Ethereum treasury firms are having a “bad time” as many fall below the value of their stockpile

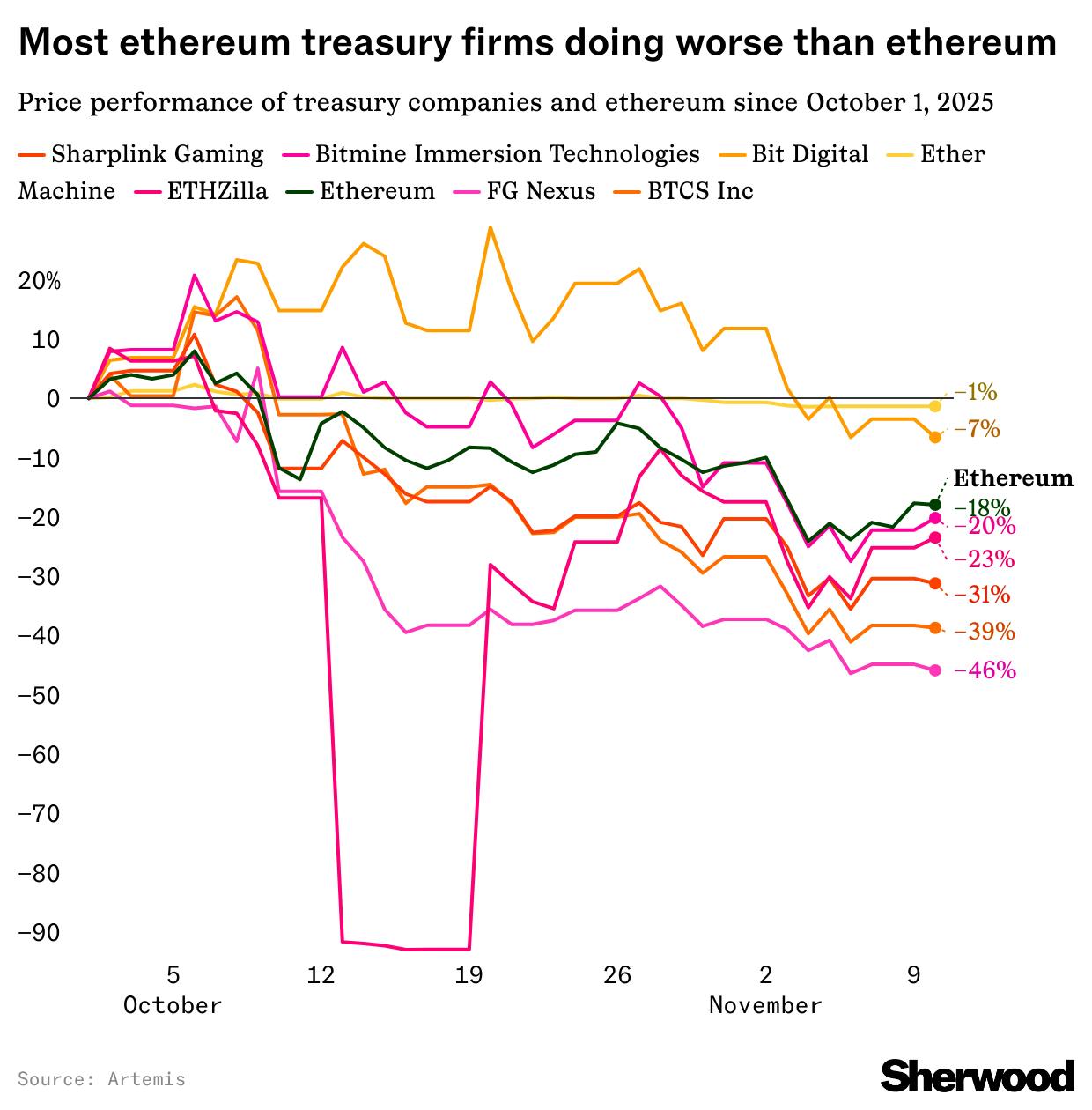

Since October, BitMine, ETHZilla, SharpLink Gaming, and several other treasury firms’ stock prices have performed worse than ethereum itself.

The overall performance of digital asset treasury firms (DATs) focused on ethereum has been significantly down as shares of these firms are performing worse than their underlying asset in Q4.

Since October, the price of ethereum has dropped 18% to under $3,500 as of Tuesday morning.

Shares of BitMine Immersion Technologies and SharpLink Gaming — the two largest ethereum stockpiling companies — have fallen 20.2% and 31.2%, respectively, in the period. ETHZilla has slid 23.5%, BTCS Inc. has slumped 38.7%, and FG Nexus has decreased nearly 46%, data from crypto analytics firm Artemis shows.

The price action comes as their basic mNAV — a metric that refers to the market capitalization of these firms relative to the value of their crypto asset holdings — is below 1, according to Blockworks Research.

“An mNAV under one limits the ability for DATs to perform accretive dilution, which is the principle that permits DATs to purchase more underlying assets and fulfill their mandate of increasing the asset value per share,” per Gurnoor Narula, a research analyst at Placeholder VC.

Narula told Sherwood News, “DATs start showing cracks when they aren’t able to close that mNAV gap, either because they’ve run out of funds to do so, or the underlying asset is distressed such that investor confidence has waned.”

Bitcoin powerhouse Strategy has also suffered, declining 26% since October 1, though its mNAV stands just above 1.

Optimism remains, but not deploying any more capital

Kenetic, a blockchain venture capital firm that invested $5 million in ETHZilla, is not deploying more funds at this point, the investment firm’s founder and managing partner, Jehan Chu, said to Sherwood.

However, Chu remains confident in the digital asset treasury model and is “optimistic that when interest rates are lowered and crypto experiences a push, we will see a corresponding surge in DATs including ETHZilla.”

Chu continued, “DATs provide leverage on the underlying assets. In good times it’s great and in bad times it’s terrible — we’re just passing through a bad time.”