Tariffs have us heading for a “do nothing” economy

To play the game, you’ve got to know the rules, and in trade, those rules are being rewritten in a very haphazard fashion.

The reciprocal tariffs that turned financial markets upside down haven’t even gone into effect yet. Even so, there’s an emergent theme in what kind of reactions we’re seeing — and realistically, would expect to see — from Corporate America.

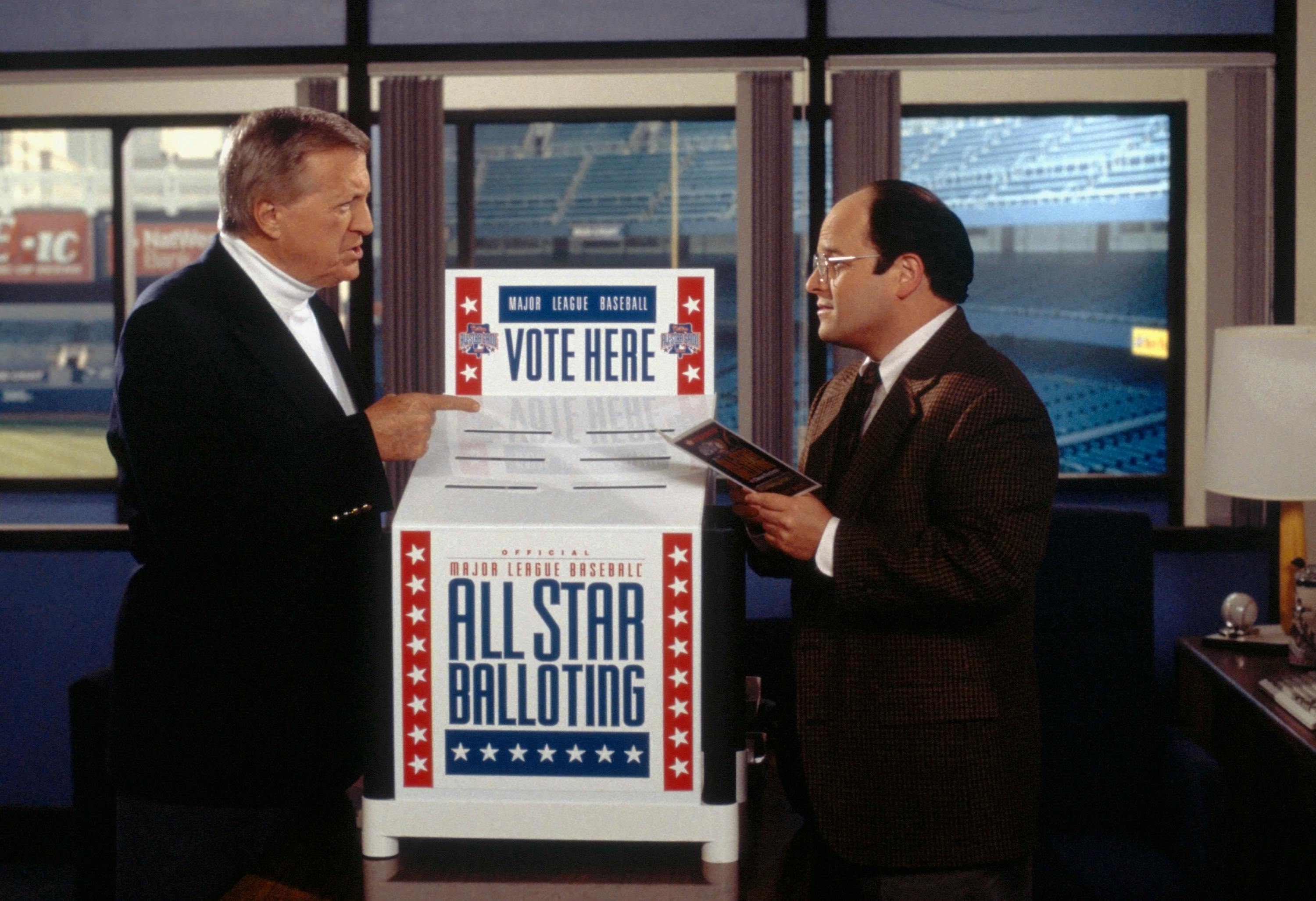

The strategy is, to borrow from “Seinfeld” character George Costanza’s TV show pitch: “We’ll do nothing!” Tariffs this large are paralyzing (or worse) for corporate decision-makers, because the rules of global trade are being rewritten to an uncertain end for a potentially indefinite period of time. Or not.

