Why is Wheels Up stock so volatile?

The company has laid off pilots, after racking up major losses in 2023

In the last month, the second most volatile US stock worth more than $2 billion has been the headline-hogging meme stock GameStop. The most volatile, per data from FinViz, is "on-demand" private aviation company Wheels Up, which has seen its share price move: +36%, +7%, +23%, -24%, and +11% in the last 5 days alone, with the stock having doubled since June 21st.

Part of the reason for that volatility is that only a small portion of its shares are available for public trading (what’s known as a low float). Another is that the company’s business model remains unproven at scale.

The 30,000 foot view

The first rule of business is that you usually shouldn’t sell a product for less than it costs to produce.

Restaurants, for example, make healthy profits — or specifically gross profits — on their sales. Salad chain Sweetgreen only spends about $4.15 out of a $15 salad on the ingredients and packaging of the food. Nike makes a ~45% gross margin, leaving itself a healthy buffer to cover marketing, admin expenses, and other overheads.

Now, the premise gets a little bit more complicated when you’re trying to be “Uber for the sky”, as you juggle planes, pilots, software, and fuel, but the fundamental rule remains: try not to lose money on each flight. Wheels Up, which opens up access to private jets not just to the super-wealthy but to the moderately super-wealthy, doesn’t make the math work.

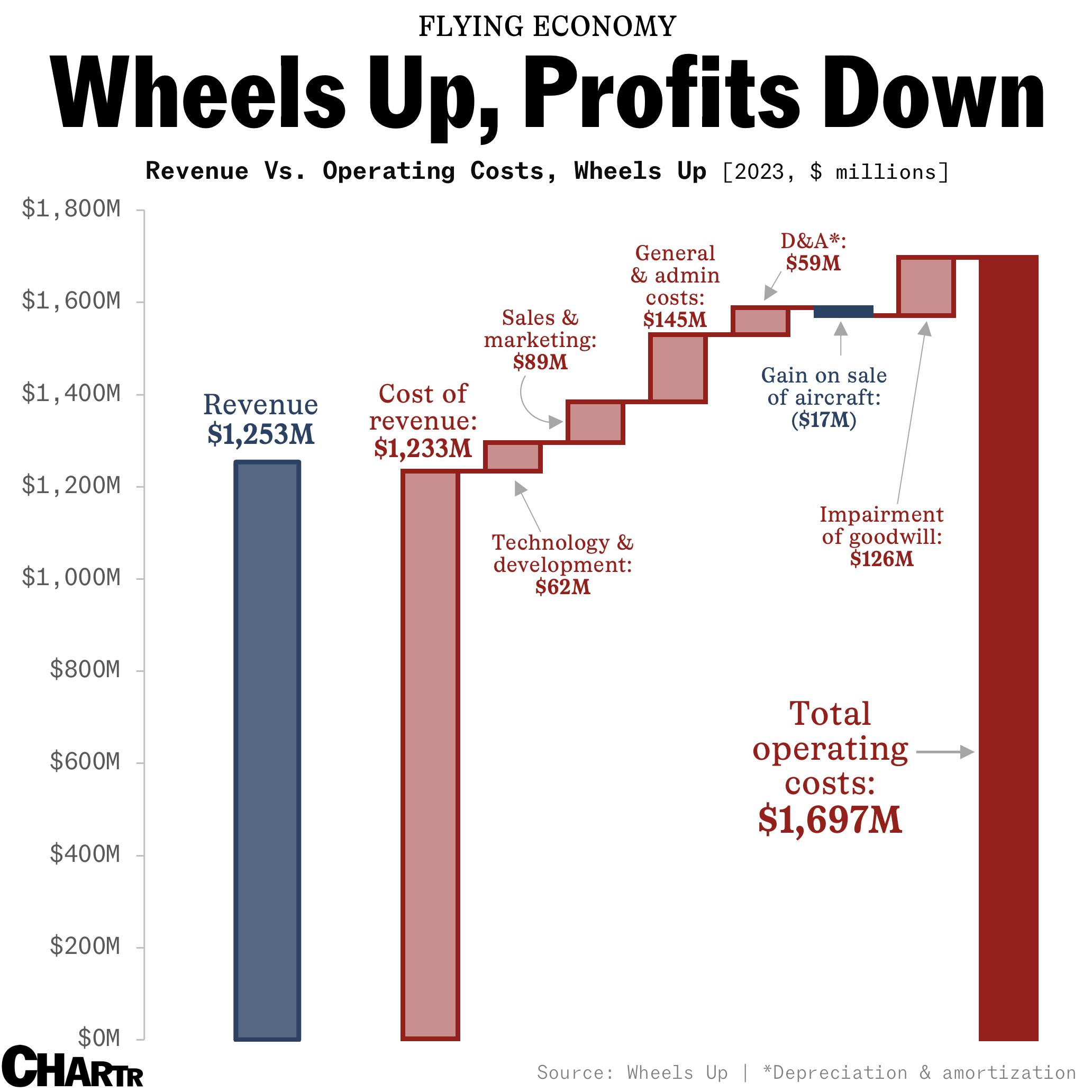

Last year, the company reported $1,253 million in revenue. However, just delivering on its service cost it almost its entire takings, with aircraft leases, fuel, maintenance, fees, cabin crew labor, plane parking, and more setting it back $1,233 million. Once other overheads were accounted for, that left the company deeply in the red.

Turbulent times

Wheels Up landed on the public markets in 2021 as part of a wave of SPACs during the pandemic. It’s time as a public company has not been smooth — despite the recent uptick, the stock is down more than 96% from its peak. Last year, Delta and a group of investors stepped in with a $500 million lifeline for the company, but UP’s woes have continued. Revenue dropped 44% year-on-year in Q1, and the company reportedly laid off around 11% of its pilots as it moves to reduce its fleet size.