Intel’s job cuts can’t distract Wall Street

Analysts say the company’s turnaround will take years: “In the meantime, Intel will continue to burn cash and concede more market share.”

Usually job cuts are just the thing to warm Wall Street’s heart.

But Intel’s disclosure that it plans to shed more than 20,000 additional jobs by the end of the year — made as part of its Q2 earnings report Thursday — still couldn’t spare the shares, which are now plunging on Friday.

There are a few factors at play: the company reported a significantly worse-than-expected adjusted loss. Sales were slightly better than expected, but were juiced by a surge of purchases and orders aimed at getting ahead of tariffs.

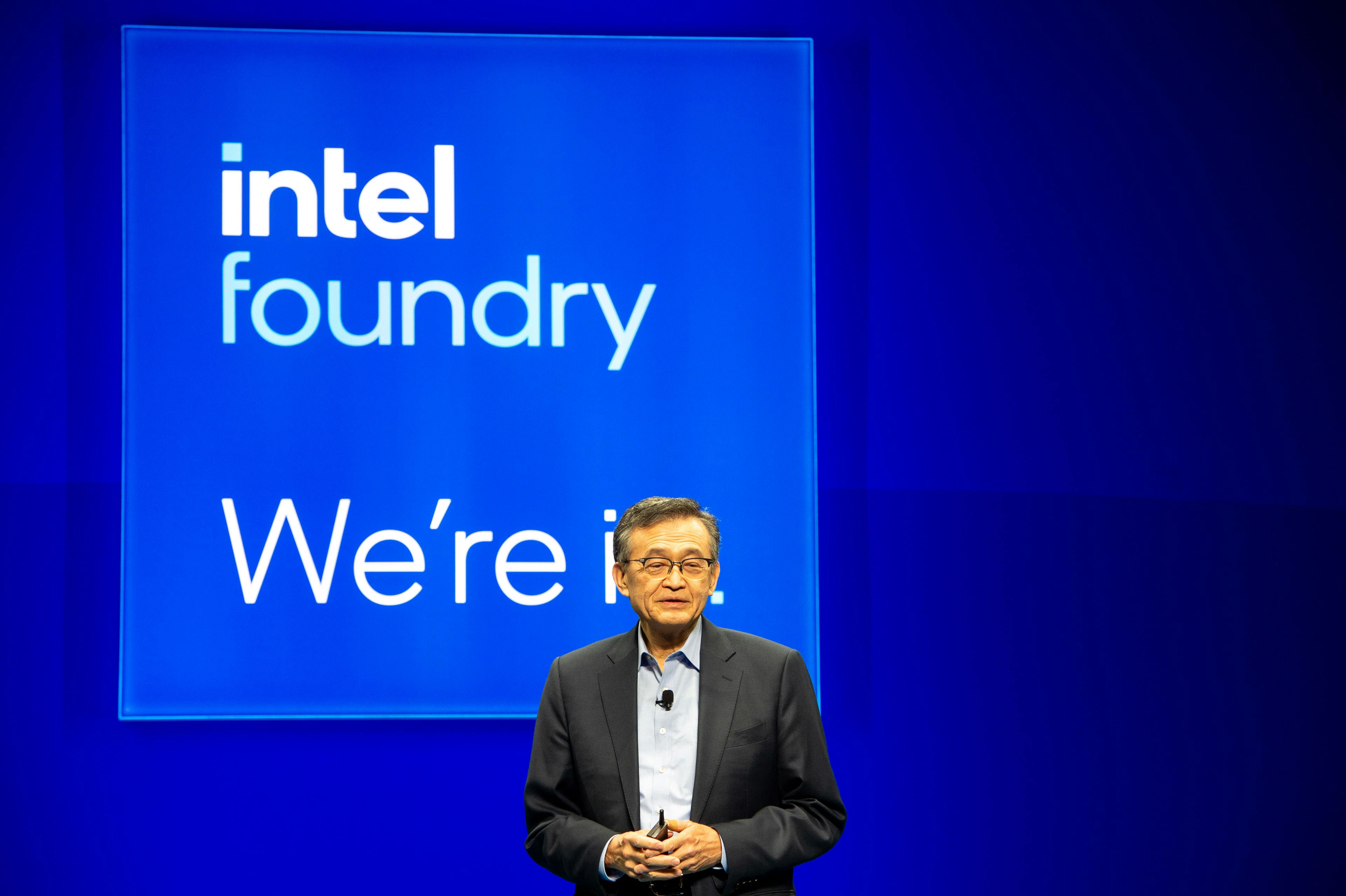

And Intel’s new CEO, Lip-Bu Tan, still faces an enormous turnaround challenge. In the Q2 earnings release, Tan did address one of the giant issues facing the firm: how to move forward with the company’s ailing contract chipmaking business, known its “foundry” in semiconductor lingo.

In its 10-Q filing, Intel said that it may “pause or discontinue” plans to pursue its next-generation chip manufacturing process — known as 14A — if it was unable to get a concrete commitment from a customer that wants to use the platform.

That sort of sounds like a decision. But the problem, from the perspective of Wall Street, is that customers won’t really be making those hard commitments on whether or not to use Intel’s 14A foundry process for a long time, leaving the company to languish, perhaps for years.

“Customer decisions on 14A node adoption won’t be made for another 18-24 months,” JPMorgan analyst Harlan Sur wrote. “In the meantime, Intel will continue to burn cash and concede more market share.”

He added, “we believe the multi-year turnaround story is progressing slowly, with a lack of upside catalysts in the near term, and we remain comfortable with our Underweight rating.”

Others saw the announcement on 14A as an important step toward exiting the foundry business altogether — the decision that Wall Street analysts, by and large, seem to be hoping for.

“We believe the move towards foundry optionality is a step in the right direction,” Jefferies analysts wrote.

Still, the verdict from the market seemed clear. The shares dropped more than 9% in early trading on Friday’s, which if sustained for the full session would be their worst drop since the market’s tariff-related freak-out in early April.