Suddenly stocks are within spitting distance of record highs

The near panic of early August seems a distant memory.

Where’d all the early August panic go?

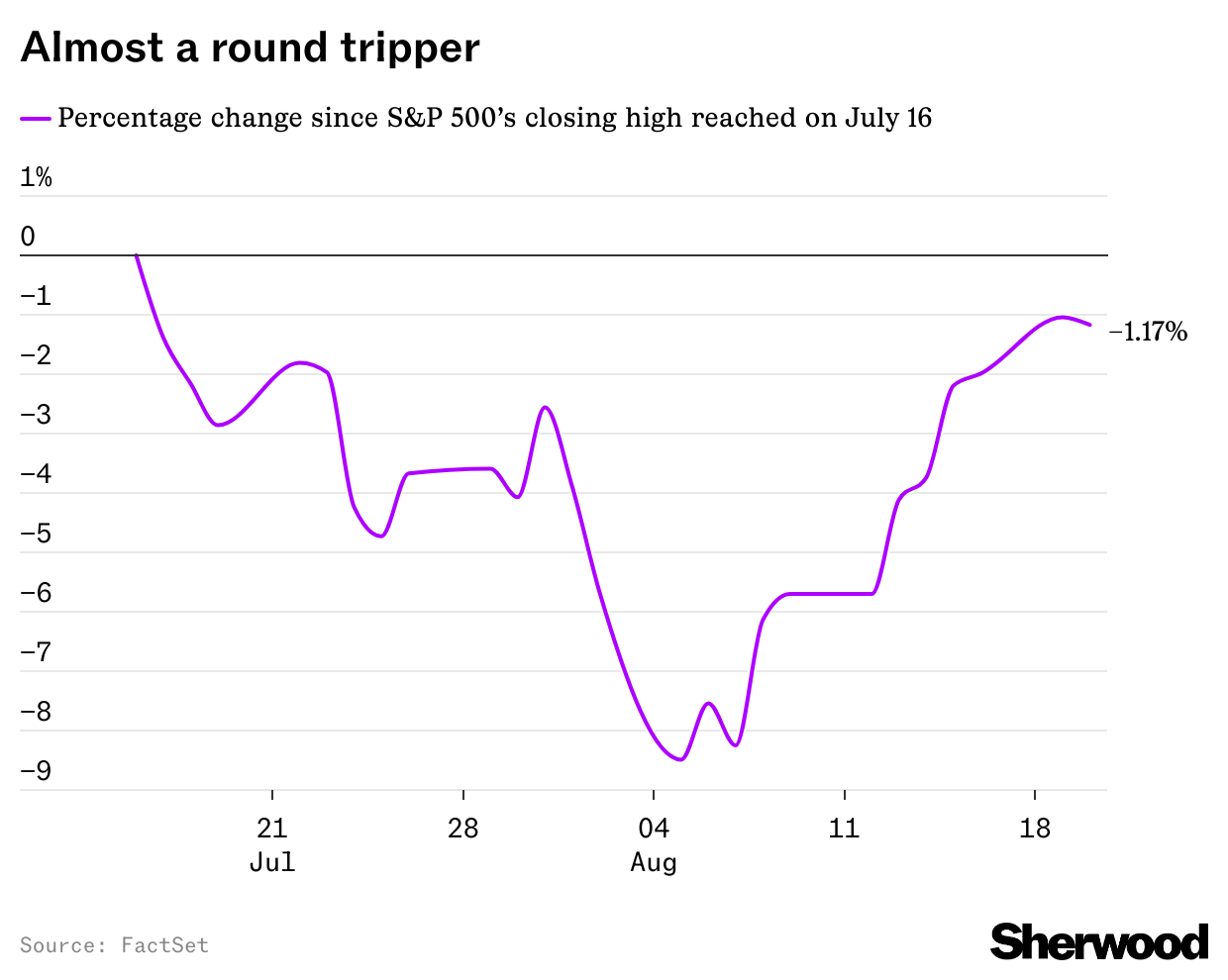

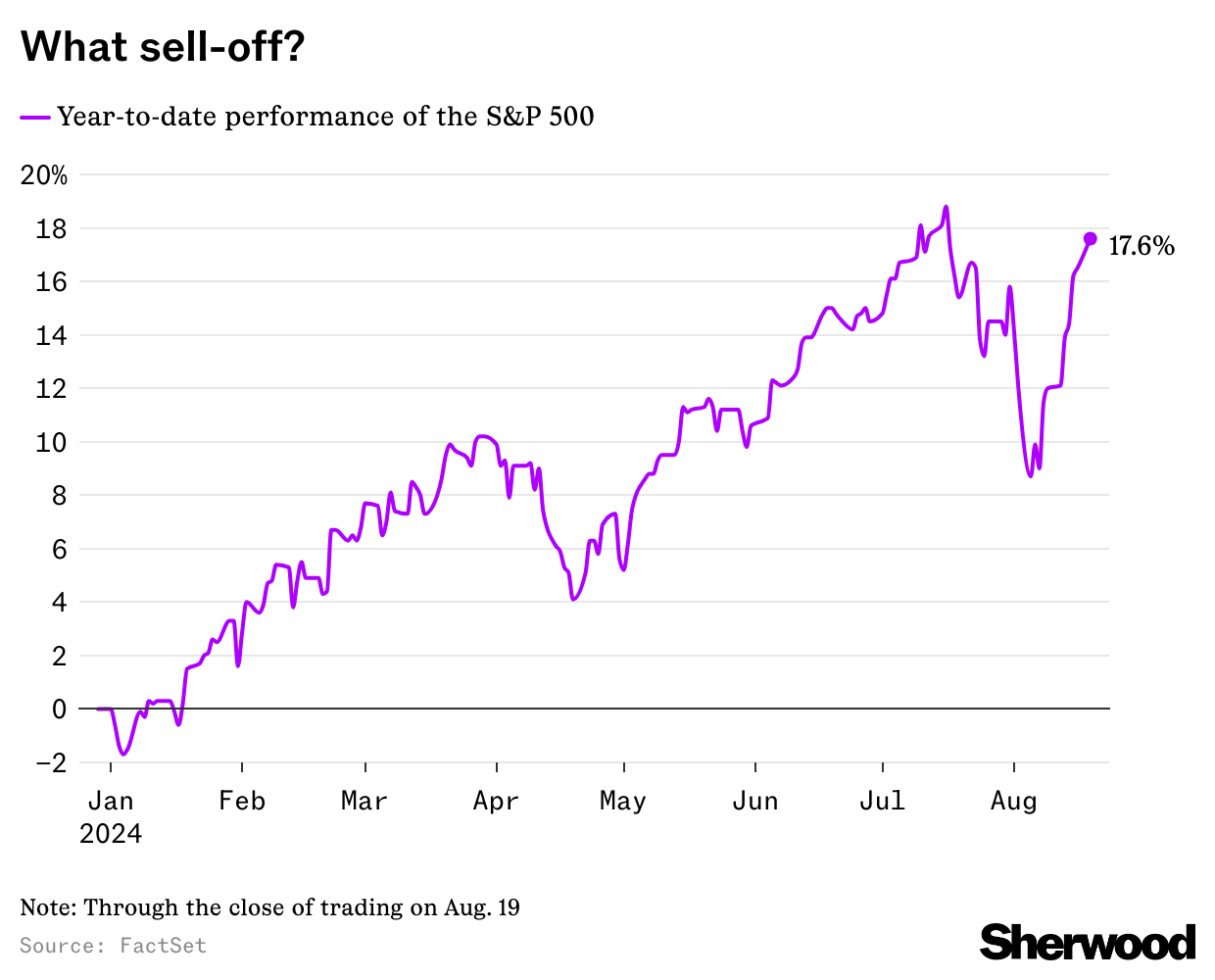

After an eight-day streak of gains — the longest such stretch of the year — the stock market is suddenly within sight of a new all-time high, even as the SPDR S&P 500 Trust takes a breather on Tuesday.

In retrospect, the kerfluffle of a couple weeks back looks a lot less like a reflection of deep investor concern about the state of the US economy — a reasonable first guess since it came after a soft July jobs report — and a lot more like a technically-driven unwind of a highly popular global trade, the yen carry trade, which was briefly blown out of the water after a surprise rate increase from the Bank of Japan.

