**A certain je ne sais quoi**

Silicon Valley has tech. Germany’s auto industry is second to none. Scandinavia is known for its design. But when it comes to luxury, no-one does it quite like the **French.**

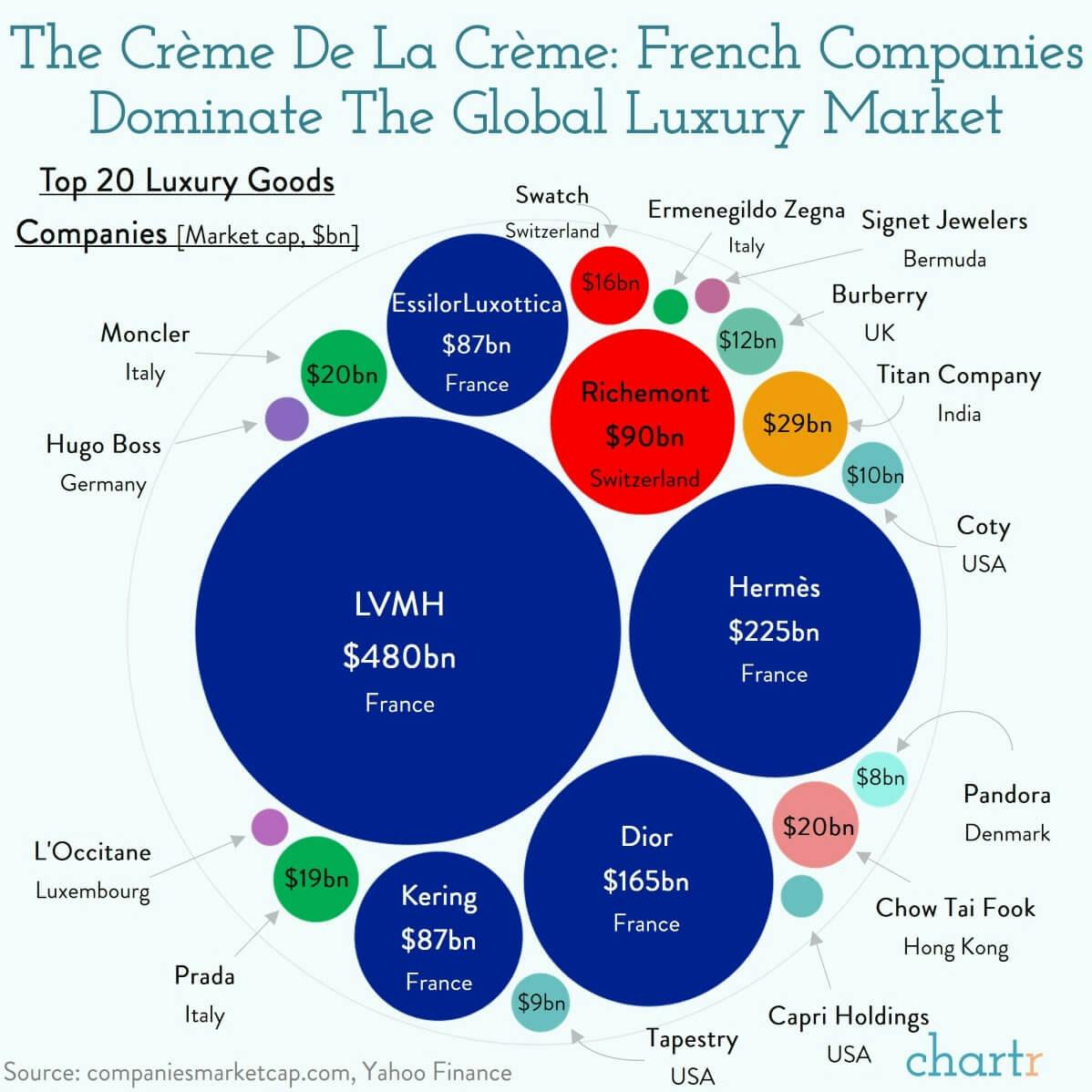

LVMH, Hermès, Dior, EssilorLuxottica, and Kering, all French, have a combined market cap of over €1 trillion, accounting for approximately 80% of the top 20 largest public luxury companies' total value. And, despite the wider malaise, those companies have seen their value soar. LVMH shares have gained 52%, Kering is up 18%, EssilorLuxottica is up 15% and Hermès has jumped 84% — helping to propel Paris's stock exchange to the largest in Europe, taking the crown from London.

French luxury has a long and storied history, dating back to the middle ages with luxury shoes, but it was arguably in the courts of King Louis XIV where haute couture was born. During Louis’ long reign French textile and jewelry industries boomed, with a strong insistence on only using French materials. In the 17th and 18th centuries the country began manufacturing high-end mirrors, symbols of opulence at the time, but it wasn't until after the July Revolution in 1830, and the rise of a middle class in France, that the first now recognizable names in luxury began to emerge. Hermès was founded in 1837, followed by Cartier in 1847 and Louis Vuitton in 1854.

Handbag empire

Since then, the country’s luxury industry has gone from strength to strength. A study from 2012 found that, out of the 270 “prestige” luxury brands in the world, a whopping 130 were French — collectively accounting for a quarter of all luxury sales. While other luxury brands from around the world, namely German’s Hugo Boss, Italian Prada and American Tapestry, which owns Coach and Kate Spade, have struggled recently, French luxury brands have shone.

Indeed, Hermès — known for its silk scarves and iconic Birkin bags — is now worth an astonishing €209bn. That’s more than 20x the value of French carmaker Renault and almost 10x what tyre manufacturer Michelin is worth. But, even Hermès pales in comparison to the true giant of French luxury: LVMH — a company that’s made its CEO Bernard Arnault the richest person on the planet.