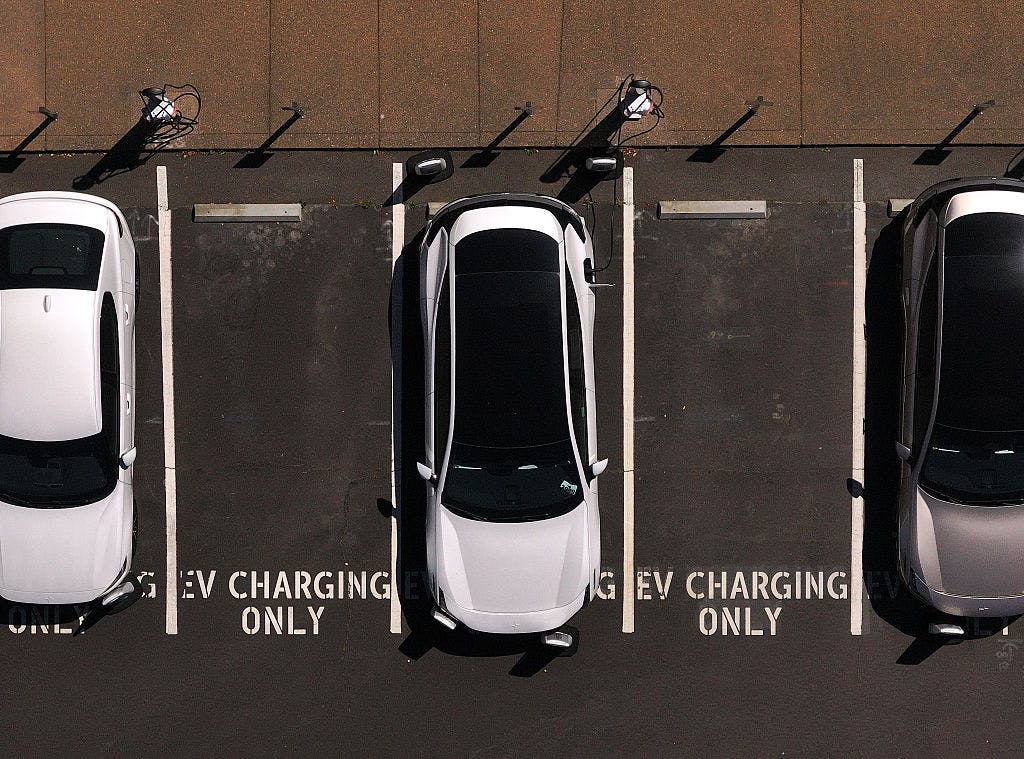

It appears the government’s $7,500 tax credit was integral for growing the EV market, because EVs just aren’t that affordable without the tax credit. There are currently only nine EV models that cost $40,000 or less, Cox reports, compared with 56 models with internal combustion engines under $40,000.

If Slate manages to retain its price target, consumers won’t need the credit to buy one.