BlackBerry: Back in the black?

The once-iconic phonemaker expects to be profitable again

We’ll be fine

Shares of BlackBerry rose 11% yesterday after the company posted a smaller than expected loss, edging the once world-beating company back towards profitability, with the CEO expecting BlackBerry to be “generating positive cash flow in the fourth quarter”.

The results had nothing to do with shipping phones, however. Since its dramatic fall from grace, the company has pivoted towards selling the software and security features that helped make its phones so popular with security-conscious white-collar workers in the first place.

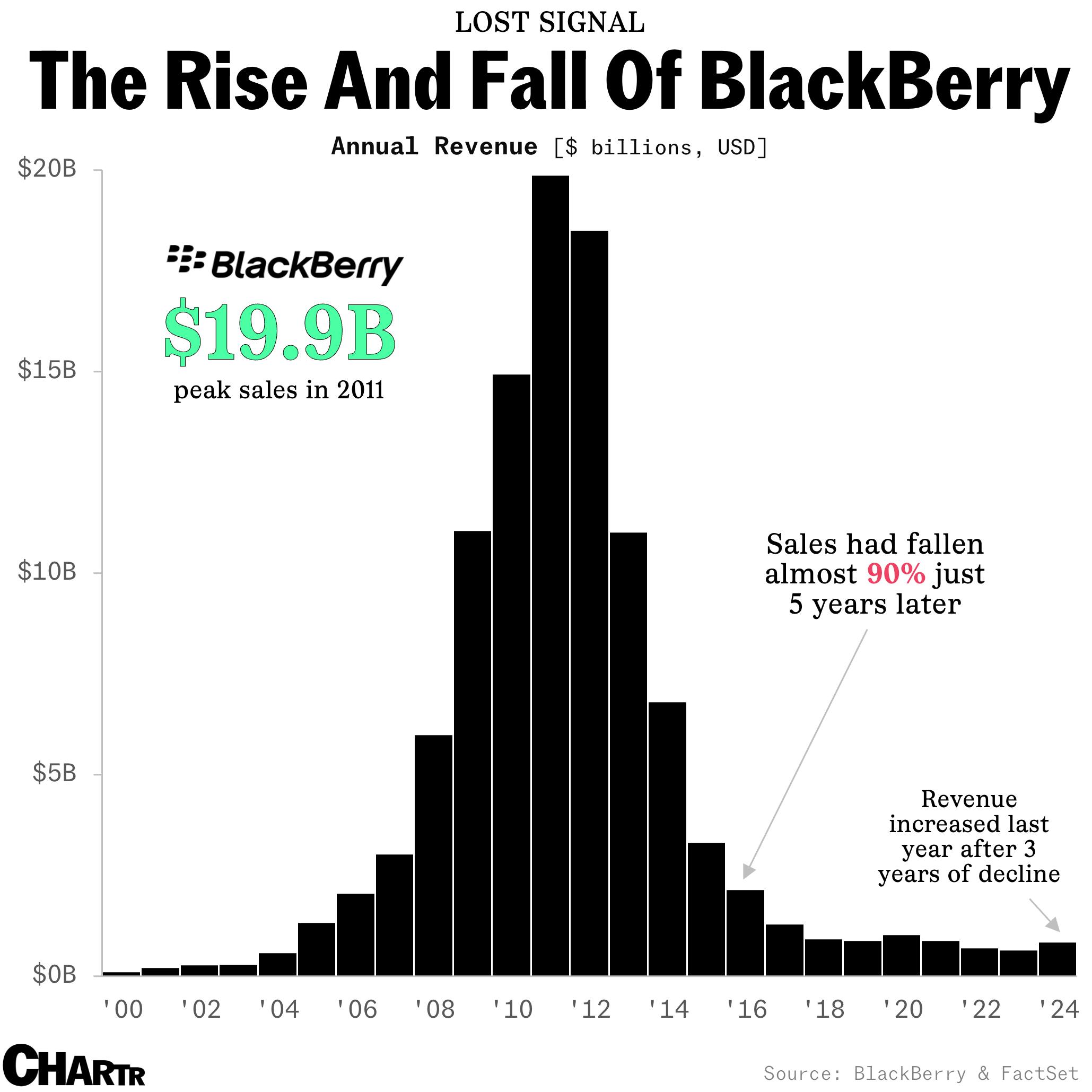

BlackBerry, along with other 2000s classics like Nokia, TomTom, and pretty much the entire MP3 market, was decimated by the release of the iPhone in 2007. The company’s revenue peaked just shy of $20 billion in 2011, but as the iPhone and other smartphones went mainstream, its sales plummeted. Just five years later, BlackBerry's revenue had dropped to around $2 billion, a period that included a staggering $4.4 billion loss in a single quarter due to a massive inventory writedown.

Realizing that its co-CEO’s famous words — "we'll be fine" — after the iPhone launch were, shall we say, a bit optimistic, the company eventually abandoned selling hardware in 2016. That shift has hardly restored BlackBerry into the global leader that it once was, its most recent annual sales amounted to just 4% of its record, but some version of the company remains alive and kicking. In fact, there’s a good chance you’ve recently used a BlackBerry product indirectly: the company reports that its software is in more than 235 million vehicles around the world.