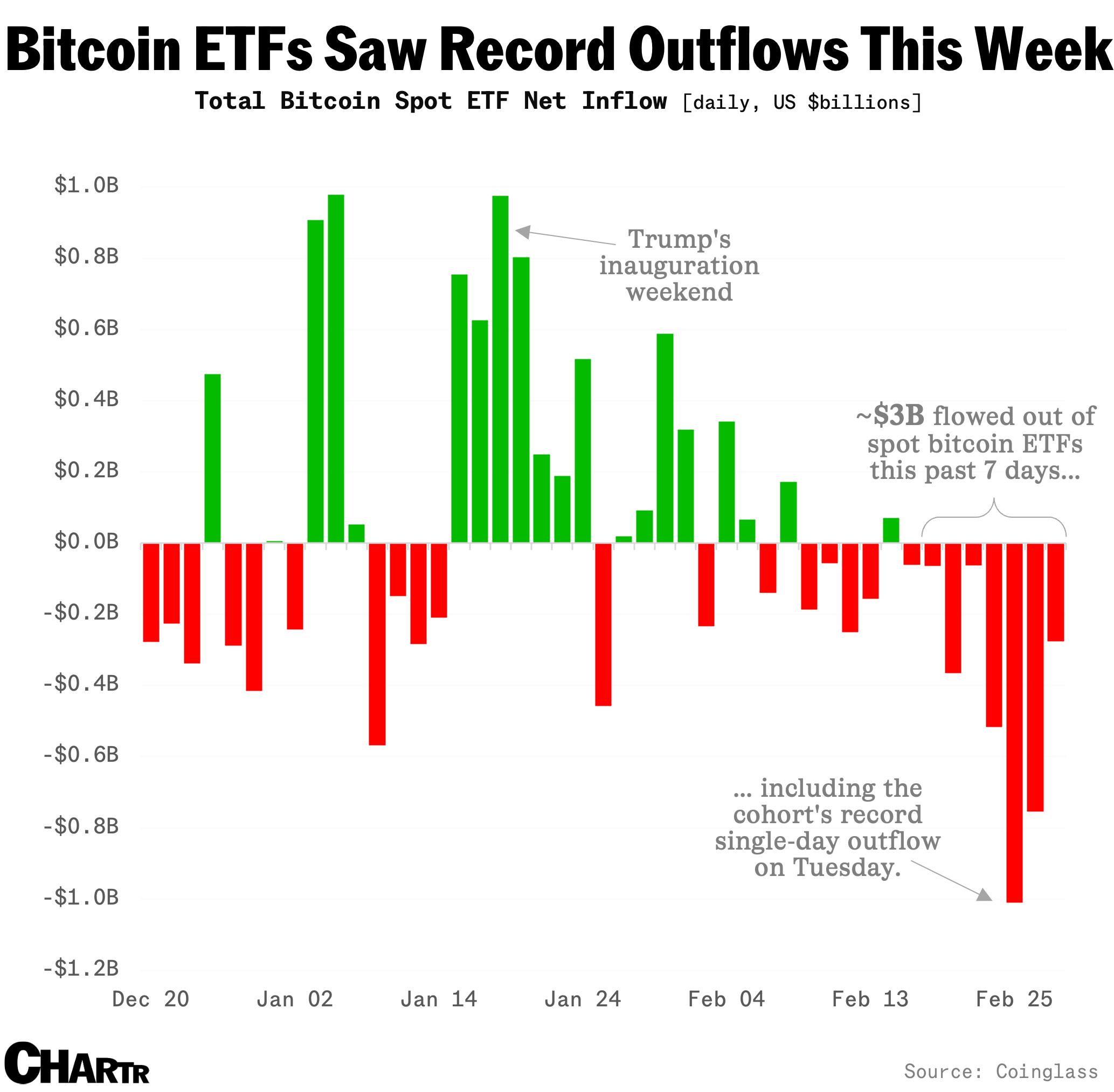

Investors yanked more than $3 billion from bitcoin ETFs in the past week

Some have rotated into gold ETFs.

Cryptocurrencies, growth stocks, and risk-on assets have been getting hammered in the last week, as investors blame a combination of tariffs, Nvidia, and good old-fashioned profit taking for this week’s sell-off.

In the crypto world, investors have been rushing to pull their money out of the very same exchange-traded funds they were piling into earlier this year, with spot bitcoin ETFs seeing a more than $1 billion outflow on Tuesday — the biggest one-day exodus since the cohort’s launch early last year.

Altogether some ~$3 billion has been pulled across the last seven trading days, per Coinglass data, with the world’s largest cryptocurrency trudging through one of its biggest declines, as bitcoin dipped briefly under $80,000 in the past 24 hours. That means much of the postelection gains have now been wiped out, with bitcoin currently 24% below its all-time high of ~$109,000.

While bitcoin funds continue to struggle, seeing only four days of inflows so far this month, gold ETFs, seen as a safe haven asset by some, have raked in the largest amount of investment since Russia’s invasion of Ukraine.