By contrast, Covid — in financial terms — was primarily a liquidity crisis, with companies racing to get their hands on cash and investors seeking safety in the most riskless asset there is. From the February 19, 2020, prepandemic peak in stocks through the end of March, money market fund assets increased by a whopping $763 billion. Long and short positions in futures were liquidated en masse to meet margin calls. Swaths of companies began to draw on their revolving credit facilities to bolster their cash reserves. Buybacks went on hold. And so on.

There is always room for any downturn to become a liquidity crisis, but for now, the defining characteristic of what we’re in the midst of is that it’s causing economic actors to want to do nothing.

Here are the not-so-sweet nothings:

̶I̶n̶i̶t̶i̶a̶l̶ ̶P̶u̶b̶l̶i̶c̶ ̶O̶f̶f̶e̶r̶i̶n̶g̶s̶

The “PO” in IPO now stands for “put off.” Swedish BNPL company Klarna delayed its initial public offering, as did StubHub. Media reports indicate that Ryan Reynolds-connected TV ad platform and fintech company Chime is also reportedly staying away, likely due to (to use a euphemism) “market conditions.”

“Expect management teams to strike a cautious tone, validate a pause in customer activity,” Bank of America analysts led by Ebrahim H. Poonawala wrote in a recent note previewing bank earnings, in which they cut profit estimates for the group.

Tapped Out

In a very related bad-news story for Corporate America in general and financials in particular, the credit market is seemingly drying up. High yield and investment grade cumulative issuance barely inched higher last week. Patterson Cos was the only new high-yield sale last week, and investment-grade issuance had its slowest week of the year. Per Bloomberg, one ready borrower passed on tapping the market on Friday after China announced retaliatory tariffs.

Act of God

According to a letter seen by Reuters, Howmet Aerospace has declared a “force majeure event” and is aiming to excuse itself “from supplying any products or services that are impacted by this declared national emergency and/or the tariff executive order.” Force majeure is typically invoked due to an “act of God,” wherein tornados or tsunamis disrupt operations and leave companies unable to make good on contracts.

And, in a small — but meaningful, for millions of gamers — example of how tariffs can undermine the best-laid corporate plans, Nintendo said it’s delaying Switch 2 preorders in light of the levies.

Just imagine thinking of sending cargo across the Pacific from Asia, where devices like the Switch are being manufactured, when you’re staring at massive tariffs once you get there. Understandably, many shippers aren’t, per the CEO of supply chain logistics company Flexport:

28% of the customers in @flexport's call down yesterday said they're pausing all ocean freight bookings from Asia until there's more clarity on where tariffs will end up.

— Ryan Petersen (@typesfast) April 5, 2025

Even worse than doing nothing, some companies are already going to be doing less, with fewer workers. Notably, Stellantis announced plans to lay off 900 US workers.

Sitting, Waiting, Wishing

Faced with a looming shock to both prices and activity, the latest message delivered by Federal Reserve Chair Jerome Powell on Friday was that it was “not clear what the appropriate path for monetary policy will be.” He added that central bankers were “waiting for greater clarity before we consider adjustments” and that it doesn’t feel like they need to be in a hurry to act.

Reply Hazy, Try Again

Earnings season unofficially kicks off this Friday with JPMorgan, Wells Fargo, and Morgan Stanley reporting before the bell. One thing you shouldn’t expect a lot of this reporting period, according to Wedbush tech analyst Dan Ives, is management teams providing a picture of what their financials will look like through the rest of the year.

“At the current situation we do not expect most tech companies to give any guidance on the 1Q conference calls over the next month including Apple given too much uncertainty,” he wrote in a note slashing his price target on the iPhone maker. “The sheer uncertainty of this tariff announcement will cause demand destruction for consumers globally (recession fears, etc) and the price consequences of this tariff action are hard to grasp and model.”