Sorry Treasury Secretary Bessent, it sure looks like we’re living in a weak US dollar world

If cyclical indicators were turning higher and gold weren’t ripping higher, I could buy this story, but nope, not now.

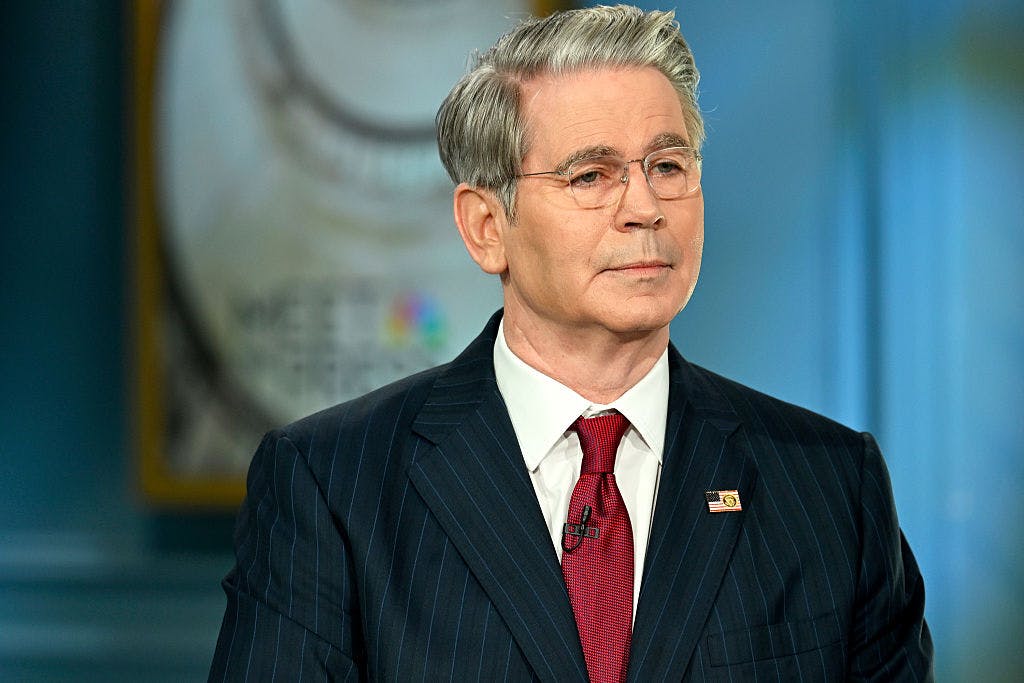

Treasury Secretary Scott Bessent made an interesting statement to Bloomberg’s David Westin earlier this morning, when asked about trends in the US dollar. (That is, trending lower, for those who might not have been paying much attention.)

“On many of them, I wouldn’t necessarily characterize it as a weak dollar,” he said. “I think a lot of this is other countries’ currencies strengthening as opposed to the dollar weakening.”

Of course, everything in currency markets is relative. A fraction requires a numerator and a denominator. But there are ways to try to tease out whether this is a case of other currencies being strong or the US dollar being weak.

And the evidence points to the idea that the market regime we’ve been in during the Trump administration (and a little before that, to be more fair and precise) is that of a weak US dollar.

The US dollar is down against every G10 currency since President Trump’s inauguration on January 20, by as little as 3.5% and as much as 16%. Crucially, the US dollar has weakened much more versus gold, the classical alternative currency store of value, than it has against anything else.

Bessent pointed to Germany’s newfound embrace of fiscal spending to bolster his argument for why we’re actually in an environment of other currencies strengthening rather than the US dollar faltering. But if you look at five-year government bond yields in Germany, they are down since Trump’s inauguration despite this loosening of the purse strings.

Five-year yields capture most of the cyclical impulse one might presume would result from the spending as currently laid out. The bond market’s message is that cyclical impulse is not enough to outweigh other negative factors shaping the growth outlook, whether that be German industry’s competition from China, the impact of US tariffs, or the long trend of moderation in global growth coming off the highs of postpandemic stimulus measures. Simply put, if it’s a good-news story about Germany, that good-news story isn’t resonating with the people trading the same news in the bond market.

By contrast, compare that with the middle two quarters of 2017. That was a period when “synchronized global growth” was the macro phrase du jour after many cyclical indicators, like surveys of manufacturers’ activity, turned sharply higher near the end of 2016 with momentum continuing through to the next year.

From April through October, the euro was a massive gainer relative to other major currencies. While the US dollar was weaker versus most currencies, you see gold there in about the middle of the pack.

Again, compare that to the first chart on the current environment, where gold’s performance is crushing every other currency by miles. That’s a pretty solid tell as to what’s going on here.

If the US dollar is weakening and five-year yields and/or cyclical indicators are turning higher while gold’s performance is nothing to speak of, you’re probably living in a world where it’s more about other currencies being strong and not the dollar being weak. If none of those things are the case, well, it’s really hard to make that case.

So with respect to the Treasury secretary, you can’t pee on someone’s boots and tell them it’s raining, and right now, I don’t see how you can do an analysis of cross-asset performance and tell me it’s anything other than a weak dollar environment.