Banks are closing all over America, but JPMorgan still sees an opportunity

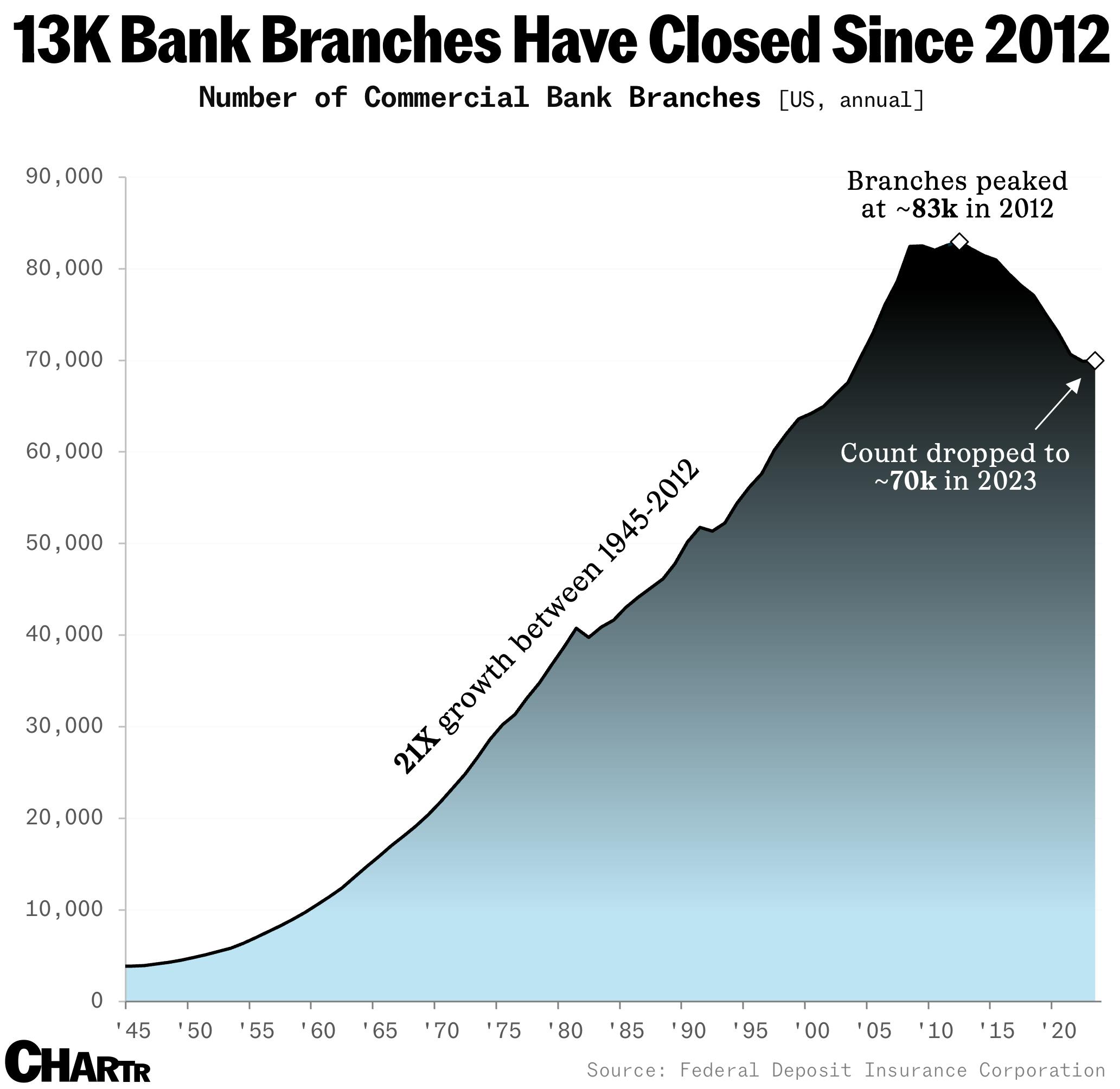

Blame the cost-cutting from COVID, the constant consolidation across the industry, or simply the mobile banking apps that have gotten better and better, but let’s face it: the days of doing all of your banking in-person are likely gone. Indeed, the number of physical bank branches has been falling since 2012, and has continued to drop this year, with America reportedly losing another 500+ local branches in the first six months of 2024.

But, the longer term trend hasn’t completely killed the appetite of America’s major financial institutions. This week, JPMorgan announced it would open nearly 100 new branches in America’s banking deserts, the latest addition to its branching-out policy which has seen it become the first bank with branches in all 48 contiguous states. These will be in areas out of reach from legacy branches, and will likely be focused on serving lower-income communities.

But as for JPMorgan, “this is not just do-gooding, this is business” — in a WSJ interview Jamie Dimon, the company’s CEO, added that, “we measured these branches by number of customers, deposits, investments, and the model works.”

Unlike many of its rivals, JPMorgan seems to be viewing its bricks-and-mortar branches as the neighborhood’s new community centers, with a focus on encouraging financial literacy and advice. So far, the business is enjoying successes: personal savings balances at its first-of-its-kind community center branch in Harlem, for instance, had grown 73% four years after its opening.