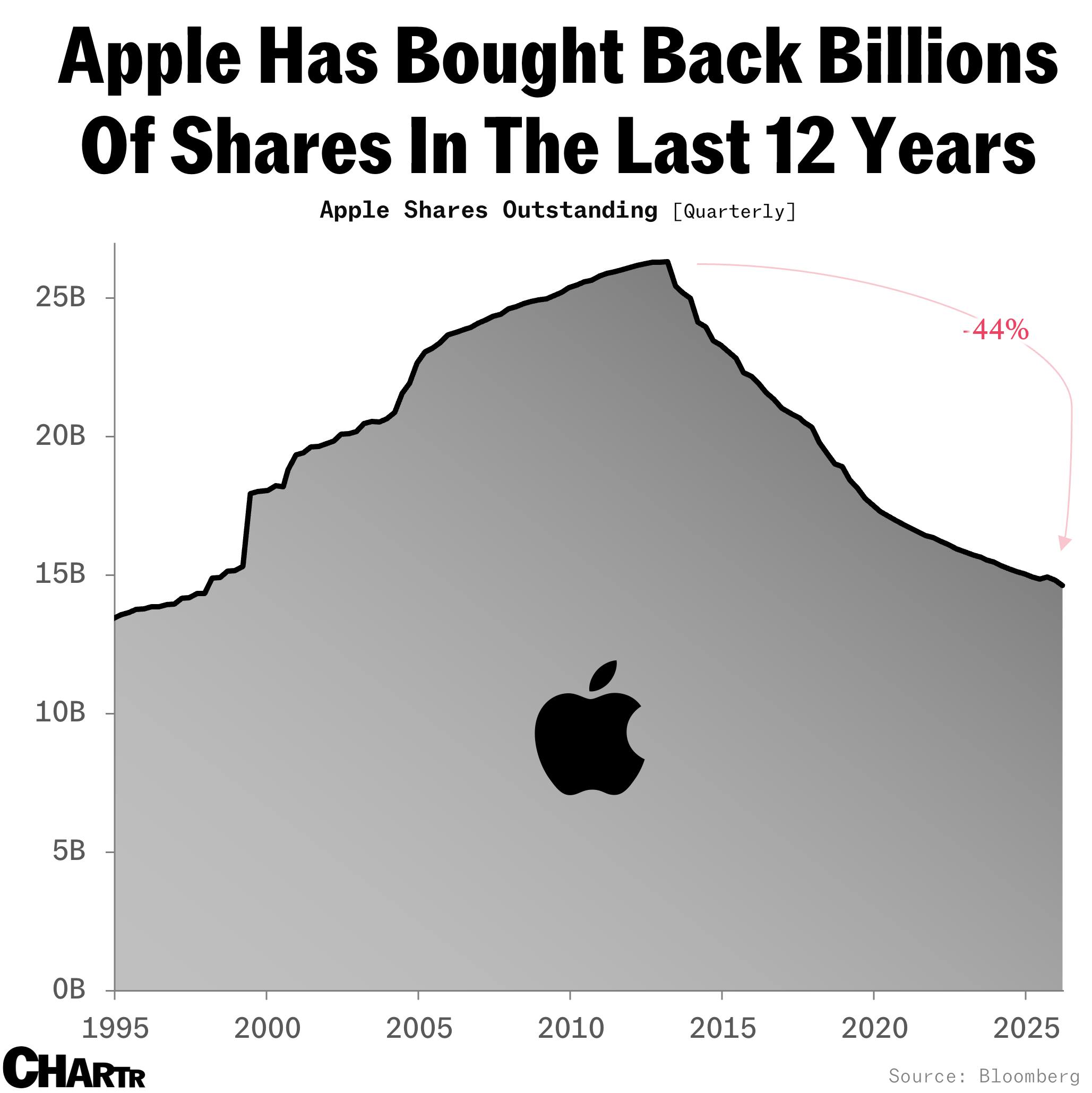

Apple remains a relentless buyback machine

American companies are set to spend $1.1 trillion on buying back their own shares this year — no company will spend more than Apple.

Big Tech is still seriously bullish on AI.

And with good reason: every time Microsoft, Meta, Amazon, or Google announces that they’re going to spend an extra $10 billion or $20 billion on data centers or AI talent, their stock prices tend to go up as investors reward their ambition.

Not i

So far, Apple has been more deliberate about its spending (gold gifts for President Trump notwithstanding), eschewing the all-in approach on AI that its peers have been exhibiting.

But there’s one thing Apple is more than happy to spend money on: its own shares.

Indeed, per data from Birinyi Associates cited by The Wall Street Journal, US public companies have already announced $984 billion worth of stock buybacks this year — a figure that could rise to a record $1.1 trillion by the end of the year.

An alternative to dividends, buybacks have become the favored way of returning cash to shareholders for much of Corporate America, and no company has embraced the practice more than Apple. The iPhone maker has already spent $70 billion on its own shares in the last nine months, and has authorized up to $100 billion worth of buybacks for this year.

The cumulative effect of more than a decade’s worth of buybacks? Apple’s share count has plummeted 44% since 2013, as the tech giant devours itself. Of course, with the share price now at $229, buying back its own stock in 2025 is a little pricier than it used to be when it kicked off buybacks 13 years ago, when shares hovered around the high teens, low 20s.