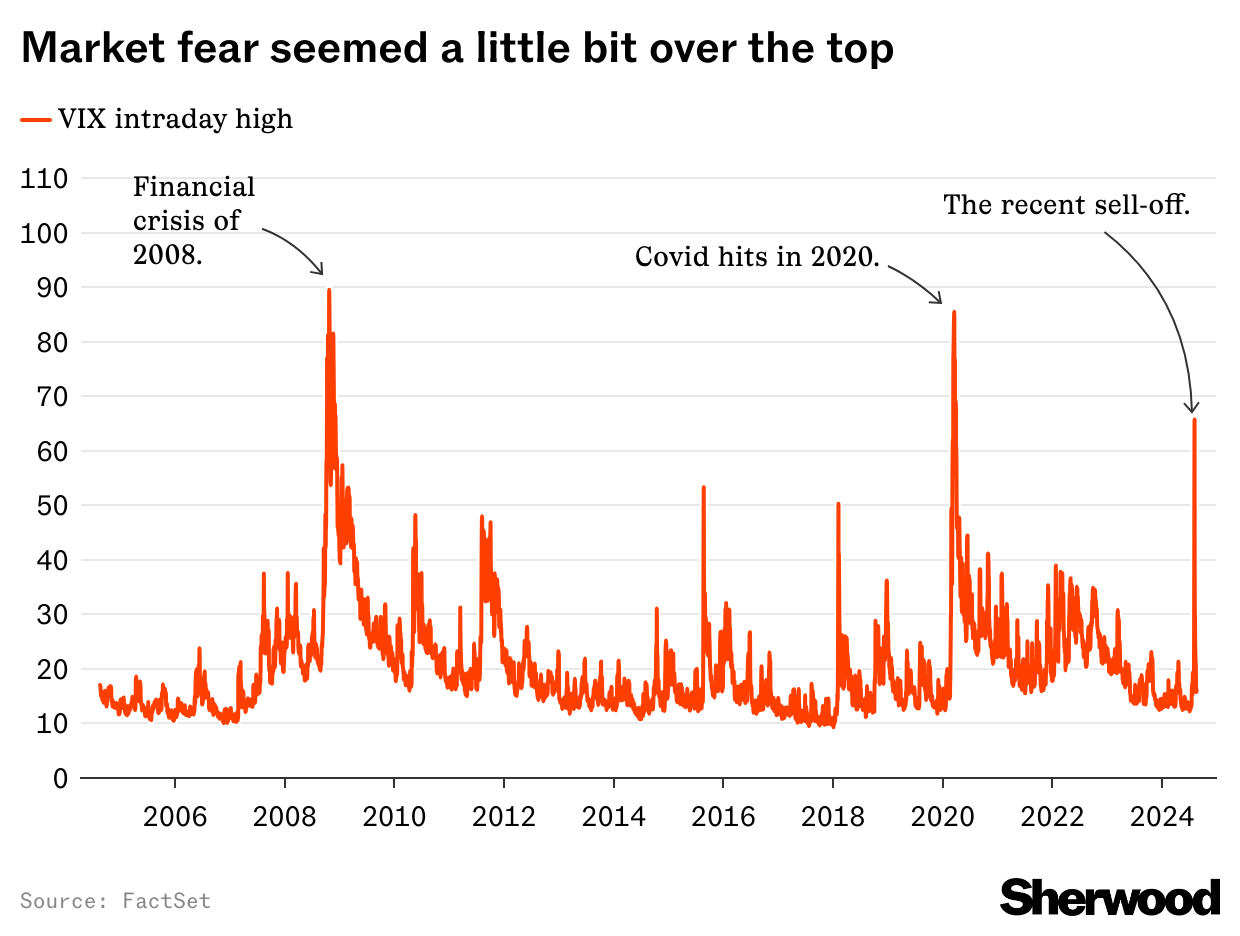

The violence of that unwind was legit scary, sending the so-called VIX — supposedly the “fear gauge” for the stock market — to levels that have previously been associated with major market events, such as the financial crisis of 2008, or the total collapse of the world economy brought on by COVID in 2020. A slight slowdown in US job growth is clearly not in the same league.

Even so, when the VIX spikes like that, it’s going to prompt both flesh-and-bone investors and algorithmic traders alike to step to the side and reassess the situation.

But once the fog of fear dissipates, the situation looks pretty good. Sure stocks might still be a bit expensive, but earnings are strong, the Fed seems certain to start cutting next month and the wobble in the July job market looks more and more like a weather-related blip rather than a serious downshift in activity. And so up we go.