Like a student who starts the homework the morning that it’s due, digital education company Chegg is trying to adapt in the face of AI, with its April-appointed CEO announcing yesterday a major restructuring plan. The strategy includes cutting its headcount by 23%, as well as an ambition to build a “platform that incorporates artificial intelligence verticalized for education”. Investors appear to like the plan, with the stock currently up around 15% on the news, but some might be thinking it’s too little too late.

Textbook troubles

Renowned for providing homework help, Chegg is seeking to reinvent itself as students increasingly turn to free AI tools like ChatGPT for assistance, a trend that’s compounded a brutal 3 years for the company.

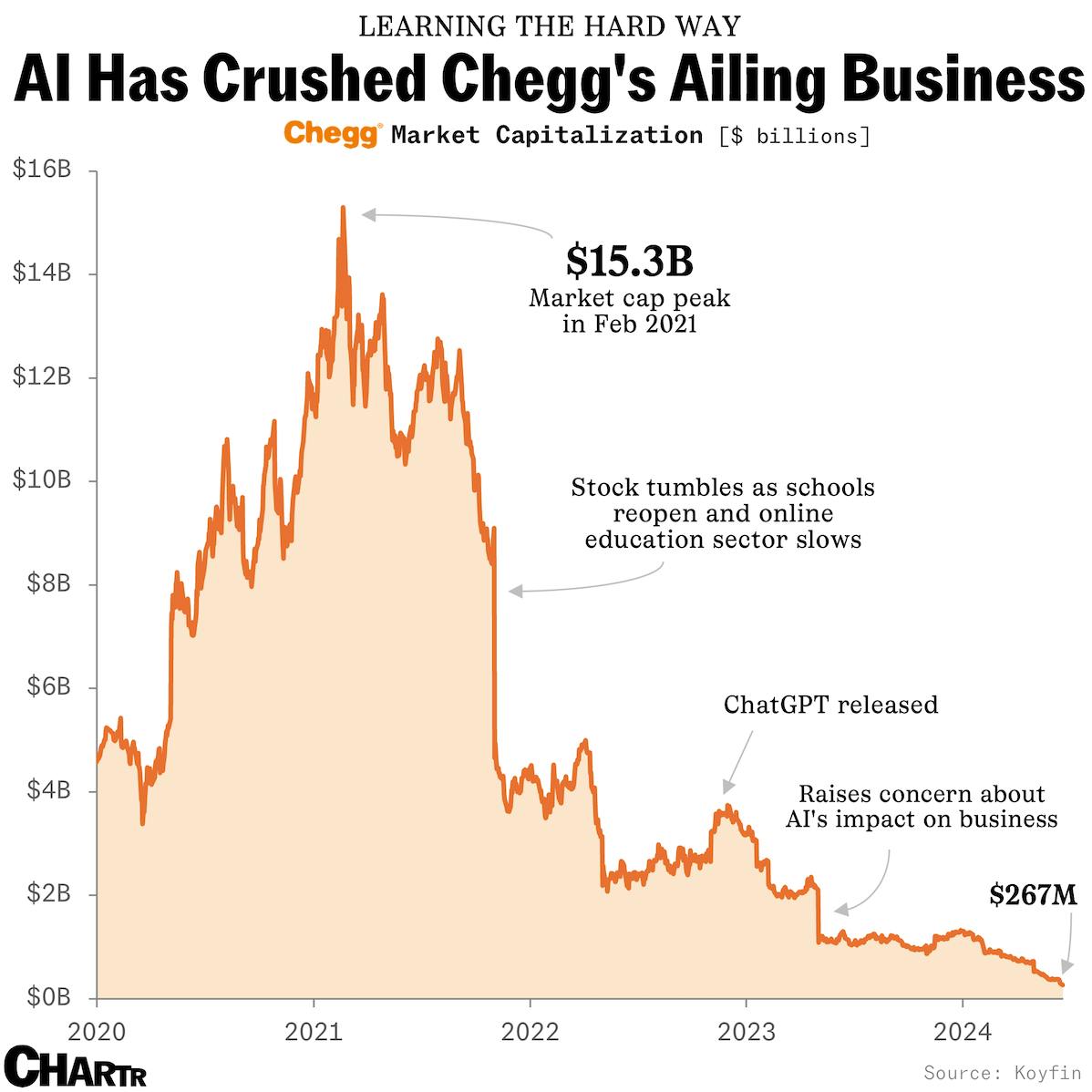

During the pandemic the company’s online platform became a lifeline for many as schools shut down and students "chegged" their way through homework and online tests by paying to access Chegg’s wide database of millions of textbooks to get the answers. Revenues at the company doubled between 2018 and 2020, turning Chegg into a business worth some $15 billion at its peak.

But, like so many pandemic-era trends, once schools opened back up, Chegg found itself losing ground. Shares lost an eye-watering 49% of their value in a single day in 2021. That misery was made worse when execs announced that ChatGPT's popularity was impacting customer growth — and its fortunes never really reversed. Once proclaimed “the most valuable edtech company in America” by Forbes, Chegg has lost some 98% of its peak market cap.