Investors are dumping CrowdStrike shares after IT outage

As reports of a global IT outage spread, everyone started asking the same question: what is CrowdStrike?

A global IT outage has hit banks, airlines, media outlets, and hospitals around the world.

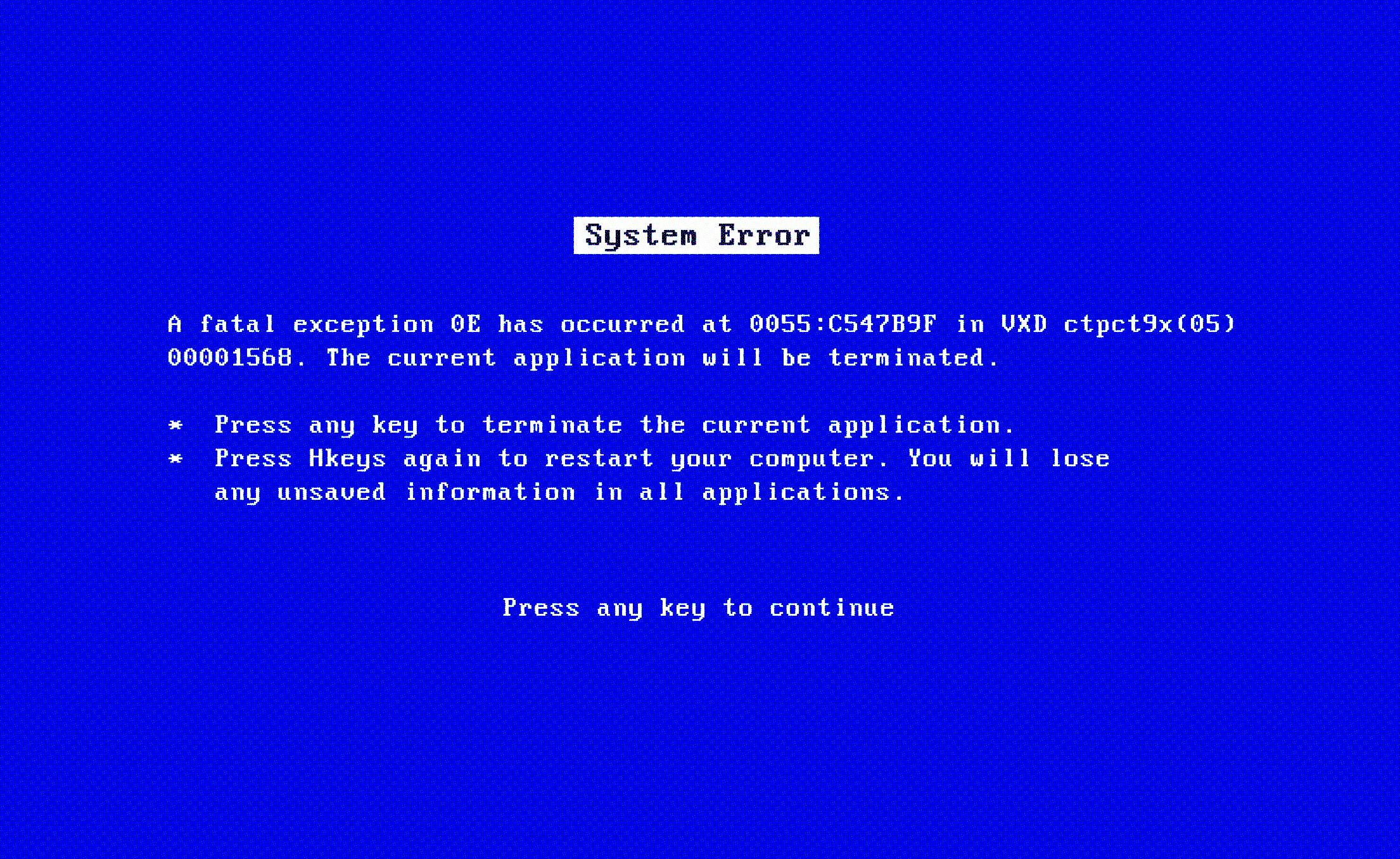

Per The Verge, Australian firms were the first to report system failures, before similar outages around the world came to light, with all flights from major US airlines grounded early this morning. Thousands of users reported seeing a “blue screen of death” on certain Microsoft Windows machines, with reports that a faulty update from cybersecurity firm CrowdStrike had knocked servers offline.

The CEO of CrowdStrike confirmed on X:

CrowdStrike is actively working with customers impacted by a defect found in a single content update for Windows hosts. Mac and Linux hosts are not impacted. This is not a security incident or cyberattack. The issue has been identified, isolated and a fix has been deployed.

The early reports sent internet users to Google to familiarize themselves with exactly what CrowdStrike does, with more searches for the firm in the last 24 hours than for Donald Trump or Taylor Swift. That level of attention isn’t usually a good sign for a critical cybersecurity company.

If it is indeed found to be at the core of the issues, questions will be raised as to how such a large portion of our IT systems became dependent on one company: according to its latest investor presentation, CrowdStrike is a cloud security provider to a whopping 62 companies in the Fortune 100.

Investors aren’t waiting to see how the outage plays out before selling CrowdStrike shares, with the stock currently down 10% today. The company had just joined the S&P 500 Index at the end of June.