Hims expands into testosterone treatments

The company will start with compounded enclomiphene, with more treatments to come in 2026.

Hims & Hers rose more than 5% on Wednesday morning after it announced that it has expanded into testosterone treatments after teasing the new category earlier this year.

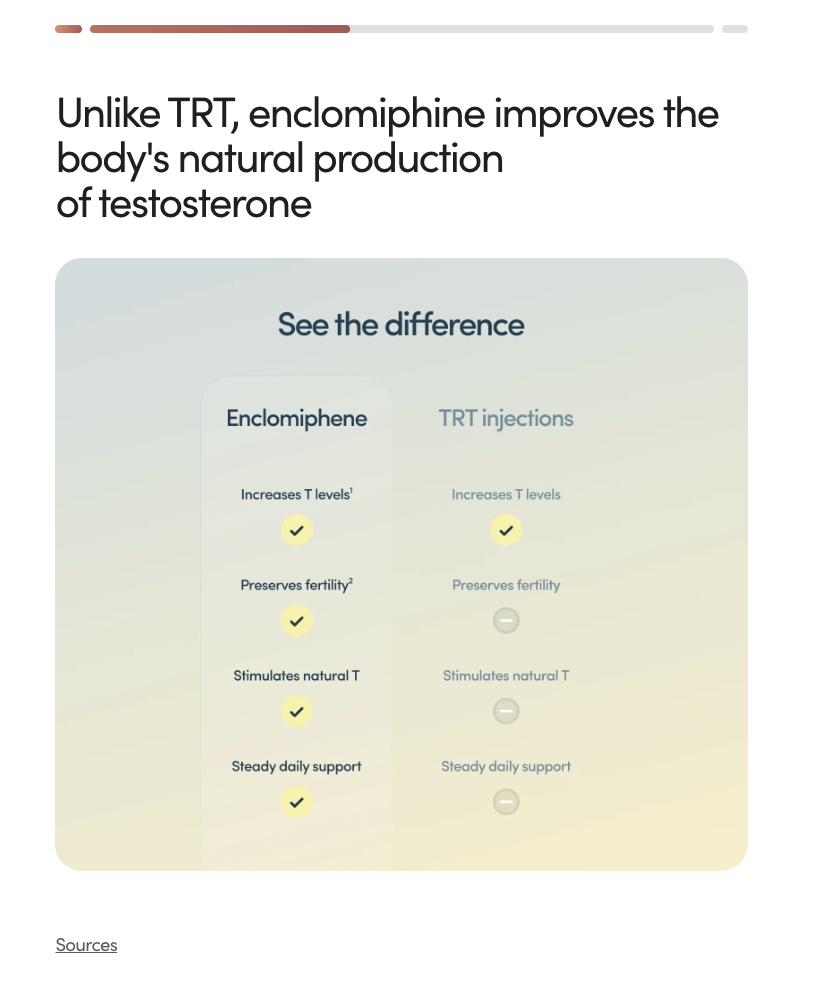

Starting Wednesday, Hims providers will be able to prescribe compounded enclomiphene, an oral off-label testosterone treatment, which the company says it can combine with tadalafil, a treatment for erectile dysfunction. Hims also said that it plans next year to introduce injectable testosterone and partner with Marius Pharmaceuticals to provide Kyzatrex, a branded and FDA-approved oral testosterone treatment.

Investors have been eager for signs of revenue growth at Hims. In its annual shareholder letter, Hims said it would expand into hormone treatments for testosterone and menopause by the end of the year.

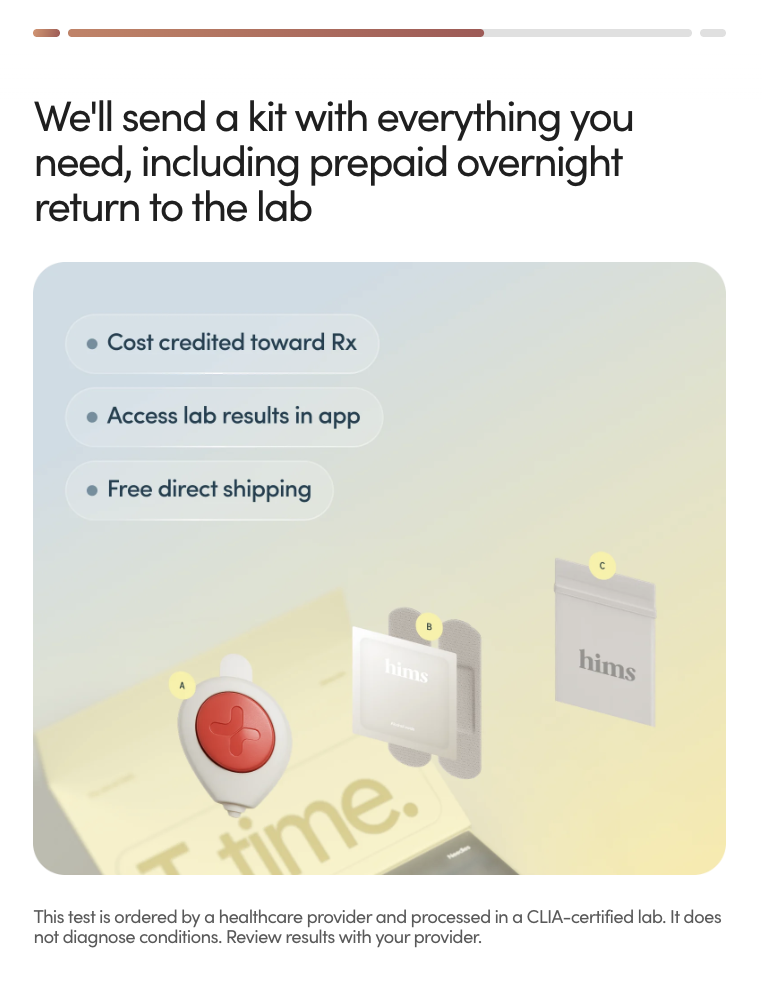

Hims patients will start with an at-home blood test. In February, the company acquired Trybe Labs, a blood-testing facility that gives patients results in days. Prescriptions for enclomiphene will be dispensed by both partner and Hims-owned pharmacies.

I tried signing up for a prescription of compounded enclomiphene (which is not available in New York, where I live) and was quoted $990 for a 10-month plan, which includes the cost of the at-home tests.

Hims saw a boom in compounded GLP-1 sales while those branded drugs were in shortage, but since the supply constraints eased earlier this year, the company has been limited in how much of the blockbuster weight-loss drugs it can sell. Last month, it reported quarterly revenue numbers that missed Wall Street estimates and fell quarter to quarter for the first time ever.

The partnership with Marius also helps bolster the company’s vision as the “Netflix of healthcare” — a narrative that got dimmed after its epic falling out with Novo Nordisk. The exclusivity of the partnership with Marius “pertains specifically to the private label aspect of the partnership,” a spokesperson for the pharmaceutical company told Sherwood News.