Macy’s ended its deal talks

Now it has to deliver on its turnaround plan, as once-reliable profits have dried up

Last week, Macy’s walked away from deal talks with two investors, leaving the iconic American department store to tackle the challenging retail landscape alone.

The deal, which would have valued the Macy’s enterprise at some $9 billion, was squashed after Macy’s board had concerns that the financing for the proposed deal wasn’t solid enough, sending shares in the company down more than 14% since the deal was called off one week ago.

The buyout saga, which began in December, saw the bid raised twice before ultimately being abandoned. But, the potential buyers weren’t reportedly interested in “Macy’s: The Enterprise” so much as they wanted “Macy’s: The Real Estate Portfolio”. The company's property portfolio is estimated to be worth anywhere from $5 billion to as much as $14 billion.

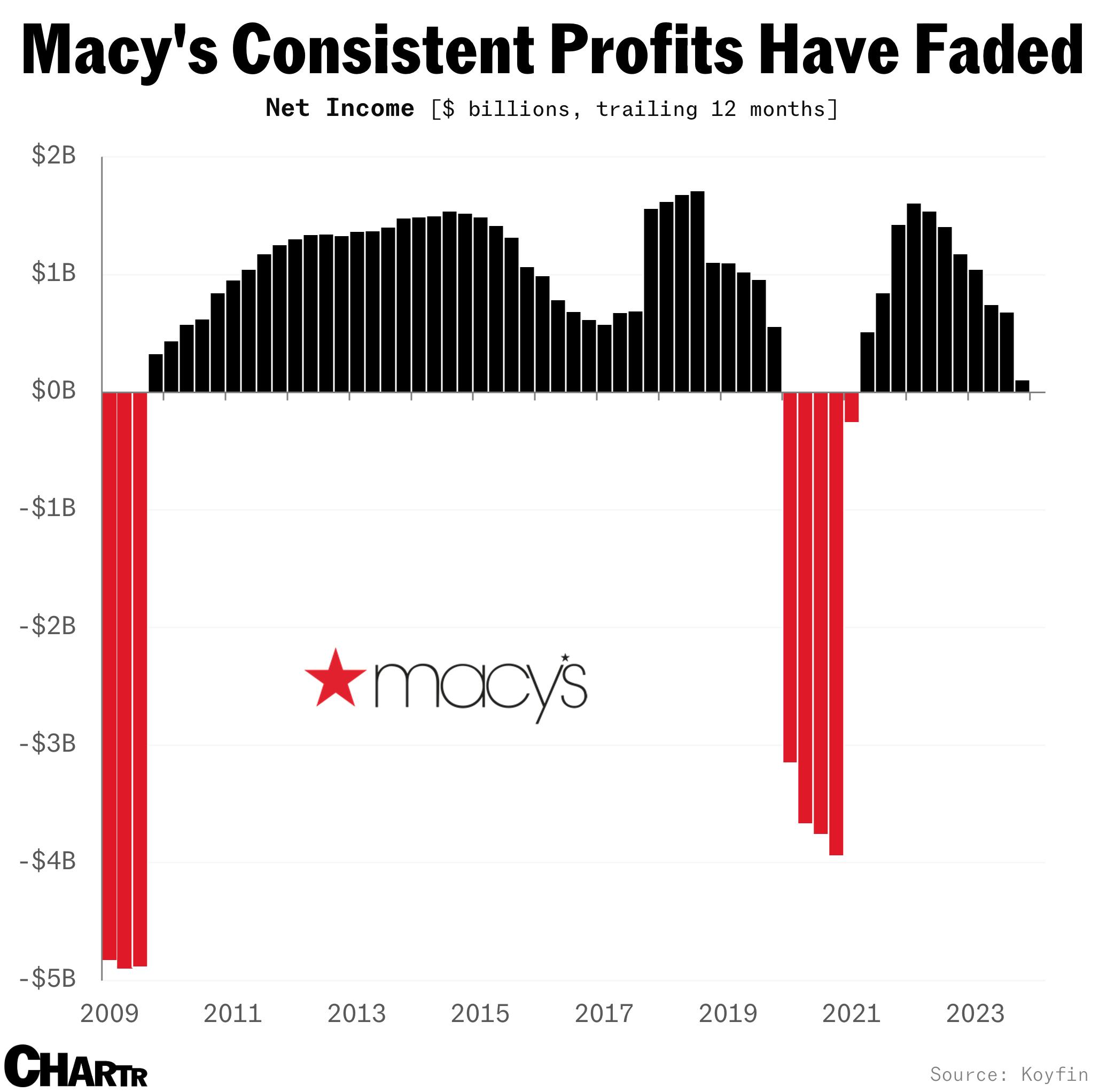

Profit parade

Despite bouncing back relatively strongly from COVID-19, Macy’s once-reliable profits have all but dried up: in the last 12 months the company has reported $13 million in net income — a figure that was routinely over $1 billion in prior years.

By ending talks, Macy’s execs are signaling that they will forge ahead with its turnaround plan. That’s a bold move considering that peers such as JCPenney and Sears have succumbed to bankruptcy, e-commerce continues to grow, and inflation-weary consumers are showing signs of weakness. The strategy is focused on doubling down on its top 50 outlets, closing underperforming stores, and adding new Bloomingdale's and Bluemercury locations.

Macy's is preparing to celebrate the centenary of its Thanksgiving Day Parade this year... its next 100 years might require some reinvention.