Airbus is pulling out all the stops to hit its delivery target

The European manufacturer just had a huge month — it’ll need one more to hit its 2024 goals.

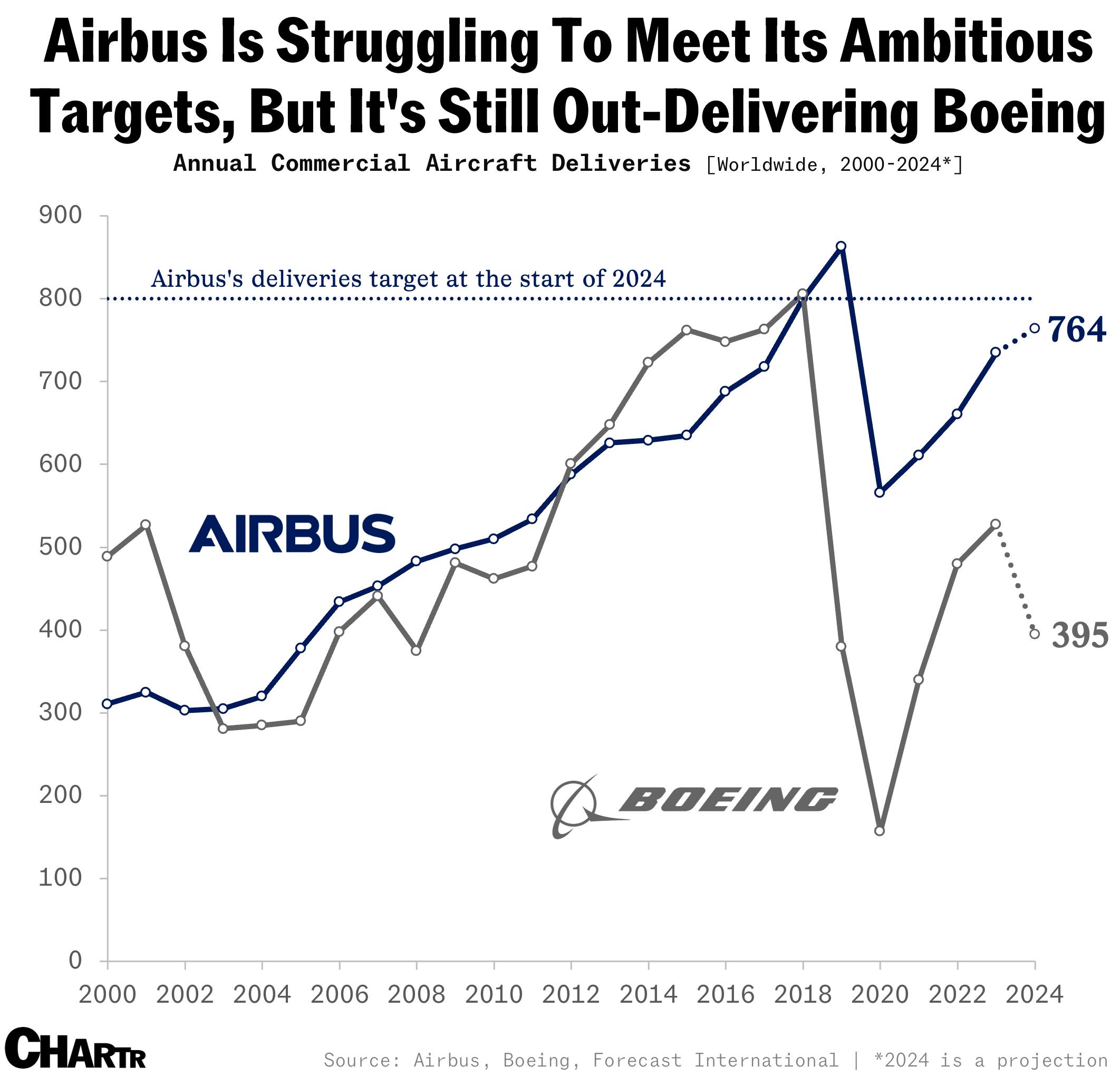

Airbus just had the best month of its year so far, with the company delivering 80 jets in November, according to Reuters, putting the European plane maker on track to outdeliver Boeing in 2024 — the sixth year in a row that the European giant has bested its American rival. That’s Airbus’ best November in six years, but it still leaves the company struggling to meet its ambitious goal of delivering “around 770” jets this year, per Sherwood Snacks.

Up in the air

Ever since a pair of fatal crashes in 2018 and 2019, Boeing has been working hard to repair its reputation for safety — a process that took a big blow in January after the midair blowout of a section of one of its jets. The plane maker has since reduced production, in line with its recovery strategy “to go slow to go fast.”

Compared to Boeing’s more cautious approach, Airbus has been ambitious, originally targeting 800 deliveries in 2024 — its third-highest delivery forecast ever — before cutting its guidance to 770 halfway through the year. By the end of October, the company had officially made 559, meaning the company would need to deliver more than 130 planes in the last month of the year, which will likely be a stretch given the company managed 112 deliveries last December.

Nevertheless, the company is pulling out all the stops to make that target. Indeed, Airbus’ determination is “putting a lot of strain on the system,” said one industry executive to the Financial Times last week, especially when the entire aircraft market is struggling with production delays. Engine suppliers are now caught up in a tug-of-war between the two airlines, with Airbus rushing to negotiate with some manufacturers to temporarily prioritize Airbus over its competitors in a bid to boost deliveries.