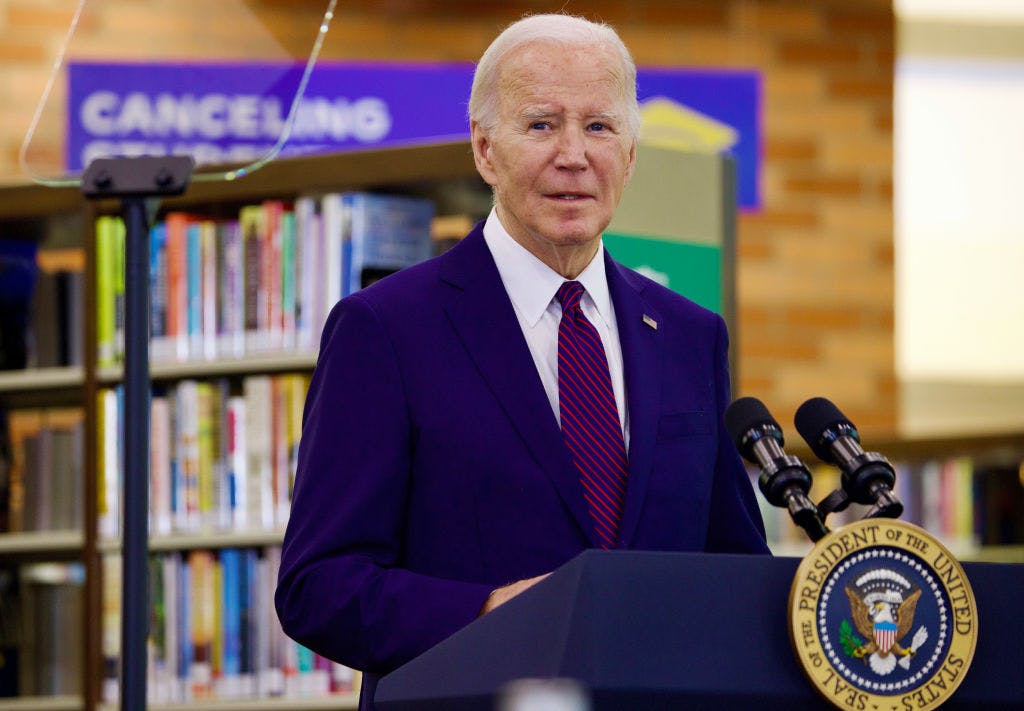

How PE firms could be the unlikely beneficiaries of Biden's student-loan forgiveness plan

Private equity is buying up private student loan debt by the billions. The government forgiving federal student debt could make their purchases less risky.

In the latest rendition of “private equity firms are eating the world,” KKR and Carlyle have acquired $10 billion in private student loans from Discover Financial, per The Wall Street Journal:

Private-equity firms are helping traditional lenders shed credit risks by acquiring student loans even as debt forgiveness remains a hot topic in Washington.

Carlyle Group and KKR underlined the trend in July, when they bought a $10.1 billion portfolio of private student loans at auction from Discover Financial Services, a digital banking and payment services company, with the purchase price expected to reach about $10.8 billion once the deal closes later this year. Half of the loans carry fixed rates and the rest have floating rates, according to the asset managers...

My first thought when reading this was: “Why?” Yes, these firms have billions of dollars that need to be deployed somewhere, but student loans seemed odd, especially considering the Biden administration’s insistence on forgiving billions of dollars of student loans. However, this forgiveness is actually a tailwind for the loans that these funds purchased, according to Carlyle’s head of credit strategic solutions, Akhil Bansil:

“Forgiveness of the federal student loans can be a credit positive for us as the private student loan owners,” Bansal said. “If the government were to forgive the federal loans, that makes that student more creditworthy to service our loan.”

Most student borrowers take out both federal and private loans, with interest rates as high as 9% on the former compared with as high as 17% for the latter, according to consumer financial-services company Bankrate.

How does that make sense? Because Biden’s student loan forgiveness plan applies to federal loans, which were issued by the government, not private loans such as those purchased by Carlyle and KKR.

While the Supreme Court blocked the Biden administration’s attempt to forgive $430 billion in student loans, the White House has still approved nearly $169 billion in loan forgiveness for ~4.8 million people, and according to CNBC, the president may start forgiving this student debt as early as October.

As the Journal piece mentioned, “most student borrowers take out both federal and private loans,” so, if Biden were to forgive $169 billion in federal debt, those borrowers would be able to more easily repay their private loans, many of which are now held by KKR and Carlyle. Basically, the White House's student loan forgiveness plan, while helping borrowers, also had a wild unintended consequence: derisking the loan portfolios of two of the world's largest PE funds.