Credit Suisse is not having a great year.

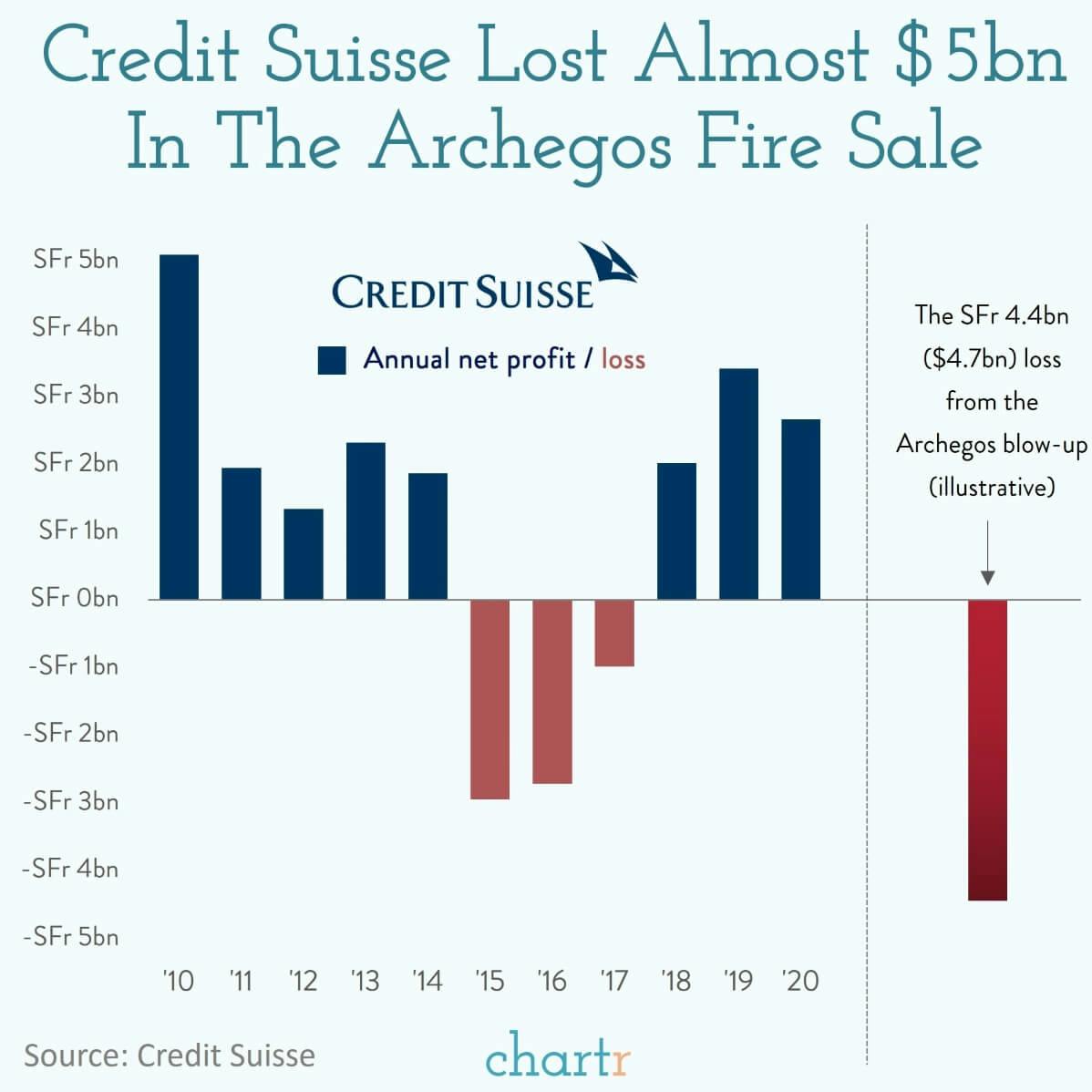

The Swiss investment bank and wealth manager announced this week that it expected to make an eye-watering $4.7bn loss from the blow-up of Archegos Capital. For context, that single loss would be enough to wipe out the entire bank's net profits from any single year from 2011-2020.

I O U, A LOT

The Archegos story is a tale as old as time on Wall Street — a hedge fund with a previously decent track record bought a bunch of stocks with a lot of leverage (i.e. money it didn't have) and everything was fine until those stocks dared to go down. The leverage magnified the losses and Archegos collapsed, leaving the banks that extended them the leverage frantically selling shares as their prices crashed. This meme sums up what happened next, but basically Credit Suisse got left holding the (biggest) bag.

For Credit Suisse the Archegos blow-up follows on from the Greensill blow-up and has left the bank reeling financially and reputationally, with 7 senior executives losing their jobs this week according to the FT.