Moonshots

After NASA’s founding in 1958, the elusive idea of “the future” looked to many like robot cleaners, flying cars, and taking in the vistas of outer space on your commute. Just 11 years later, one giant leap towards that vision was taken — when man first visited the moon — but, for many decades after the lunar expeditions, progress in space was more small steps than giant leaps.

Recently, however, space travel has been blasting back into the headlines, as private enterprise has taken up the mantle of exploration, with trips to space, zero-gravity experiences, and even a space hotel just some of the projects underway. At the forefront of space tourism are billionaires Bezos, Musk and Branson, with ‘cosmic one-upmanship’ peaking in 2021 amidst competing launches, massive PR pushes, and celebrity-packed flight crews.

Cosmic capitalism

These endeavors promise a bright future for humans in space, with commercial and scientific interests briefly aligning, upending the government-funded model that defined the previous century. But, much like the US government discovered in the 1960s… space travel requires almost infinitely deep pockets — and some billionaires have had enough of pouring their capital into a black hole.

Feeling the weight

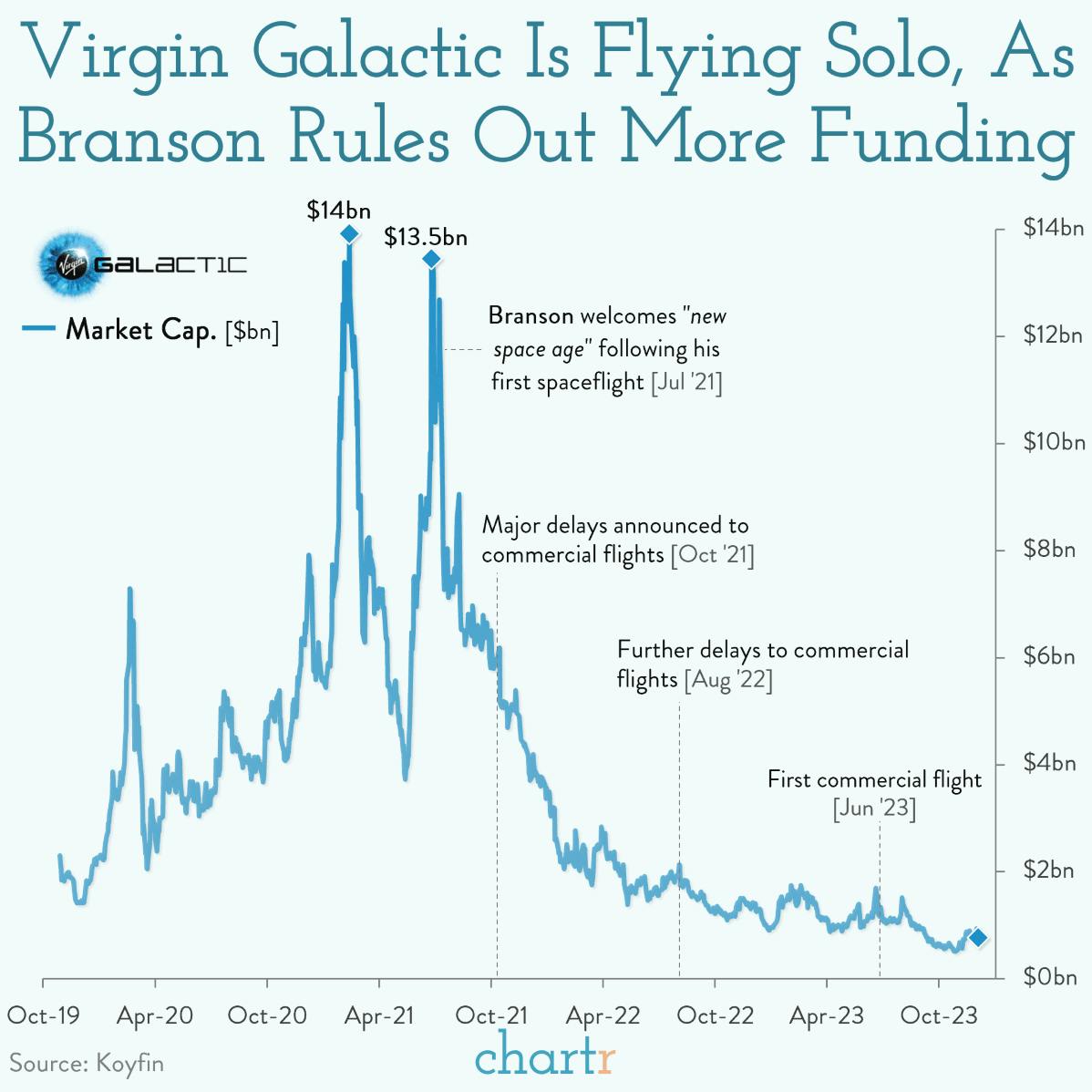

Indeed, only a month after laying off 18% of its workforce, Sir Richard Branson announced last week that Virgin Group will no longer be investing in Virgin Galactic. That was a big blow to the company which had finally flown its first commercial customers in June; a launch that took 3 tourists, including a mother-daughter duo, to the edge of space, where they experienced a few minutes of weightlessness.

Branson’s pullback sent Virgin Galactic shares tumbling on Monday, and although they've since recovered some of that fall, the stock remains down 44% in the last 6 months, and a whopping 96% from its peak in 2021. Even at $450k per ticket, Virgin Galactic has a very long mission to making any kind of profit.

To put it simply, Branson’s rivals in the billionaire space race — Bezos’s BlueOrigin and Musk’s SpaceX — simply have a lot more cash, with Musk’s personal $200bn+ hoard often gaining or losing Branson’s entire net worth (~$3bn) in a single day, depending on what Tesla’s stock is doing.