Choo choo

Tapestry, the parent company of Coach, Kate Spade, and Stuart Weitzman, is set to add Michael Kors, Versace, and Jimmy Choo to its bag after striking a deal to acquire Capri Holdings in a deal reportedly worth some $8.5 billion.

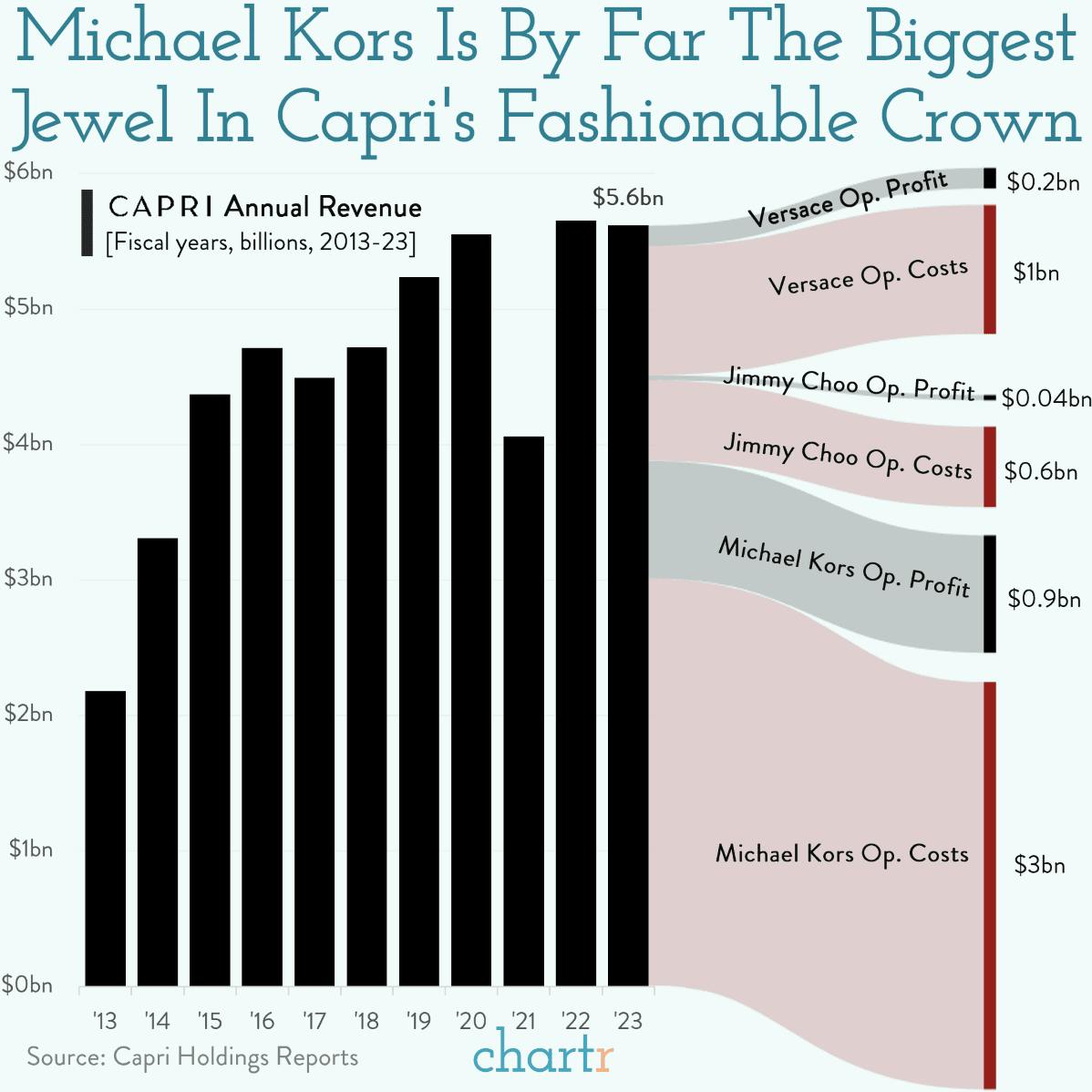

The 6 brands netted a collective $12 billion in revenue last year and, according to Tapestry CEO Joanne Crevoiserat, will combine to create “a new powerful global luxury house”, presumably with an eye on competing with European behemoths like LVMH and Hermès.

Michael Kors is very much the jewel in the Capri crown. In the last financial year, MK’s bags, accessories, and clothing accounted for ~70% of Capri Holdings’ sales, and the company eked out a 22% operating margin on those sales, better than the 14% managed at Versace, and the 6% for Jimmy Choo.

Of Kors it makes sense

Coach and Michael Kors have been locked in a handbag war that has raged for nearly a decade. In recent years, Coach has gained the upper hand thanks to a careful strategy: don’t over-expose in department stores, re-target the younger demographic with pop-up shops and new designs, and use more sustainable materials. That trifecta has worked, with Coach able to steadily raise prices — hence some analysts seeing this deal as a final victory for Tapestry.

But, negotiations were presumably fierce and Tapestry is having to reach very deep into its luxury purse. The agreement has been struck at $57 for every Capri share, a whopping 59% premium over the average from the last 30 days.