Cash machines now cost more than ever to use

Inflation comes for everything, even getting cash itself out from ATMs

Every year since the pandemic — when the last thing anyone wanted was to handle banknotes that had been thumbed by countless people before — society has moved closer to being cashless.

Now, simply getting your hands on physical currency is coming with a heftier price tag.

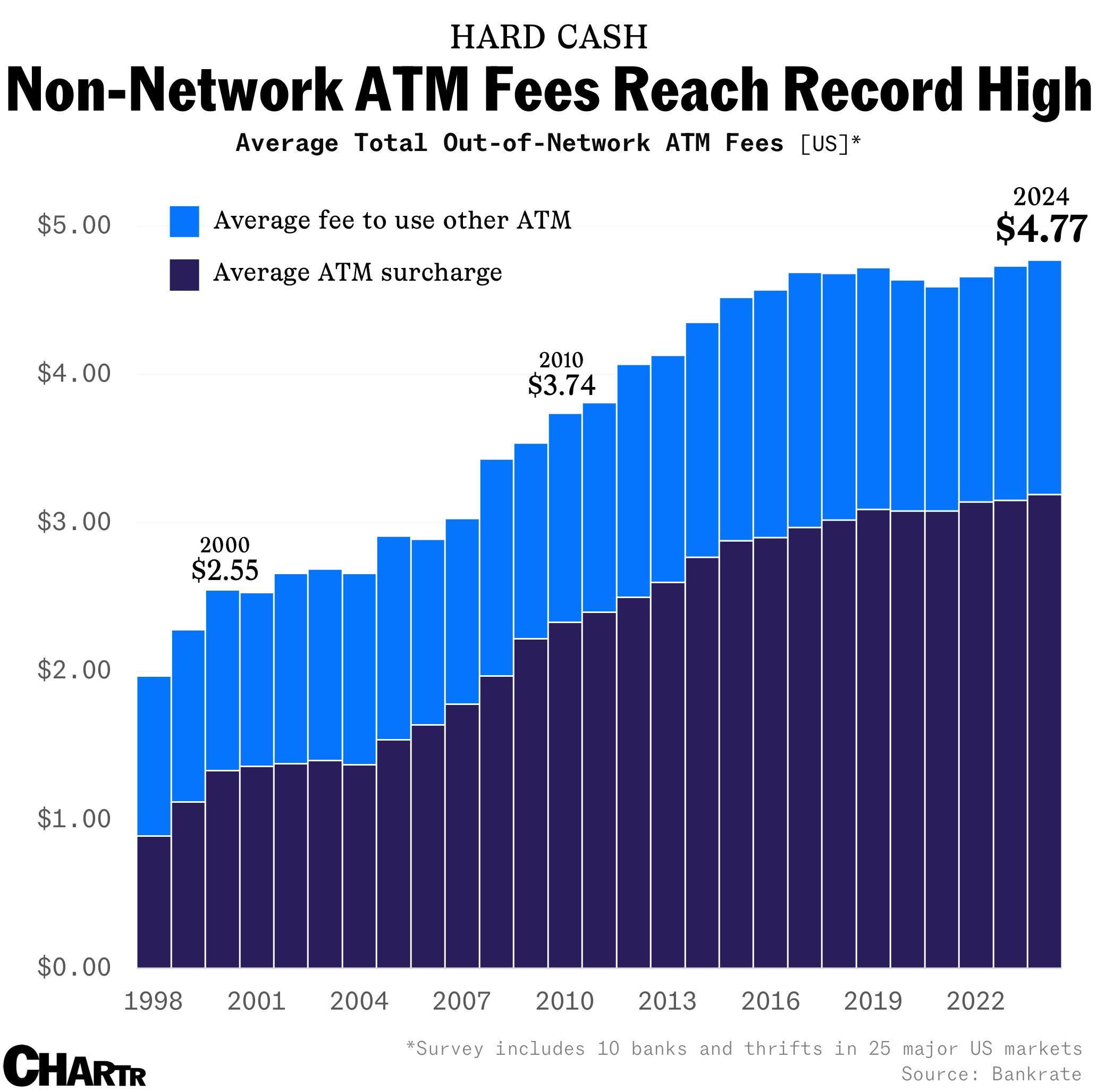

Indeed, ATM fees have hit a new high, according to a Bankrate study released yesterday, with it costing the average American $4.77 to withdraw money from an out-of-network cash machine — $3.19 of which comes from the surcharge charged by ATM owner, on top of a $1.58 fee that’s kindly doled out by your own bank for using a non-network machine.

Balance on screen

This marks the 4th consecutive year that ATM fees have risen, with the overall decades-long trend largely driven by the hikes in surcharges incurred to non-bank cardholders by ATM owners.

However, not all machines are created equal: while the study found that the metropolitan areas with the lowest combined average ATM fees were Boston ($4.16) and Seattle ($4.34), the district with the highest combined fees for the second year in a row was Atlanta, where you’ll get charged ~$5.33 for using an out-of-network ATM.

Even with steeper withdrawal charges, as well as overdraft fees also increasing by 1.7% to ~$27 this year, banks still appear to be loosening up on some other stipends: the same report outlined that average non-sufficient fund fees fell by a further 11% from last year to a record low of $17.72.