Tinder is trying everything to return to growth, including bringing back a “Double Date” feature

The dating app is once again trying its luck with pairs after falling out of favor with singles.

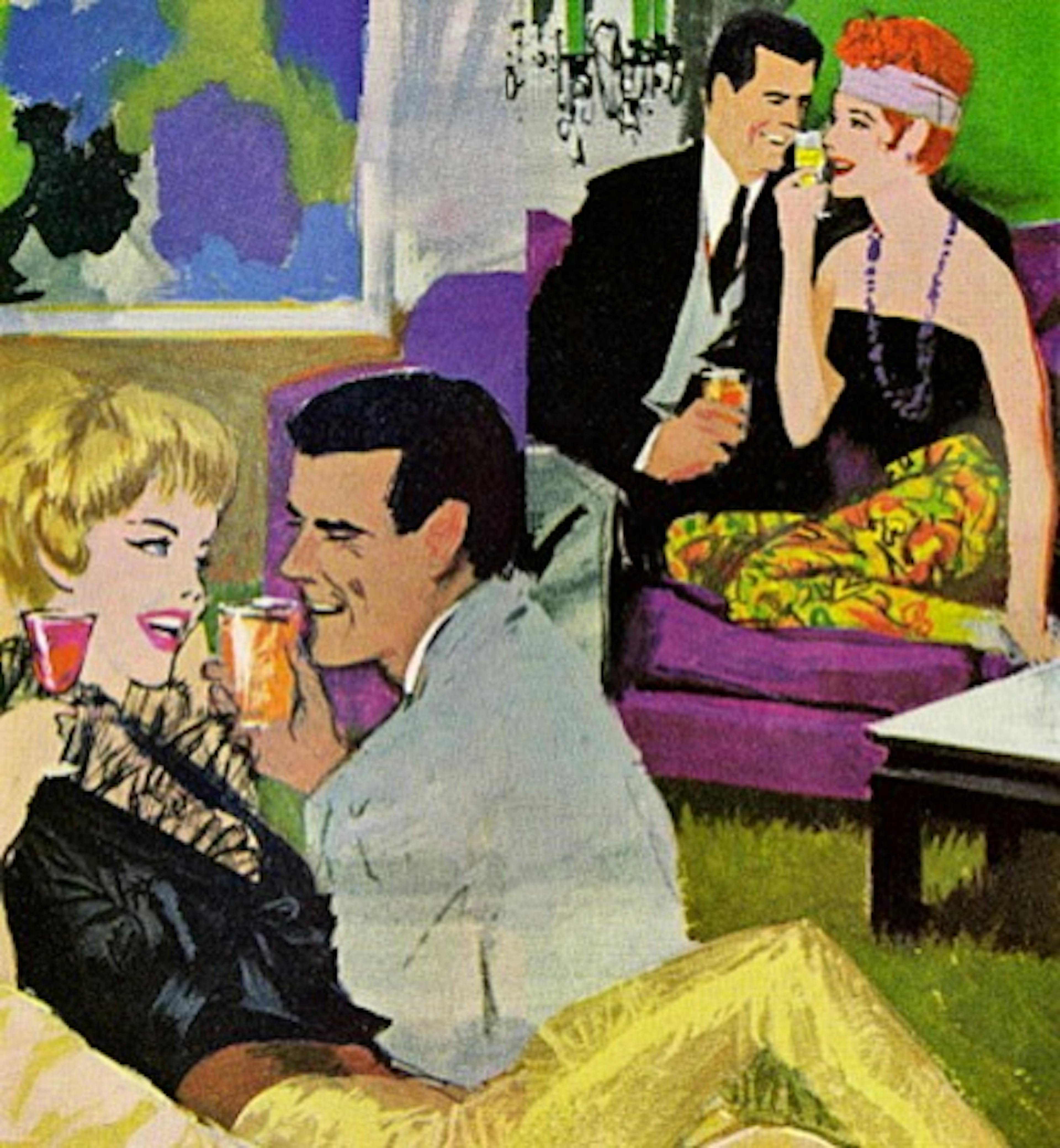

Tinder, the OG swipe-centric dating app owned by Match Group, announced the launch of “Double Date” on Tuesday, a feature that allows pairs of users to match with other pairs... betting on a (previously unsuccessful) hypothesis that “Dating is better with friends” to boost the platform’s falling user numbers.

Singled out

Tinder first tried to launch a double dating product back in 2016, but shelved it a year later due to privacy concerns and confusion about whether the option was meant for monogamous users, per Bloomberg.

Now, in 2025 — ironically a time when polyamory has increasingly become normalized, though this is “not what [Double Date] has been built for,” according to Cleo Long, senior director of global product marketing — Tinder is doubling down on “low-pressure, group-first” dating with friends. The feature will allow users to invite up to three people to match with other duos alongside their solo accounts.

Up to date

The move is one of the initiatives Tinder is introducing to try to turn its fortunes around, as well as using “advanced AI” to help people find matches. But revamping a previously failed feature might suggest that the app, which revolutionized online dating when it first launched in 2012, is running out of ideas.

The number of paying Tinder users has dwindled to just ~9 million in its most recent quarter — down 18% from a peak of ~11 million in late 2022. While Tinder remains Match Group’s biggest brand, Hinge, another dating app under the Match umbrella, saw paying users grow 19% year over year in Q1 2025.

Double Date is now available in the US, with a global rollout planned for July. So far, the results seem hopeful: after first trialing the feature in a handful of European countries, Tinder reported that women were 3x more likely to “like” a pair than an individual profile, and that nearly 90% of Double Date profiles came from users under 29.