Etsy doubles down on handmade goods

As e-commerce competition intensifies, Etsy is refocusing on its artisan roots

This week, e-commerce platform Etsy announced a major policy overhaul, with items sold on Etsy now having to fall under one of four explicit labels:

"Made by" (handcrafted)

"Designed by" (original designs produced by a third party)

"Sourced by" (items that enable buyer creativity)

"Handpicked by" (vintage)

Doubling down on its artisan roots — the very thing that took it from a cute platform for homemade trinkets and unique gifts into a multi-billion-dollar giant — is part of Etsy’s battle against its “Amazonification” problem. A 2013 rule change opened the platform to factory-made goods and dropshippers; sellers who buy cheaper, mass-produced items and resell them. It’s also, presumably, an attempt to reinvigorate growth.

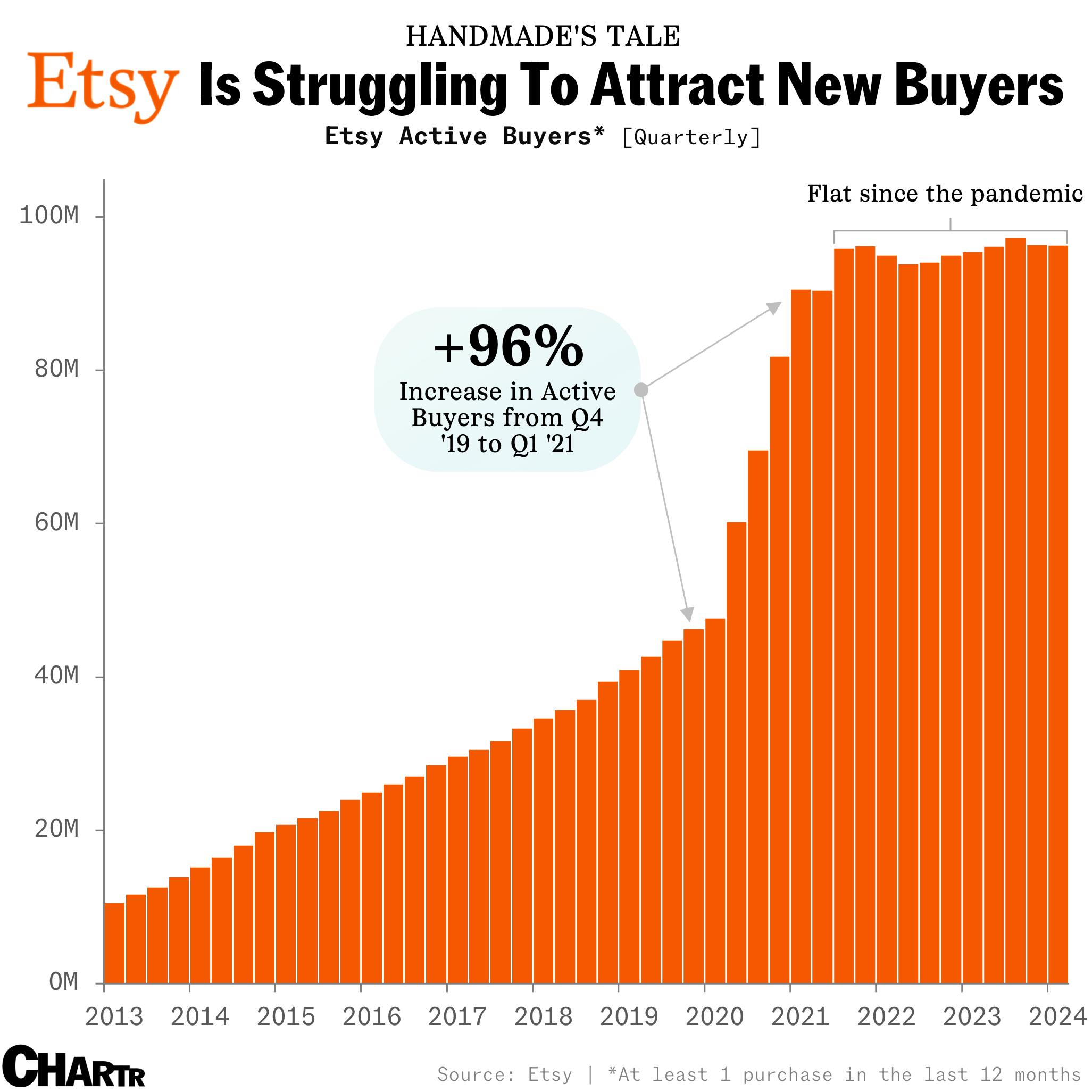

For years, Etsy’s buyer numbers grew steadily. Then, during the pandemic, they soared. But growth has since plateaued — and the loss of Etsy's human touch became the source of major complaints during the 2022 Etsy seller strike, as did hikes in seller fees. As it drifted away from trinkets and homemade items, the brand also found itself in more direct competition with e-commerce giant Amazon, whose ~$750 billion in goods sold through the site last year eclipses Etsy’s $13 billion.

Furthermore, the rise of ultra-cheap retailers like Temu and Shein — which have even prompted Amazon to act quickly to maintain its competitive edge — has further squeezed Etsy’s place in the marketplace. Google search trends in the US show that Shein has matched Etsy in popularity since 2021, with Temu not far behind.