Amazon is spending billions to make sure it doesn’t fall behind in AI

The company’s $75 billion capital splurge shows no signs of slowing in 2025.

With Microsoft tightly intertwined with OpenAI, and Apple, Google, and Meta stuffing their own versions of AI into pretty much all their products, Big Tech is hard at work capturing as much value — or garnering as much hype — from AI as possible. Amazon’s latest move is a $4 billion bet on Anthropic, announcing the investment in the AI startup on Friday, doubling its total stake in OpenAI’s largest rival to $8 billion. (See here for a great explainer of the web of investments in AI companies.)

Amazon’s deal will see Anthropic use AWS chips for its foundational models, and it follows Anthropic’s June release of the latest version of its AI assistant, Claude. The company says Claude outperforms OpenAI’s GPT-4o and Google’s Gemini 1.5 Pro across a range of tasks: writing, coding, solving math problems, interpreting charts, transcribing text from images, and, apparently, understanding humor.

Of capital importance

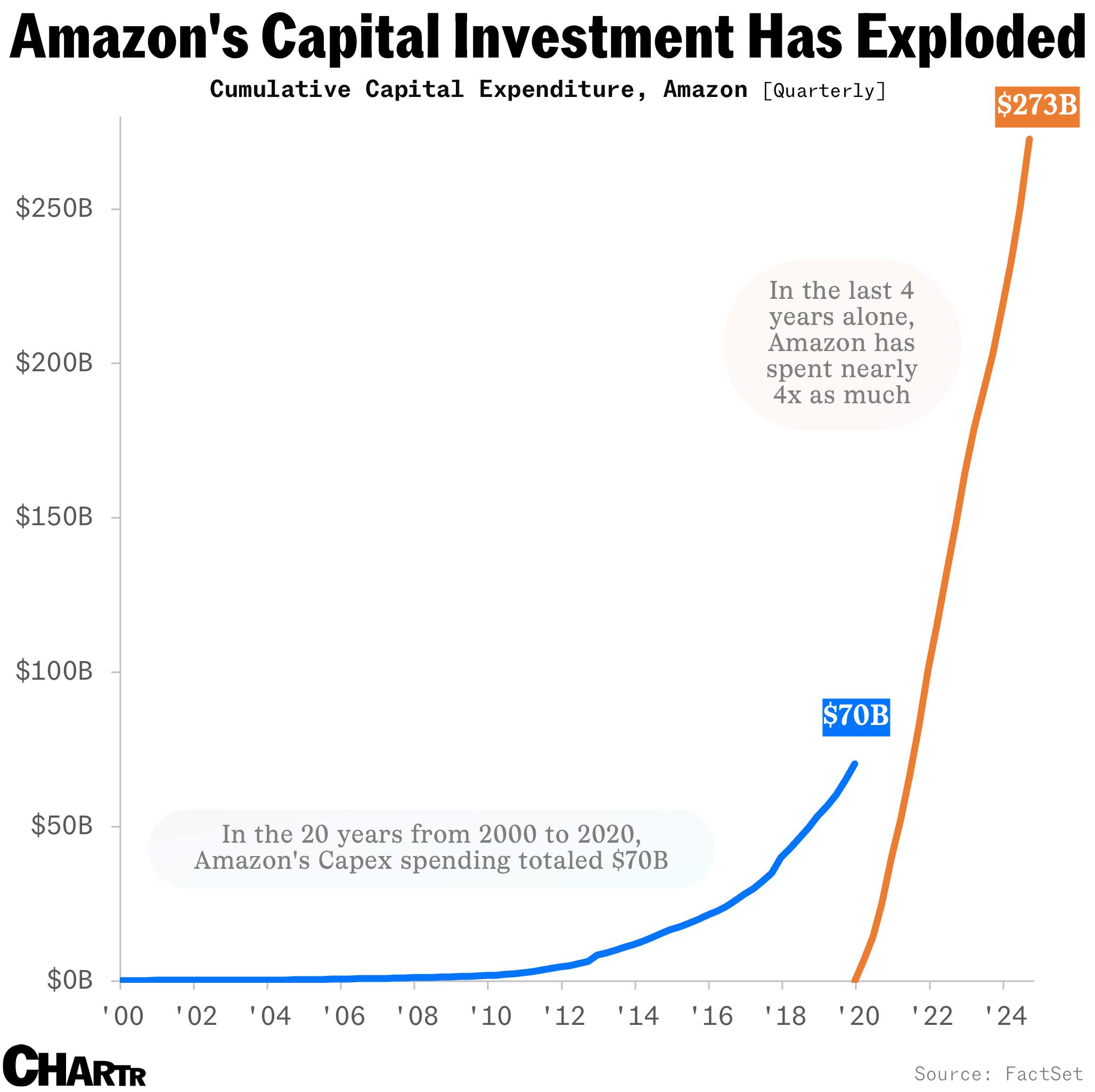

The investment is a continuation of Amazon’s (and the rest of Big Tech’s) new strategy: spend billions of dollars to make sure you don’t fall behind in AI. That doesn’t just mean passive investments in startups. Indeed, for years, Big Tech was the epitome of the capital-light business model, driving profits from intangible assets like software. Now, the tech giants are pouring billions into physical stuff, including massive data centers and custom chips.

The four tech giants — Amazon, Microsoft, Meta, and Alphabet — spent nearly a combined $60 billion on capital investments in Q3, up 59% from last year. By the end of 2024, this figure is expected to surpass a total of $200 billion, with Amazon leading at $75 billion — most of which supports AWS and its AI business. AWS, while accounting for just 16% of Amazon’s revenue in 2023, generated two-thirds of the company’s operating profit.

Amazon’s spending spree shows no signs of slowing, with the company expecting to splurge even more in 2025. In the latest earnings call, CEO Andy Jassy called the company’s relentless spending a “once-in-a-lifetime type of opportunity.”