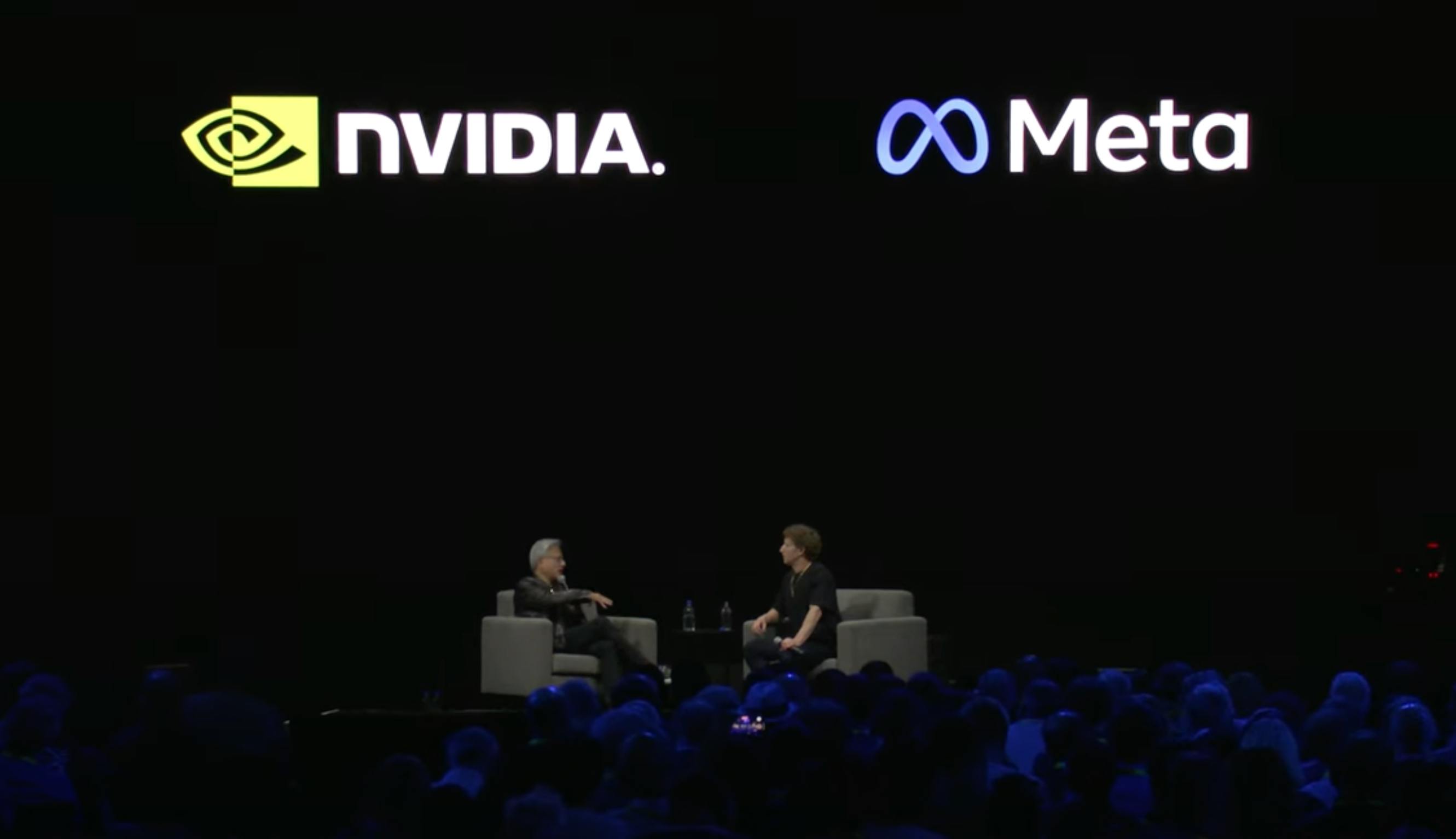

Nvidia enhances partnership with social media giant Meta to deploy “millions” of its GPUs

Winners: Nvidia, Arm. Losers: AMD, Broadcom, Intel, Arista.

Meta is laying it out in no uncertain terms: its AI build-out will be brought to you by Nvidia.

In pair of press releases after the close on Tuesday, the social media giant and chip designer detailed a “multi-year, multi-generational strategic partnership” that “will enable the large-scale deployment of NVIDIA CPUs and millions of NVIDIA Blackwell and Rubin GPUs, as well as the integration of NVIDIA Spectrum-X Ethernet switches for Meta’s Facebook Open Switching System platform.”

There’s also a deeper integration with a very commonly used communications tool at play. “Meta has adopted NVIDIA Confidential Computing for WhatsApp private processing, enabling AI-powered capabilities across the messaging platform,” per the press release, with plans to add these capabilities to other use cases at the Mark Zuckerberg-led firm.

One obvious winner, of course, is Nvidia, as investors may now have a clearer line of sight to millions of GPU sales that include not only this generation, but future editions, as well. The inclusion of CPUs in this pact, and with an expanded role in data center environments, also appears to be boon for Arm Holdings, whose IP was utilized to develop these products.

Shares of Nvidia, Arm, and Meta rose in after-hours trading, albeit fairly modestly.

The losers?

Nvidia’s competitors in...

AI chips: Advanced Micro Devices and Broadcom, as the dominant incumbent’s big, long-term deal with a hyperscaler seemingly reduces their ability to gain market share.

CPUs: Intel (and AMD again!).

And an established Meta networking client: Arista Networks, which is seeing Nvidia muscle in on this territory.

Intel was roughly flat in after-hours trading on Tuesday, while the other three stocks fell.

“Meta’s partnership with Nvidia — spending tens of billions of dollars on its new family of GPUs and, more importantly, making the first major deployment of Nvidia’s stand-alone CPUs for backend CPU servers — suggests rising market share and associated average selling price gains for Arm,” wrote Bloomberg Intelligence analyst Oscar Hernandez Tejada. “Increasing server CPU share gains for Nvidia stand to aid Arm’s share growth against x86, posing a clear headwind for Intel.”

The press release did not spell out any contractual purchase obligations on Meta’s behalf, but is more of a statement of intent on how aligned the parties plan to be in attempting to deliver on the promise of the AI boom.

Ian Buck, vice president of accelerated computing at Nvidia, said the companies haven’t assigned a dollar value or timeline to this expanded partnership yet.

“While specifics of the deal are still unknown (value, power, etc), we view this announcement as another positive catalyst for NVDA into 2026 and beyond, reaffirming that hyperscaler propensity to spend on AI infrastructure remains strong and NVIDIA will be a primary beneficiary,” Needham & Co. analyst Quinn Bolton wrote.