The NFL just opened itself up to some very deep-pocketed investors

After all, there are only so many billionaires to buy teams

Yesterday, a special meeting of the 32 NFL team owners approved a measure allowing select private equity firms to purchase up to a 10% stake in a team, loosening a long-standing ownership restriction.

The move comes as NFL franchises reach stratospheric valuations, with the Dallas Cowboys — a team that hasn't clinched a Super Bowl since 1996 — recently becoming the first team to reach a $10 billion valuation, per Sportico.

Allowing pooled institutional investment seems like a no-brainer. After all, there are only so many billionaires capable of buying teams, with the average NFL franchise now worth a staggering ~$6 billion.

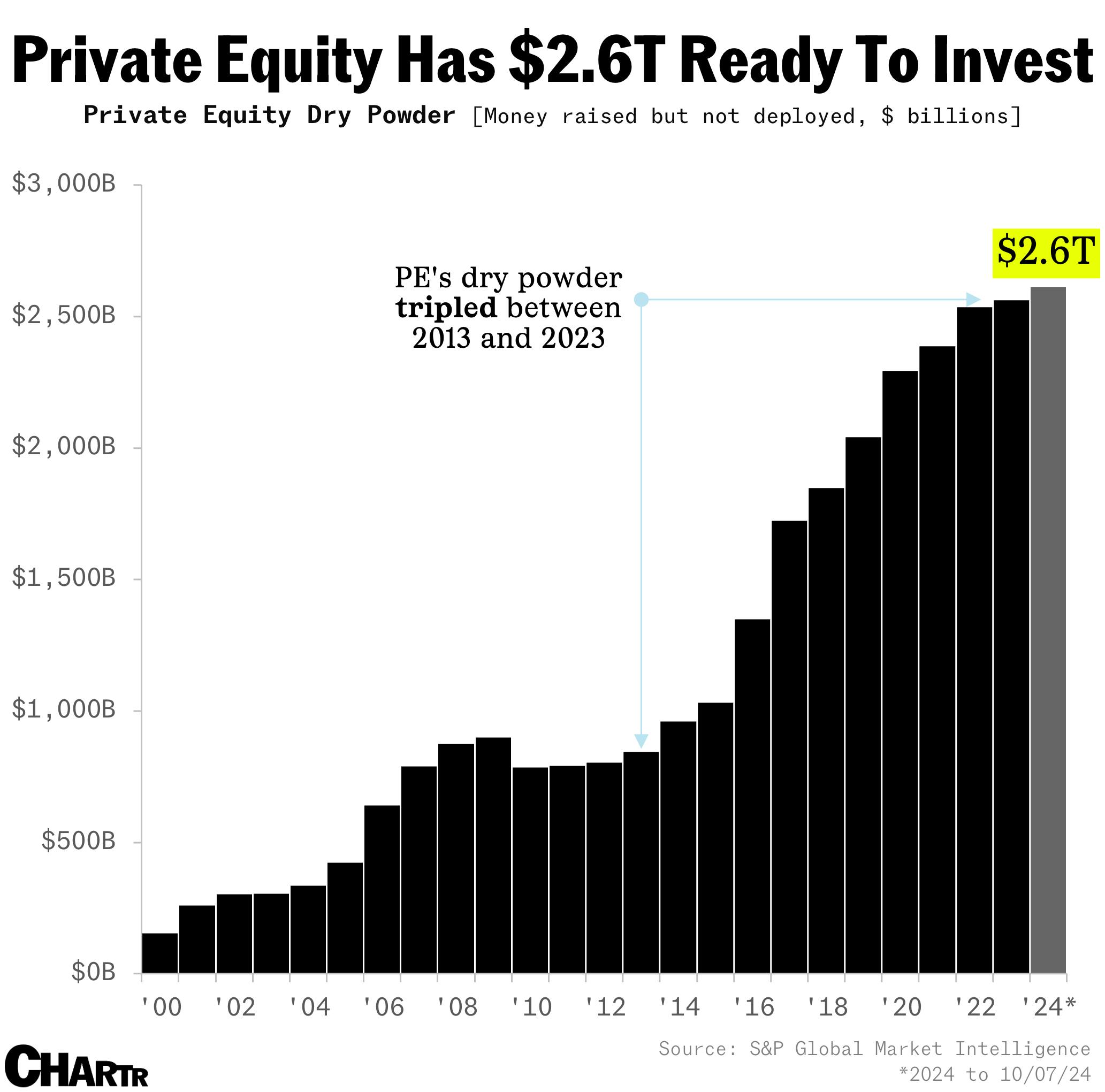

By opening the doors to private equity, the NFL is unlocking a treasure trove of capital: according to data compiled by S&P Global, private equity and venture capital funds currently hold a record $2.6 trillion in uncommitted capital, often referred to as "dry powder".

This enormous sum is burning a hole in the pockets of some firms. After convincing investors to entrust them with their money, which many PE shops did very successfully during massive fundraising efforts in 2020-2021, they then have to actually do something with it — people don’t typically like paying management fees while their money is parked on the sidelines.

However, faced with only being able to build a 10% stake in a team, a hypothetical investment of ~$600 million would barely scratch the surface for the largest funds. Investing in multiple teams might help them deliver the impact they want, with the new NFL rules allowing funds to invest in up to 6 individual teams.