Pfizer’s stock has almost halved since its pandemic peak

Activist investors want to shake things up at the $165 billion giant, but Pfizer’s not the only pharma stock that’s come under pressure

Shot in the arm

Activist investor Starboard Value has built a ~$1 billion stake in Pfizer, with hopes of forcing through changes at the pharma company, according to The Wall Street Journal. Starboard is reportedly looking to enlist a couple of former Pfizer execs to help, but exact details on what they want to change are as yet unknown.

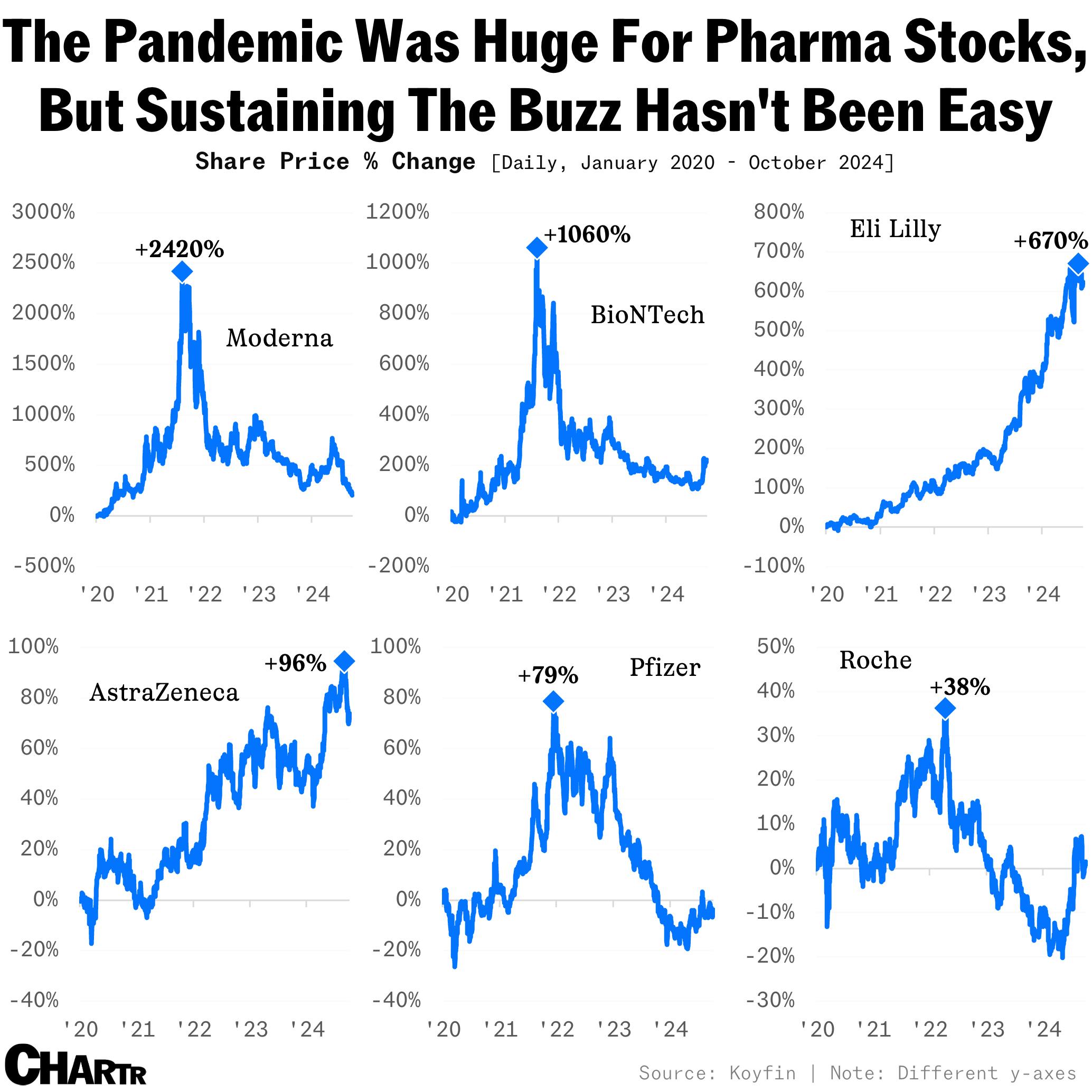

Ultimately, the goal will be to lift the company’s share price — which soared during the pandemic thanks to its COVID-19 vaccine. Developed in conjunction with BioNTech, the vaccine became the first to be approved in the world and was the top-selling pharmaceutical product in history across a single year. But with the pandemic now receding further in the rear-view, some investors (activist and otherwise) are clearly starting to lose a little faith in Pfizer, with the stock falling 46% since its peak almost 3 years ago.

It’s far from the only name in the industry to have fallen off since the pandemic, though.

At one point in August 2021, for example, BioNTech’s market cap. sat at €92 billion (~$100 billion), it’s now worth less than a third of that — Moderna has struggled too, shedding more than $170 billion over the same period too. Meanwhile, more diversified companies like Eli Lilly and, to a lesser extent, AstraZeneca have held up better over that time frame, with drugs treating weight loss and cancer impressing investors over the years.